CJ Chairman Lee Jae-hyun Visits Tokyo, Japan

"K-Culture Is a Decisive Opportunity"

CJ Group Expands Food, Entertainment, and Cosmetics Businesses in Japan

Hyundai Department Store and Musinsa Actively Promote Fashion Brand Expansion into Japan

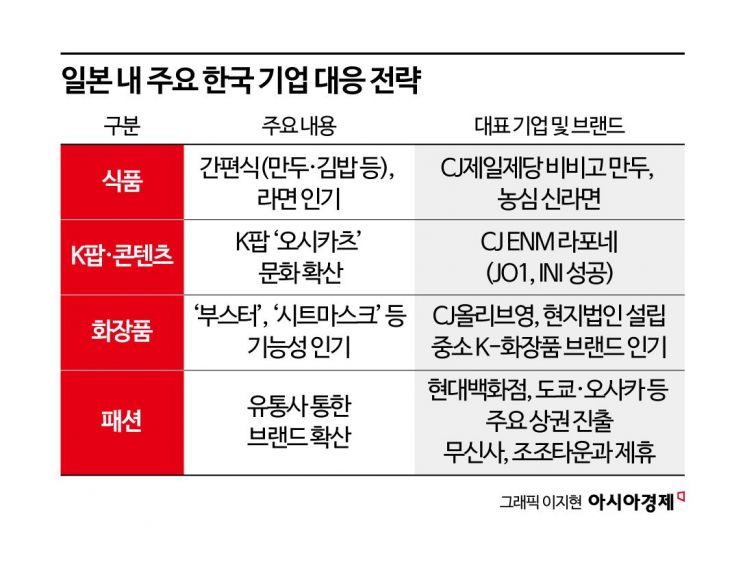

The 'K-Trend' that has surpassed Hallyu is spreading throughout Japan. Moving beyond the past consumption of cultural content centered on K-pop and dramas, demand is expanding across the entire lifestyle spectrum, including food, beauty, and fashion, accelerating the pace of domestic distribution industries. CJ Group, along with Hyundai Department Store and Musinsa, is speeding up localization strategies targeting Japan's MZ generation (Millennials + Generation Z).

Lee Jae-hyun, Chairman of CJ Group (second from the right), is holding a meeting with local Japanese officials.

Lee Jae-hyun, Chairman of CJ Group (second from the right), is holding a meeting with local Japanese officials. [Photo by CJ Group]

According to the distribution industry on the 9th, CJ Group Chairman Lee Jae-hyun visited Tokyo, Japan, from the 2nd to the 4th of this month to directly inspect local business sites and held consecutive meetings with senior executives from major Japanese distribution, entertainment, and financial industries. Chairman Lee emphasized, "The Hallyu that is reigniting in Japan is not just a simple trend but a decisive opportunity for the global spread of K-culture," adding, "Businesses already prepared, such as Bibigo and content, must not miss this timing."

During this business trip, Chairman Lee expanded global partnerships by meeting consecutively with Japanese political and business figures such as Takashi Sasaki, Chairman of TBS Holdings; Masahiro Okafuji, Chairman of Itochu Corporation; and Seiji Imai, Chairman of Mizuho Financial Group. He also instructed to explore new businesses based on cooperation with local partners, including the entry of Olive Young into Japan.

CJ Group currently operates a diversified business portfolio in Japan, including food, entertainment, and cosmetics. CJ CheilJedang is expanding convenience food products such as dumplings and gimbap under the brand 'Bibigo,' while CJ ENM established the Japanese joint venture Lafone in 2019 to directly nurture K-pop groups JO1 and INI locally. CJ Olive Young has established a Japanese corporation and is actively expanding online and offline distribution channels.

In fact, centered on Japan's MZ generation, fan activities called 'Oshikatsu (推し活)' are connecting to everyday consumption, accelerating the spread of the K-Trend. It is analyzed that beyond content consumption, K-food, K-beauty, and K-fashion products are becoming part of the lifestyle of young Japanese people.

In the food industry, Nongshim is achieving visible results. Nongshim's Japanese subsidiary has recorded an average annual growth rate of 16% over the past five years, and last year, Shin Ramyun sales increased by 22.7% compared to the previous year. In particular, Nongshim significantly expanded its distribution network by placing 'Shin Ramyun Tomba' in about 21,000 stores of Seven-Eleven, the number one convenience store in Japan. Nongshim stated, "We will strengthen emotional marketing of 'Shin Ramyun in everyday life' to deepen emotional connections with Japanese consumers."

The cosmetics industry is also enjoying a special demand in Japan. According to the Ministry of Food and Drug Safety, Korea's cosmetic exports to Japan reached a record high of $1 billion (about 1.46 trillion KRW) last year. At the '2023 Best Cosmetic Awards' announced by Japan's largest beauty platform '@cosme,' Korean brands swept the top ranks in major categories. Asahi Shimbun analyzed, "The popularity factor is that Korean brands pioneered new categories such as 'boosters,' used before functional cosmetics."

The fashion industry has also begun full-scale entry into Japan. Hyundai Department Store is helping domestic brands enter the local market through its own export platform 'The Hyundai Global.' In May last year, it opened pop-up stores for domestic brands such as Matin Kim and Noise at Tokyo Parco Shibuya, recording sales of 3 billion KRW, and this year, it has expanded the stage to Osaka Parco and Daimaru Department Store, showcasing a total of 21 brands. The number of participating brands nearly doubled compared to the previous year.

Musinsa is also actively supporting the local entry of domestic brands through its Japanese subsidiary 'Musinsa Japan.' Following the signing of the exclusive distribution contract for Matin Kim in Japan last year, it secured an online distribution network by signing a memorandum of understanding (MOU) with Japan's largest online fashion platform 'ZOZOTOWN.' A Musinsa official said, "We are building strategic partnerships that can help brands settle in the Japanese market beyond simple sales."

An industry insider said, "In the past, Hallyu was limited to K-pop or dramas, but now it is permeating overall consumption," adding, "Localization and local partnerships will be the core competitiveness for business expansion."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)