Bank of Korea Financial Stability Report

386,000 High-Risk Households with Declining Debt Repayment Capacity

Last year, the number of 'high-risk households' with declining debt repayment ability reached 386,000. Their financial debt amounts to 72.3 trillion won. The Bank of Korea recently emphasized that, with housing prices, which constitute a significant portion of household assets, falling mainly in the provinces, the debt repayment burden of high-risk households in the provinces may increase, and that the risk of their insolvency should be closely monitored.

According to the Bank of Korea's financial stability report on the 27th, the number of high-risk households in South Korea last year was 386,000. High-risk households are defined as those with a Debt Service Ratio (DSR) exceeding 40% and Debt-to-Asset ratio (DTA) exceeding 100%, evaluating debt repayment ability by comprehensively considering household assets and liabilities.

Last year, high-risk households accounted for 3.2% of households holding financial debt. The financial debt held by these households amounts to 72.3 trillion won, representing 4.9% of all households. Although the number of high-risk households and the proportion of financial debt decreased compared to 2023 (3.5% and 6.2%), when they were significantly elevated due to rising interest rates, they remain at a high level compared to 2022. In terms of the number of households, it exceeds the long-term average from 2017 to 2024 (3.1%). The proportion of households lacking repayment ability in either DSR or DTA is 26.5% (3.18 million households), holding 34.8% (512 trillion won) of total financial debt.

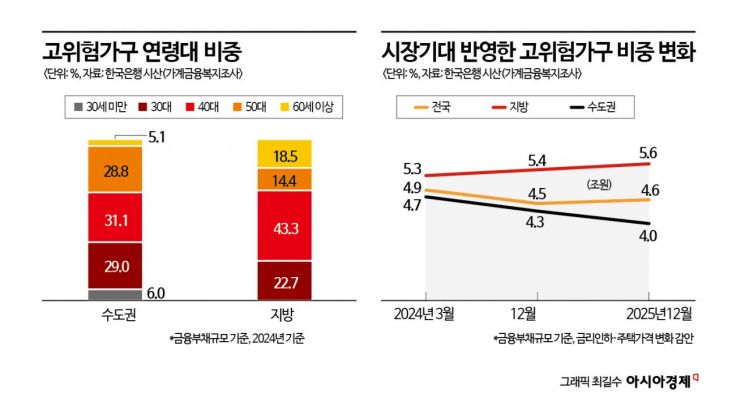

The Bank of Korea assessed that the DSR of high-risk households in South Korea is 75.0% (median), and the DTA is 150.2%, indicating a significant deterioration in debt repayment capacity in terms of income and assets. The median DSR and DTA of high-risk households in the provinces are 70.9% and 149.7%, respectively, showing little difference from those in the Seoul metropolitan area (78.3%, 151.8%). However, the proportion of household heads aged 60 or older among high-risk households in the provinces (18.5%) is higher than in the metropolitan area (5.1%), suggesting a relatively weaker income base.

The decline in housing prices may increase the number of high-risk households. When the Bank of Korea estimated the proportion of high-risk households (based on financial debt) in the provinces and the metropolitan area by reflecting changes in interest rates, housing prices, and housing price forecasts, it found that at the end of last year, the proportions were 5.4% and 4.3%, respectively. By the end of this year, the gap in the proportion of high-risk households between the provinces (5.6%) and the metropolitan area (4.0%) is expected to widen to 1.6 percentage points.

Given the sluggish economic growth in the provinces compared to the metropolitan area and the recent decline in housing prices in the provinces, there is a need to be cautious about the possibility of increasing debt repayment burdens for high-risk households in the provinces. A Bank of Korea official stated, "Compared to the metropolitan area including Seoul, regions where unsold housing is increasing and the construction industry is sluggish are likely to see an increase in high-risk households," adding, "It is necessary to closely monitor related trends and the effectiveness of government response measures to prevent the expansion of insolvency risks, especially among high-risk households in the provinces."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.