The remaining 1.3 trillion won will be secured through a third-party rights offering

"Major shareholders sacrifice while minority shareholders benefit"

Continued investment planned for essential business activities

Goal to achieve 70 trillion won in sales by 2035

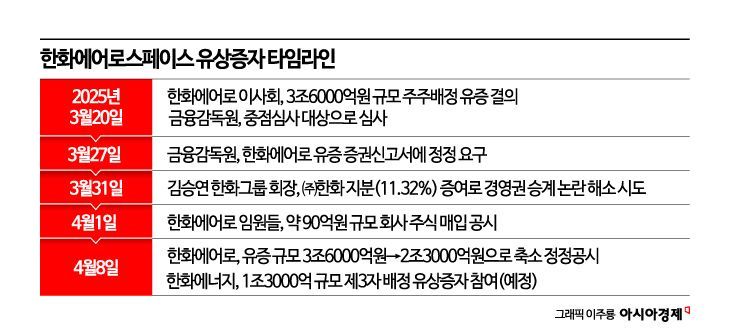

Byung-chul Ahn, President and Chief Strategy Officer of Hanwha Aerospace, recently bowed his head, admitting that "there were clearly many shortcomings" in the process of pursuing a 3.6 trillion won rights offering that sparked controversy.

On the 8th, at the 'Future Vision Briefing' held for the media at the Hanwha Building in Jung-gu, Seoul, President Ahn stated, "After the announcement of the rights offering, we received harsh criticism and concerns from shareholders, the media, and civic groups. No matter how correct the management direction is, pushing it through like this is not appropriate. Therefore, we decided to reduce the scale of the rights offering and proceed with a third-party allotment." He added, "The method of returning 1.3 trillion won also means that major shareholders will participate without the 15% discount that general shareholders receive."

On the 2nd, Hanwha Aerospace's multiple launch rocket system Cheonmu was exhibited at the 'Korea International Defense Industry Exhibition' held at Gyeryongdae, Chungnam. Photo by Jinhyung Kang aymsdream@

On the 2nd, Hanwha Aerospace's multiple launch rocket system Cheonmu was exhibited at the 'Korea International Defense Industry Exhibition' held at Gyeryongdae, Chungnam. Photo by Jinhyung Kang aymsdream@

Prior to this, Hanwha Aerospace announced that it would reduce the scale of the shareholder rights offering, previously set at 3.6 trillion won, to 2.3 trillion won. The remaining 1.3 trillion won will be secured through a third-party rights offering in which Hanwha Energy, wholly owned by the 'owner family,' will participate. Once this method is finalized, Hanwha Energy will participate in the 1.3 trillion won third-party allotment rights offering of Hanwha Aerospace without any discount. The 1.3 trillion won paid by Hanwha Aerospace to Hanwha Energy from the proceeds of the Hanwha Ocean sale will effectively return to Hanwha Aerospace. Meanwhile, minority shareholders participating in the shareholder rights offering of Hanwha Aerospace will be able to purchase shares at a 15% discounted price.

At the future vision briefing, President Ahn also announced plans to secure local production bases and establish strategic partnerships as part of mid- to long-term investment plans. He presented a blueprint to leap forward as a top-tier comprehensive defense company through continuous investment. He set this year's targets at 30 trillion won in sales and 3 trillion won in operating profit. He said, "By 2035, we expect to become a company capable of achieving 70 trillion won in consolidated sales and 10 trillion won in operating profit." President Ahn also spoke about Hanwha Ocean, stating, "We will expand the business through continuous investment and grow it into a company with maximum sales of 30 trillion won."

President Ahn also emphasized that the rights offering and acquisition of Hanwha Ocean shares are unrelated to management succession. He said, "This is a decision made after sufficient consideration and discussion by the board of directors with our business goals in mind. Going forward, we will always regard enhancing shareholder value as the highest priority and will make much greater efforts than before."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.