VI Triggered on KRX Does Not Apply to NXT

"Simultaneous VI Activation Could Lead to Overregulation and Excessive Triggers"

Concerns are emerging that the Volatility Interruption (VI) mechanism introduced by Korea Exchange (KRX) and NextTrade (NXT) may effectively become useless. This is because even if VI is triggered for a stock traded on KRX, it is not automatically applied on NXT.

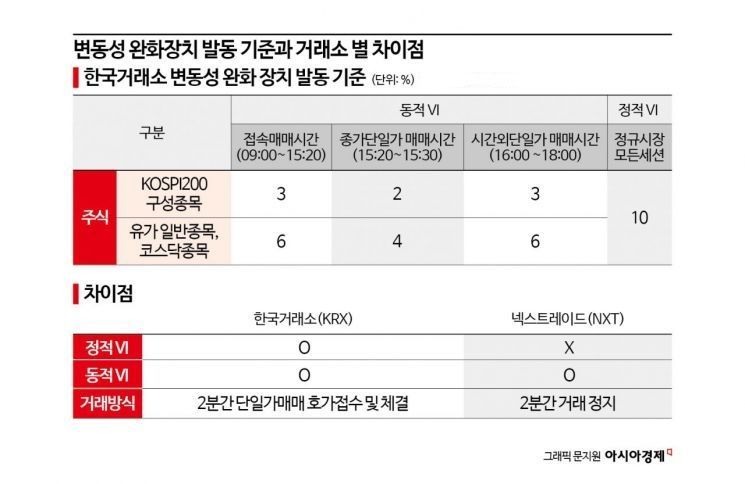

According to the financial investment industry on the 4th, both KRX and NXT apply VI. Currently, KRX activates both static and dynamic VI, while NXT only activates dynamic VI. When VI is triggered, KRX allows single-price trading with order submission and execution for 2 minutes. In contrast, NXT halts trading for 2 minutes.

Dynamic VI applies to sudden price changes (3-6% change compared to the previous transaction price), while static VI applies to larger fluctuations (more than 10% change compared to the previous day's closing price). VI was first introduced in 2014. Before that, there was no price stabilization mechanism to mitigate temporary sharp price changes before individual stock prices reached the price limit.

Previously, since stocks were only traded on KRX, VI was effective in enhancing price stability. However, the situation changed with the emergence of Alternative Trading Systems (ATS). Currently, even if VI is triggered on KRX, it does not necessarily operate on NXT.

A KRX official stated, "Prices differ by market, and there can be slight differences by time. VI is applied based on each market's price standards, and the criteria are the same."

In particular, investors can exploit this to gain arbitrage profits. For example, they can check the price of a stock with VI triggered on KRX, buy it at a lower price on NXT, and then sell it through KRX.

A financial investment industry insider said, "Trading methods using VI can certainly emerge. Similarly, in NXT's after-market or pre-market, liquidity is low, causing price gaps, and some investors have taken advantage of this."

Financial authorities have already emphasized the need to be cautious about follow-up trading using after-market or pre-market. Right after the pre-market opens, the initial price can be set at the upper or lower limit with only a small number of odd-lot orders, followed by no price movement for a certain period, and then a process where the price returns to normal, causing sharp price fluctuations.

KRX explains that there are several constraints to applying VI simultaneously on both exchanges. A KRX official said, "Applying VI simultaneously on both sides could lead to excessive regulation or over-triggering. If VI is triggered on KRX, liquidity tends to move to NXT, which could immediately trigger VI there."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.