Reflecting Political Instability Including Martial Law and Impeachment

US-China Trade War Also Cited as a Risk Factor

Inflation Rate Expected to Slow to 1.9%

The Asian Development Bank (ADB) has revised down its forecast for South Korea's economic growth rate this year by 0.5 percentage points from four months ago to 1.5%. It cited the impact of the US-led global tariff war and domestic political instability as factors hindering South Korea's economic growth.

According to the Ministry of Economy and Finance on the 9th, ADB projected in its "Asian Economic Outlook 2025" released that South Korea's real gross domestic product (GDP) growth rate this year will be 1.5%. This is a 0.5 percentage point downward revision compared to the previous forecast in December last year.

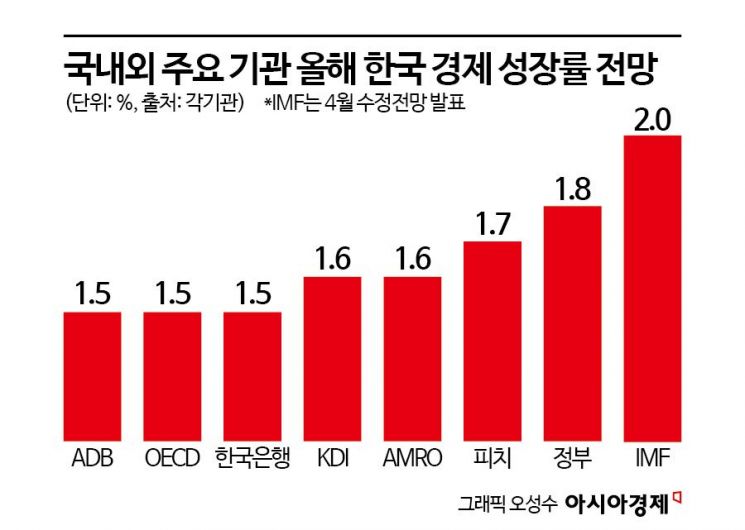

ADB's forecast is lower than the government's (1.8%), the Korea Development Institute (KDI, 1.6%), and the ASEAN+3 Macroeconomic Research Office (AMRO, 1.6%), but is at the same level as the Organisation for Economic Co-operation and Development (OECD, 1.5%) and the Bank of Korea (1.5%).

ADB cited the US reciprocal tariff shocks and political instability as reasons for the downward growth forecast. ADB stated, "Domestically, weakening private consumption due to high interest rates, household debt, and political uncertainty, along with sluggish construction, and externally, intensified export competition with the US and China and trade uncertainties will act as downside risks to the economy."

In the context of the escalating US-China trade war, where China imposed a 34% retaliatory tariff in response to US reciprocal tariffs and the US countered with an additional 50 percentage points tariff, ADB judged that a further decline in South Korea's growth rate, which is highly dependent on exports, is inevitable. ADB also incorporated for the first time in this forecast the economic impact of political turmoil surrounding the emergency martial law situation and the impeachment of former President Yoon Seok-yeol.

However, ADB expected that "despite difficult domestic and external conditions, growth will recover in the second half of this year, supported by strong semiconductor exports related to artificial intelligence (AI), increased government spending, political stability, and expansionary monetary policy." It predicted a growth rate of 1.9% for next year.

This year’s domestic inflation rate is forecasted to be 1.9%, 0.1 percentage points lower than the previous forecast, based on the decline in international oil prices and stabilization of food and energy prices. The inflation rate for next year is projected at 1.9%.

ADB projected the overall growth rate for the Asia region this year to be 4.9%, an increase of 0.1 percentage points from the December forecast last year. It expects growth to slow somewhat to 4.7% next year, citing expanded trade uncertainties due to US tariff measures and China’s real estate slump as reasons. However, demand for semiconductors is expected to drive exports, and price stability and tourism recovery are anticipated to contribute to demand expansion.

ADB also forecasted the inflation rate in the Asia region to be 2.3% this year, a 0.3 percentage point downward revision from the previous forecast. The outlook for next year is 2.2%, with international oil and raw material price declines and China’s low inflation trend contributing to price stability and a slight slowdown.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.