Bogeumjari Loan Sales Reach 1.44 Trillion KRW in February

Highest in 14 Months

Driven by Government Household Loan Control Policy and Preferential Rates for Multi-Child Families

Due to the government's policy to curb the increase in household loans and the expansion of benefits for multi-child families, the sales of the Bogeumjari Loan have surged.

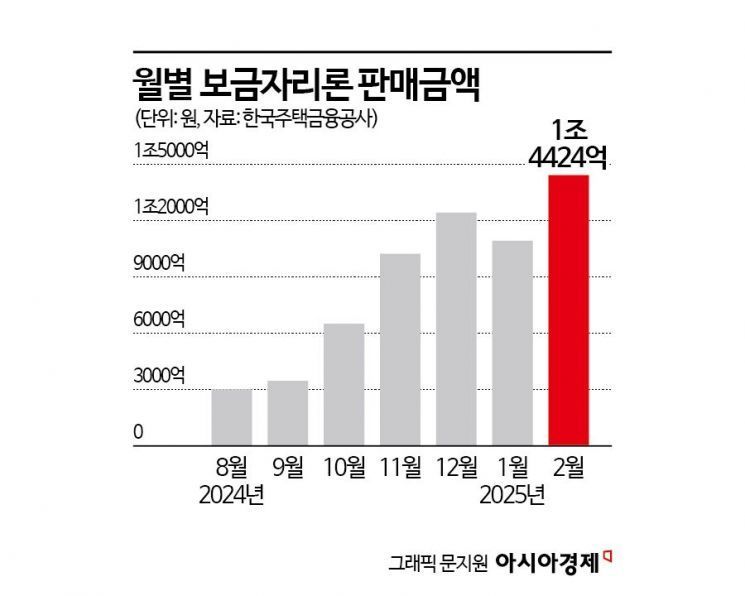

According to the Korea Housing Finance Corporation (KHFC) on the 11th, the sales amount of Bogeumjari Loan in February reached 1.4424 trillion KRW, a 191.6% increase compared to 494.5 billion KRW recorded in the same period last year. It also increased by 32% compared to 1.0934 trillion KRW in January. This is the largest sales volume in 14 months since the 1.7702 trillion KRW recorded in December 2023.

The Bogeumjari Loan is a policy loan (mortgage) product used for purchasing homes and returning jeonse deposits. Basically, only those with a combined annual income of 70 million KRW or less for couples purchasing homes priced at 600 million KRW or less are eligible, making young people the main target for sales.

Until mid-last year, interest in the Bogeumjari Loan was not high, but it is analyzed that interest increased as the government began managing loans from the second half of last year to control household debt.

At that time, the Bogeumjari Loan interest rate was as low as 4.05%, while commercial banks raised their loan interest rates above that level as part of household debt management, creating a relative advantage. In February this year, the lowest interest rate for the Bogeumjari Loan dropped to 3.75%. Another advantage of the Bogeumjari Loan is that it is not subject to the stress Debt Service Ratio (DSR). Without DSR application, borrowers can receive loans with limits higher than their repayment ability.

A KHFC official explained, "The reduction in loan supply from commercial banks due to financial authorities' household debt measures since the second half of last year had a significant impact."

It is also analyzed that the government's provision of preferential interest rate benefits on the Bogeumjari Loan to households meeting specific conditions, such as multi-child families or low-income households, is influencing this trend.

KHFC offers a preferential interest rate of 0.5 percentage points for households with two or more children. For households with three or more children, the preferential rate is 0.7 percentage points. Starting this month, the income requirements for the Bogeumjari Loan have been relaxed from 80 million KRW or less to 90 million KRW or less for households with one child, and from 90 million KRW or less to 100 million KRW or less for households with two or more children. The preferential interest rate for newlywed households was also raised from 0.2 percentage points to 0.3 percentage points.

When additional preferential interest rates are applied to multi-child families, low-income youth, newlyweds, and socially disadvantaged groups (such as people with disabilities and single-parent families), the Bogeumjari Loan interest rate can drop to as low as the mid-2.6% range annually, making it highly competitive compared to commercial banks' mortgage loans.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.