Rising RWA Management Burden Due to Decline in Won Value

Financial Holding Companies Strengthen Soundness Management

with Continuous Exchange Rate Monitoring and Support for Export Companies

As the tariff war between the U.S. and China looms, the won-dollar exchange rate has surged to levels seen during the 2009 financial crisis, raising red flags for the financial sector's soundness management. A decline in the won's value increases foreign exchange losses, leading to a deterioration in financial soundness. The burden of managing risk-weighted assets (RWA), such as corporate loan delinquency rates, is increasing, which could also impact value-up plans. In response, financial institutions have entered an emergency response system, implementing real-time exchange rate monitoring and credit checks on import-export companies to manage capital soundness and foreign currency liquidity.

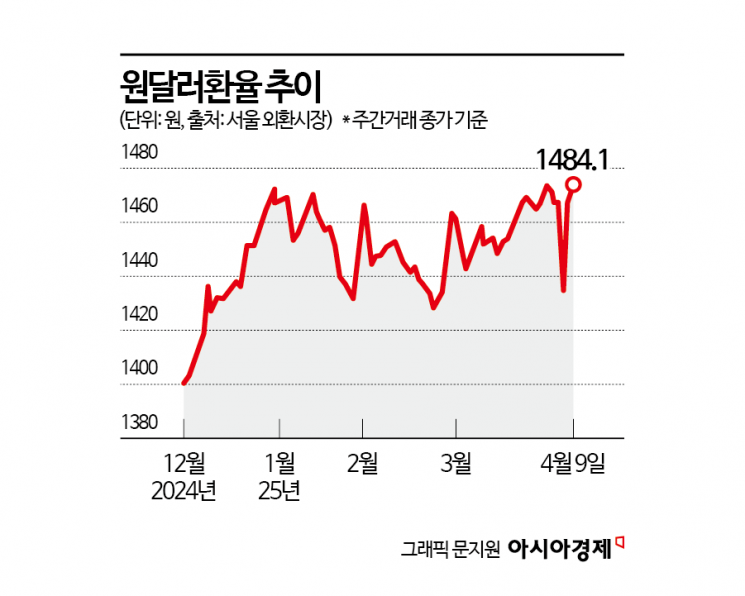

In the Seoul foreign exchange market, the won-dollar exchange rate closed at 1,484.1 won as of 3:30 p.m. on the 9th, up 10.9 won from the previous day. During the session, the rate peaked at 1,487 won, marking the highest level since March 12, 2009 (1,496.5 won) during the global financial crisis.

With growing concerns that the exchange rate could surpass the 1,500 won mark, the financial sector has begun managing risk assets in response to exchange rate volatility. The four major financial holding companies (KB, Shinhan, Hana, Woori) and banks plan to strengthen asset soundness management through continuous exchange rate monitoring, credit checks on import-export companies, and special support measures.

KB Financial is monitoring market trends in real-time, including capital market conditions and exchange rate fluctuations. A KB Financial official stated, "We are maintaining an emergency response system while conducting real-time monitoring and status checks of exchange rates, focusing on capital markets and foreign exchange operations. However, we believe the impact on value-up scenarios will be limited as risk management related to exchange rates is incorporated as a key element in our management strategy."

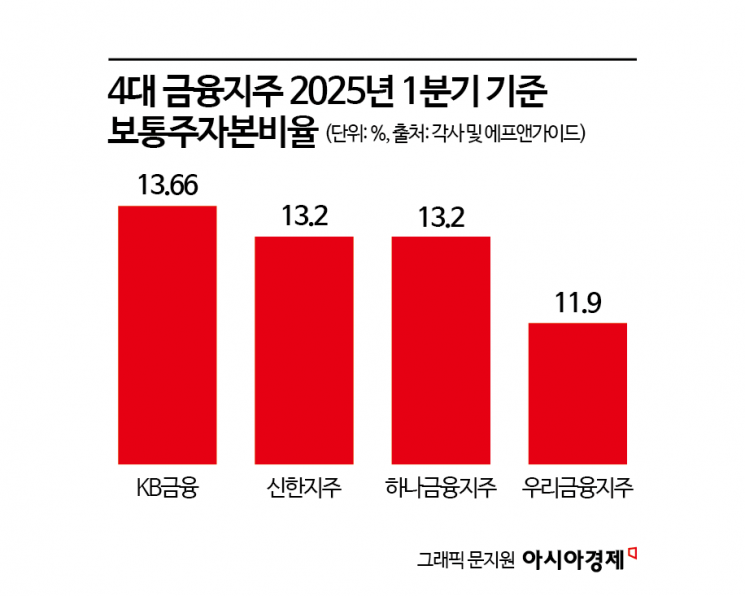

Shinhan Financial Group also said, "The Common Equity Tier 1 (CET1) ratio decreases by about 0.8 basis points (1bp = 0.01 percentage points) for every 10 won change in the exchange rate, which means an 8bp change for a 100 won move, so the impact is not significant. However, since import-export companies are facing difficulties due to exchange rate volatility, we are focusing on corporate support measures in our response."

Hana Financial Group is responding with a focus on strengthening management of delinquent and non-performing assets due to worsening export company performance, rising import prices from exchange rate fluctuations, and increased credit risk from declining profitability. A Hana Financial Group official said, "Due to the increased risk of corporate loan defaults, we have included industries directly exposed to risk, such as the secondary battery industry, in our key management sectors and reflected this in the bank's portfolio policy to reduce loan concentration. Additionally, we plan to ensure thorough asset soundness management through early identification of potential problem areas and strengthened delinquency management."

Woori Financial Group is establishing response plans based on exchange rate levels through consultations among related departments within its emergency task force. A Woori Financial official said, "We are continuously monitoring exchange rate levels and strengthening management of exchange rate-sensitive assets such as derivatives accordingly. We also plan to enhance foreign exchange loan management by focusing on high-quality loans and operate conservatively by selectively reducing unused credit limits."

The entire financial sector has entered an emergency management system because an increase in delinquency rates among import-export companies, which are directly affected by exchange rate fluctuations, would burden financial institutions' RWA management. When the exchange rate rises sharply in won terms, foreign currency loan assets increase, which lowers the CET1 ratio. CET1 is a key indicator of a financial institution's financial soundness, calculated by dividing common equity capital by RWA. A higher ratio indicates better soundness.

As of the first quarter of this year, the CET1 ratios of the four major financial holding companies are KB Financial (13.66%), Shinhan Financial Group (13.2%), Hana Financial Group (13.2%), and Woori Financial Group (11.9%). Financial authorities recommend maintaining a CET1 ratio of 12% or higher. Financial holding companies aim to keep their CET1 ratios above 13%.

However, there is some expectation that the burden of soundness management will ease somewhat, as the Financial Supervisory Service (FSS) has mentioned measures to relax capital ratio requirements for the financial sector. On the 8th, FSS Governor Lee Bok-hyun instructed at a U.S. reciprocal tariff response review meeting, "Review incentive measures related to capital regulations to enable banks to smoothly provide funds to companies struggling due to tariff impositions." Accordingly, there is also talk of excluding foreign exchange risk from overseas subsidiaries' capital as much as possible when calculating RWA for commercial banks.

A financial sector official said, "We will have to wait for specific measures to be announced, but since there is a demand from authorities to support import-export companies directly affected by exchange rates and tariffs, there is some expectation that the burden of soundness management will be somewhat reduced."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)