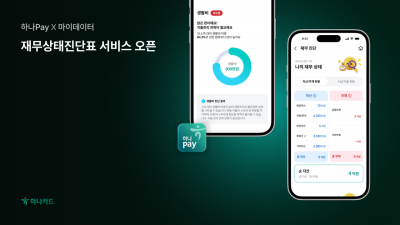

Visualization of Income, Expenses, Assets, and Liabilities

Hanacard announced on the 9th that it has launched the 'Financial Status Diagnosis Table' service in the Hanapay app, which provides a comprehensive diagnosis of individual financial status based on MyData.

The diagnosis table integratively analyzes key items such as the customer's monthly income and expenses, assets and liabilities, living expenses, savings, insurance, loans, and pensions. It visualizes these in the form of financial statements to help customers intuitively understand the financial condition of their assets.

In particular, this service comprehensively evaluates the appropriateness of the spending structure relative to the customer's income level, the presence of emergency reserve funds, the level of debt burden, and insurance subscription status, providing both a financial health diagnosis result and customized management points.

Hanacard plans to provide practical financial management tools through this service so that users can check their assets themselves and establish financial plans.

A Hanacard official said, "The financial diagnosis service is a core function of Hanapay that supports customers in managing their financial lives more proactively," adding, "We will expand this into a total financial management service linked to customized financial product proposals through collaboration with Hana Financial Group affiliates and financial companies in the future."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)