Nvidia Tops Gartner's Semiconductor Sales Rankings for the First Time

Samsung Overtaken in Final Results, Contrary to February Forecast

SK Hynix Rises Rapidly with HBM Supply

Intel, Once CPU Leader, Falls to Third Place

Professor Kim Jeong-ho: "Growth Driven by GPUs and HBM Will Continue"

The year 2024 is expected to be recorded as the inaugural year when the semiconductor market, once centered on central processing units (CPUs), shifted its focus to graphics processing units (GPUs), the representative semiconductors of the artificial intelligence (AI) era.

This is because Nvidia, a GPU manufacturer, rose to the top of the semiconductor market sales rankings for the first time in history in 2024. The rise of SK Hynix, which supplies HBM to Nvidia, was also remarkable.

On the other hand, Intel, which once raced to the number one spot globally, fell to third place, losing face, and Samsung Electronics' ranking also dropped. Experts diagnose this change as a case representing the rise of the GPU era and the fall of the CPU era.

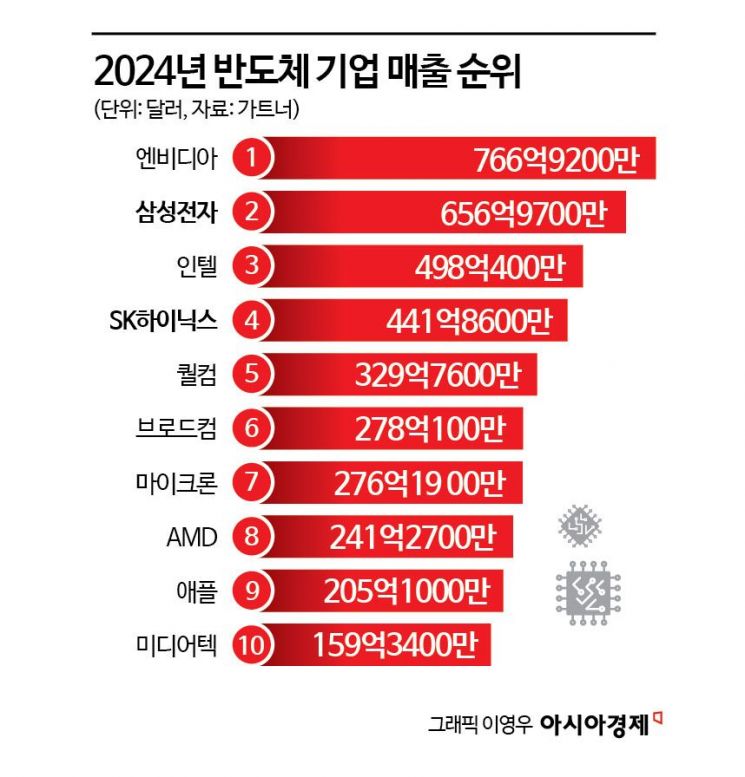

Market research firm Gartner finalized and announced the semiconductor industry sales rankings for 2024 on the 10th (local time). This ranking excludes foundry companies such as TSMC.

Nvidia recorded an explosive sales growth rate of 120% compared to the previous year, reaching the number one position in the global semiconductor market based on Gartner's criteria for the first time since its founding. Considering that the growth rate forecasted in February was 84%, the increase is even more pronounced.

The final results differed significantly from expectations because they reflected the recent earnings reports of each company, revealing that demand for AI server GPUs and high-bandwidth memory (HBM) dominated the market. It was truly a complete upheaval in the semiconductor industry.

According to Gartner, the global semiconductor market in 2024 grew much more steeply than initially expected, recording total sales of $655.9 billion. Last year's sales growth rate reached 21%, an upward revision from Gartner's preliminary growth rate of 18.1% presented in February.

The memory semiconductor industry also rebounded sharply, supported by price recovery since the second half of 2023 and HBM for GPUs. SK Hynix recorded an annual sales growth rate of 91.5%, and Micron 71%, both significantly exceeding the market average. Their sales rankings improved notably to 4th and 7th, respectively, from 6th and 12th the previous year. Both companies supply HBM to Nvidia, growing alongside Nvidia's performance.

Samsung Electronics, which lost the lead in HBM, grew 60.8% amid the rebound in DRAM and NAND prices last year but fell to second place, failing to maintain the number one sales position forecasted in February.

Intel's situation is serious. Although it was expected to rank second, it ended up in third place. This is a ranking unseen since Intel led the semiconductor market with CPUs. Having recently competed with Samsung for first place, it has now fallen out of the top tier.

AMD, long considered the perennial second in the CPU field, grew 8.2% year-over-year, while Intel's growth was only 0.8%. The sales gap between the two companies is narrowing, and AMD's market capitalization has long surpassed Intel's in the stock market.

Intel's presence in the AI accelerator market was minimal, and the growth limits of its existing x86-based products became clearly evident. It is apparent that Intel failed to properly adapt during the transition to the AI era.

Intel and AMD have attempted to block Nvidia's GPU dominance but have fallen behind in the market without engaging in proper competition.

Qualcomm, expanding from smartphones into the PC sector, recorded double-digit growth of 12.8%, expanding its premium smartphone market share amid Samsung's Exynos chip slump. The weakening competitiveness of Exynos has relatively benefited Qualcomm. Taiwan's MediaTek also continued its growth, ranking 10th.

Although not a semiconductor manufacturer, Apple, which designs chips for iPhones and produces them at TSMC, ranked 9th.

Broadcom, which has drawn attention by collaborating on the design of Google's AI computing semiconductor, the Tensor Processing Unit (TPU), posted a growth rate of 8.5%, but its sales ranking was 6th, widening the gap with Nvidia.

Gartner forecasts that while demand for AI-specific chips and infrastructure and memory demand centered on HBM are increasing sharply, the traditional general-purpose CPU-based architecture will continue to face growth limitations.

Gartner particularly expects the share of HBM in the DRAM market to expand from 13.6% this year to 19.2% next year, anticipating that memory and GPUs will continue to play a dual leading role in the global semiconductor market for the foreseeable future.

Professor Kim Jeong-ho of KAIST said, "Currently, AI is based on text-based large language models (LLMs), but in the future, it will expand into the video field, requiring GPU and HBM performance to increase by more than 1000 times, and demand will continue. The fate of Samsung and SK Hynix also depends on HBM," he predicted.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)