SK Hynix Hits Upper Limit in Pre-Market as Market Cap No. 2

Opening Price Distortions Worsen Amid Increased Volatility

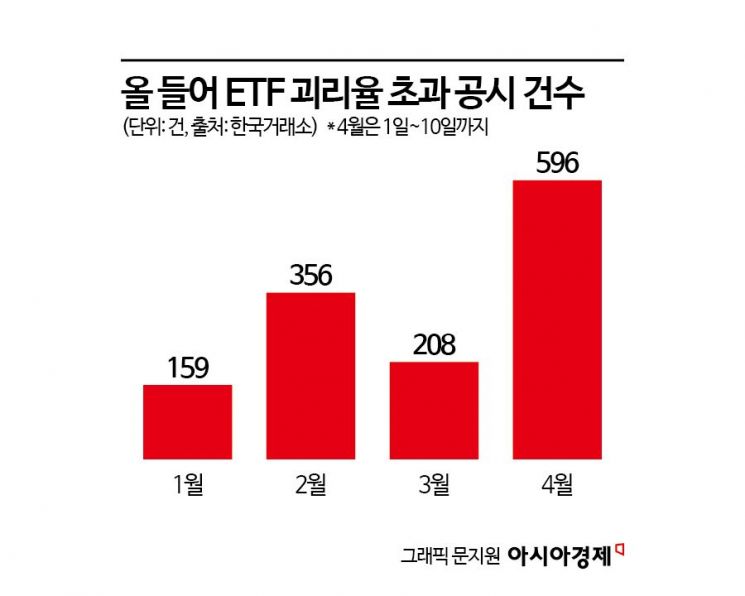

ETF Premium/Discount Rate Disclosures Reach Record High This Year

As the domestic stock market experiences rollercoaster fluctuations due to a tariff shock originating from the United States, price distortions are occurring in various places, requiring investors to exercise caution.

According to alternative exchange NextTrade on the 11th, SK Hynix's stock price soared 28.21% immediately after the pre-market opened the previous day, hitting the upper limit. However, within less than five minutes, it plunged about 13%, falling below the upper limit. Only 108 shares were traded at the upper limit price, moving the chart of the second-largest market capitalization on the KOSPI with about 23 million KRW. Besides SK Hynix, Qualitas Semiconductor, Classys, Hanwha Ocean, Hi-Vision System, and SeAH Steel Holdings also hit the upper limit immediately after the pre-market opened, then quickly declined.

Recently, with increased volatility in global stock markets, price distortions at the pre-market opening have become prominent. Currently, NextTrade restricts market orders in the pre-market due to concerns over rapid price fluctuations. However, since there are no market makers to fill the order book, even trading just one share at a limit price can set the opening price at the upper or lower limit. On this day, WyBioLogics and Lumir surged about 25% with just one share traded.

An industry insider said, "Normally, securities firms should supply liquidity to the market by signing market-making contracts with alternative exchanges and continuously submitting two-way quotes for assigned stocks. However, there is no system in place to exempt securities transaction tax for this, so they are unable to do so. Since price fluctuations in the NextTrade pre-market are not reflected in the Korea Exchange charts, investors need to be especially cautious."

The warning signs for investment are not limited to this. As the tariff shock causes global stock markets to fluctuate wildly, the premium/discount rates of overseas investment exchange-traded funds (ETFs) listed domestically are also becoming extreme. So far this month, there have been 596 disclosures of ETF premium/discount rate excesses, surpassing the previous month's 208 cases in just ten days. This is nearly four times the number compared to January.

The premium/discount rate is an investment risk indicator that shows the ratio of the difference between an ETF's market price and its real-time estimated net asset value (iNAV). The previous day, the premium/discount rate of 'TIGER Euro Stoxx Leverage (Synthetic H)' soared to 14.89%, ranking first among ETFs. This means the ETF was traded about 15% more expensive than its actual value. Asset management companies are required to disclose when the premium/discount rate of overseas investment ETFs exceeds ±2% (±1% for domestic investment ETFs).

Most premium/discount rate excesses occur in overseas investment ETFs. For ETFs investing in the United States, the net asset value (NAV) is calculated daily after the U.S. market closes, reflecting changes in the prices and quantities of underlying assets. The iNAV is a figure to which the Korea Exchange adds real-time exchange rate fluctuations after the domestic market opens. The problem is that liquidity providers (LPs), who determine market prices, submit quotes reflecting real-time futures market flows even after the U.S. market closes, making it easy for the premium/discount rate to widen.

An asset management company official advised, "In volatile markets like these, if you trade based solely on stock prices without checking the premium/discount rate for simple arbitrage, profitability may decline. When the premium/discount rate is high, it is wise to refer to real-time futures prices and confirm the price direction before investing."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.