Domestic equity covered call ETFs are rapidly growing.

Samsung Asset Management announced on the 31st that KODEX 200 Target Weekly Covered Call has simultaneously achieved the highest net asset value and year-to-date individual net purchases among domestic asset covered calls.

The net assets of KODEX 200 Target Weekly Covered Call amount to 353.9 billion KRW, with individual net purchases this year totaling 140.9 billion KRW, making it the largest among the nine domestic asset covered call ETFs.

Among a total of 39 covered call ETFs combining domestic and foreign assets, it ranked second in individual net purchases following KODEX U.S. Dividend Covered Call Active. On the 28th, it recorded daily individual net purchases exceeding 10 billion KRW in a single day, ranking fourth among 960 ETFs overall.

This is the first target covered call ETF introduced domestically using the KOSPI 200 index and on-exchange derivatives. Aiming for an annual premium income of 15%, it flexibly adjusts the weekly call option selling ratio on the KOSPI 200, allowing partial participation in the index's rise when the KOSPI 200 increases. It also pays monthly distributions by including dividends from KOSPI 200 stocks, which are expected to be around 2%, resulting in an effective expected distribution yield of about 17% annually. As a monthly distribution product listed in December last year, it has paid distributions three times totaling 484 KRW, or 4.87%.

KODEX 200 Target Weekly Covered Call has grown rapidly in about three months since listing, thanks to stable high monthly distributions and tax-exempt benefits. Investors can enjoy a 100% tax exemption on the expected premium income of 15% generated from selling call options. Capital gains on the held domestic stocks are also tax-exempt, attracting high-net-worth investors sensitive to comprehensive financial income taxation. However, dividend income at around 2% is subject to dividend income tax.

Lee Daehwan, a manager at Samsung Asset Management, said, "When new option selling volume arises from domestic covered call ETFs causing option prices (premiums) to decline, individual and institutional investors seeking profits through risk-free arbitrage and other strategies re-enter the market, generally leading premiums to converge to appropriate levels."

He added, "As the fund's net assets continue to grow and the volume of option selling increases, market participants will also increase, resulting in a virtuous cycle that expands the size of the options market."

With the popularity of weekly covered call ETFs, the weekly options market based on the KOSPI 200 is growing rapidly. Since the first weekly option was listed in September 2019, trading volume has steadily increased, with the monthly average trading value reaching about 3.4 trillion KRW.

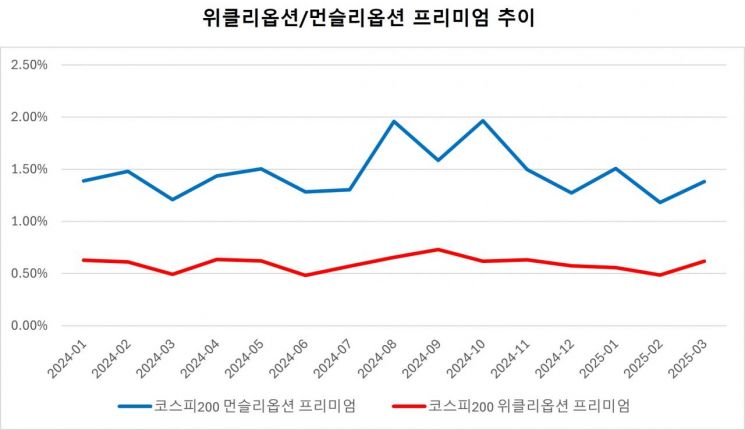

Since April last year, the weekly options market has surpassed the trading volume of existing monthly options, with the daily average trading volume increasing to over 1.25 million contracts this year, indicating a shift of market participants from monthly options to weekly options. As participation in the weekly options market grows, the market is efficiently reflecting prices. The premium level of weekly options remains similar to that before the listing of the weekly covered call ETF early last year.

Jung Jaewook, head of ETF Management Team 3 at Samsung Asset Management, introduced, "KODEX 200 Target Weekly Covered Call is designed to automatically adjust the option selling ratio according to market conditions. It is the first domestic asset target covered call product that aims for a 15% annual target premium income while allowing partial participation in stock price increases." He added, "Unlike overseas asset ETFs, it offers tax-exempt benefits, making it suitable for investors who lack pension assets and require a certain level of cash flow."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.