Full Ban on Naked Short Selling Lifted After 17 Months

Foreign Investor Inflows Increase Except During Pandemic

Inclusion in MSCI Developed Markets Index Also Anticipated

As the resumption of short selling approaches, the return of foreign investors is anticipated. Foreign investors, who employ various strategies such as long-short and hedging, had distanced themselves from the Korean stock market due to the ban on short selling limiting their investment methods. The return of foreign investors is expected to have a positive impact on the Korean stock market.

Another hopeful aspect is the restoration of investor confidence. In the past, short selling favored institutional investors and foreigners. In other words, individual investors faced a "tilted playing field." Financial authorities have made efforts to improve the system and enhance trust by strengthening penalties and establishing a short selling monitoring system after the ban.

Expectations Rise for Foreign Investors with Short Selling Resumption

According to the financial investment industry on the 27th, short selling will resume in the stock market starting from the 31st. This comes about 17 months after a full ban was imposed in November 2023 to eradicate naked short selling.

The most anticipated effect of the short selling resumption is the return of foreign investors. Foreign funds use short selling to hedge against the price decline risk of stocks they hold, enabling them to implement long-short strategies. This is why the ban on short selling was seen as an obstacle to foreign capital inflow.

During the first short selling ban period caused by the global financial crisis (October 1, 2008 ? May 31, 2009), foreigners net purchased 4.135 trillion KRW in KOSPI but net sold 1.331 trillion KRW in KOSDAQ. During the second period triggered by the European debt crisis (August 10, 2011 ? November 9, 2011), they sold 1.499 trillion KRW in KOSPI and 997 billion KRW in KOSDAQ. In the third period (March 16, 2020 ? May 2, 2021), foreigners net sold 23.084 trillion KRW and 189 billion KRW respectively, showing stronger selling pressure.

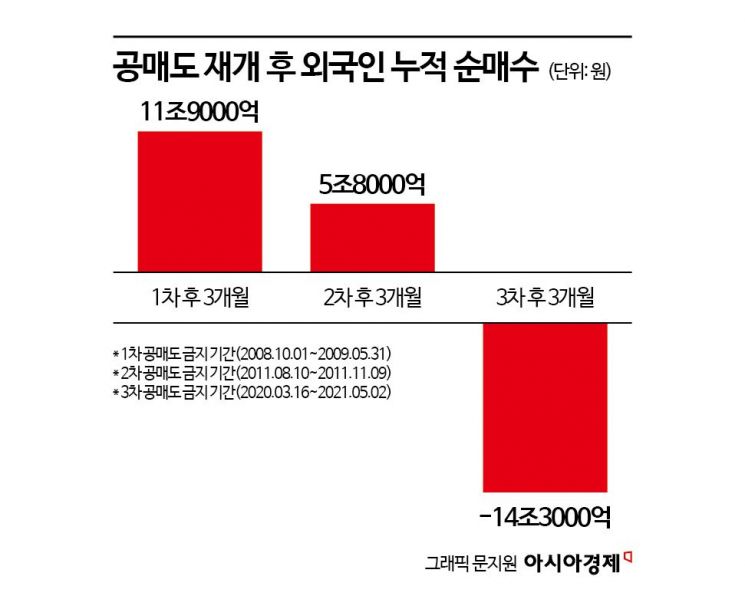

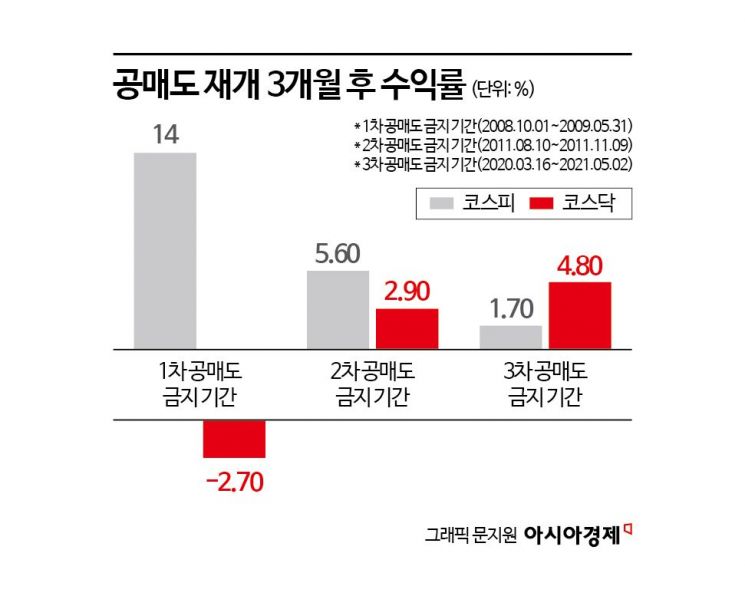

However, after the resumption of short selling, a net buying trend was observed. According to Daol Investment & Securities, in the month following the first short selling resumption, foreigners net purchased 2.1 trillion KRW in KOSPI, and over three months, 11.6 trillion KRW. In the second period, foreigners net sold 1.2 trillion KRW after one month but net purchased 5 trillion KRW after three months. After the third short selling resumption, a different trend emerged compared to the first two periods. Three months later, foreigners net sold 14.3 trillion KRW. This period coincided with the COVID-19 pandemic, which caused a continuous exodus of foreign investors, making it an exceptional case.

Experts predict that the KOSPI could also show an upward trend with the return of foreign investors. According to Shin Young Securities, one year after the first short selling resumption, the foreign ownership ratio increased by 11.1% compared to the short selling period, and the return was 17.6%. One year after the second short selling period ended, the KOSPI return was 6.5%, and foreign ownership increased by 5.6%.

Additionally, inclusion in the Morgan Stanley Capital International (MSCI) Developed Markets Index is expected. In June last year, MSCI pointed out that Korea's short selling ban policy limited foreign investors' access. KB Securities researcher Tae Yoon-sun said, "With the resumption of short selling, short-term index plunges and increased sector volatility may occur," but added, "Ultimately, liquidity improvement through foreign capital inflow and inclusion in the MSCI Developed Markets Index are expected."

However, even with the resumption of short selling, fundamentals ultimately determine the market direction, making the economic environment more important. Lee Kyung-min, a researcher at Daishin Securities, explained, "The resumption of short selling may be one factor promoting foreign market participation," but "foreign capital inflows and outflows respond more sensitively to changes in the global economic situation, interest rates, and exchange rates."

Will the Newly Introduced NSDS System Restore Investor Confidence?

Moreover, the resumption of short selling is expected to enhance investor confidence. Financial authorities have taken various measures against illegal short selling. After the short selling ban in November 2023, the Korea Exchange introduced the Central Monitoring System (NSDS). NSDS is linked with the short seller's balance management system and determines in real time whether there is sufficient balance to sell, preventing illegal (naked) short selling in advance.

Along with this, during the short selling ban period, a full investigation into illegal short selling by global investment banks (IBs) was conducted, and procedures such as fines were implemented. Additionally, through amendments to the Capital Markets Act, fines up to six times the illegal gains can be imposed for illegal short selling activities.

Financial authorities expect NSDS to block illegal short selling. Last month, Lee Bok-hyun, Governor of the Financial Supervisory Service, said, "Experiments on past illegal cases showed a 99% detection rate," adding, "It will be possible to block naked short selling."

Regarding concerns that system errors might affect the stock market, financial authorities expressed confidence. A financial authority official explained, "The NSDS system is a post-detection system, so it does not affect trading."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.