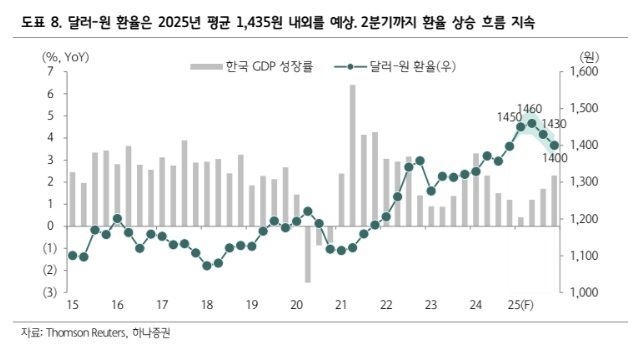

The won-dollar exchange rate is expected to maintain strength until the second quarter before turning weaker. This is analyzed to be triggered by the slowdown in U.S. employment and the Federal Open Market Committee (FOMC) interest rate cut in June.

On the 28th, Kyuyun Jeon, a researcher at Hana Securities, explained in a report titled "The Return of Trade Dispute Pressure," "The won-dollar exchange rate is expected to maintain an upward trend linked to the U.S. dollar's strength until the second quarter," adding, "In times of increased uncertainty, the upper limit of the exchange rate could rise to around 1,500 won."

He stated, "During the process of digesting the trade dispute forecasted in April, the foreign exchange market will increase preference for the safe-haven U.S. dollar," and "The widening fundamental gap between the U.S. and other countries is also likely to induce U.S. dollar strength."

He further analyzed, "Although U.S. President Donald Trump prefers a weaker dollar, saying that a strong dollar accelerates the U.S. trade deficit and lowers manufacturing competitiveness," he noted, "The expansion of local investments by overseas companies, which Trump is inducing through trade negotiations, increases demand for the U.S. dollar and expands capital inflows into the U.S."

However, the won-dollar exchange rate is expected to weaken in the second half of the year. Hana Securities forecasted that the won-dollar exchange rate will average 1,460 won in the second quarter, then gradually decrease to 1,430 won in the third quarter and 1,400 won in the fourth quarter. He said, "The U.S. dollar is expected to gradually turn weaker in the second half," adding, "The triggers for the U.S. dollar's decline will be the U.S. employment slowdown and the June FOMC interest rate cut."

He emphasized, "Whether global funds that have been concentrated in the U.S. will be redistributed, as well as the expansion of the U.S. fiscal deficit and the burden of U.S. Treasury issuance, are also expected to affect the medium- to long-term trend of the U.S. dollar."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.