Chinese Cargo Ships Hold 50% Market Share, U.S. Only 0.01%

U.S. Exports May Fall 12%, GDP Down 0.25%

Small Ports Face Collapse... Canada Could Take Over

The U.S. government is considering imposing port entry fees on Chinese shipping companies and Chinese-made vessels docking at U.S. ports to counter China and strengthen domestic industries, but opposition is emerging within the United States. Since the shipbuilding and shipping industries currently have a high dependence on China, this measure is said to actually harm U.S. shipping companies, ports, and exporters.

On the 24th (local time), U.S. economic media CNBC reported, citing the World Shipping Council (WSC), that approximately 98% of the world's vessels are estimated to have to pay fees when calling at U.S. ports.

This figure considers not only the currently owned Chinese-made vessels but also ordered quantities. According to the U.S. Trade Representative (USTR) policy currently under discussion, shipping companies must be based outside China, Chinese-made vessels must account for less than 25%, and no orders or deliveries from Chinese shipyards should be scheduled for the next two years. Under these criteria, 90% of the world's vessels are subject to the fee.

USTR will hold hearings on the 26th following the 24th to discuss imposing port entry fees to weaken China's influence in the shipbuilding and shipping industries. For Chinese shipping companies, fees of up to $1 million per vessel may be imposed. For foreign-flagged shipping companies with Chinese-made vessels, fees of up to $1.5 million per U.S. port call will be charged.

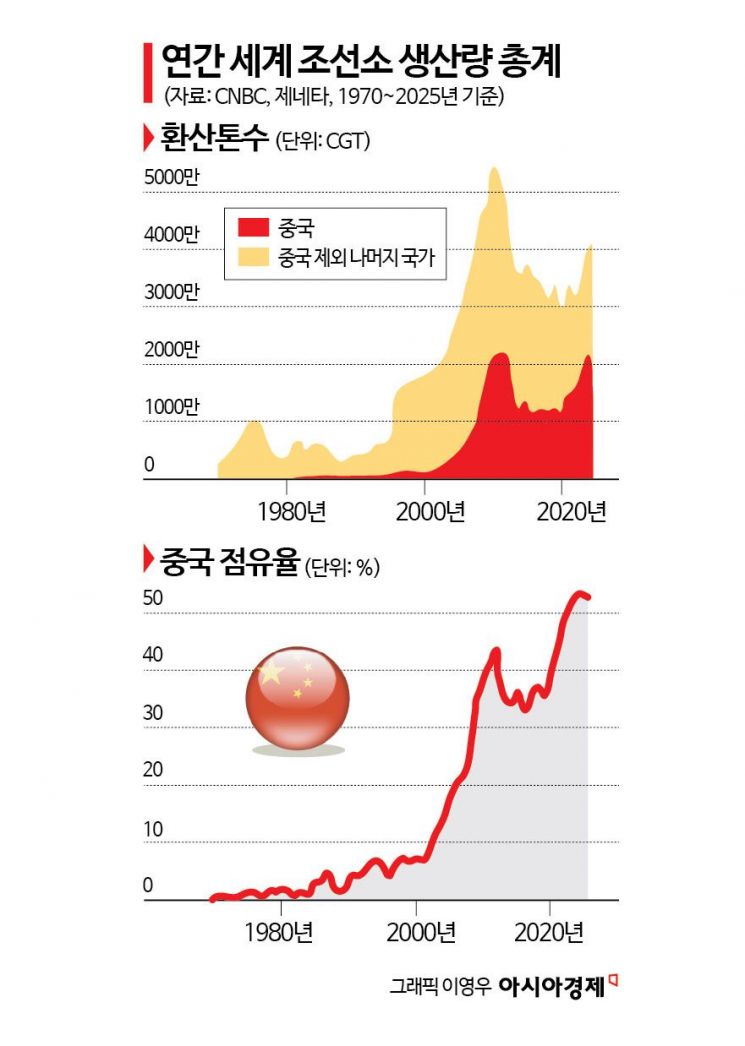

According to USTR, China's market share in cargo ship manufacturing surged from less than 5% in 1999 to over 50% in 2023. The remainder is mostly held by South Korea and Japan. The U.S. share is only 0.01%. Representatives from the U.S. shipping industry argued at the hearing that while U.S. shipyards produce fewer than 10 vessels annually, China produces 1,000 vessels, making it difficult to immediately replace Chinese-made vessels. While allied shipyards in South Korea and Japan are suggested as alternatives while the U.S. builds shipbuilding capacity, the industry believes meeting demand will be challenging.

Edward Gonzalez, CEO of Seaboard Marine, the largest international maritime freight carrier in the U.S., said, "If efforts to promote U.S. shipbuilding unintentionally harm U.S. carriers, it will not benefit national interests." Of the 24 vessels owned by the company, 16 were built in China.

Industry insiders expect severe impacts not only on shipping but also on export industries and port-related sectors. The U.S. Footwear and Apparel Association forecasted that costs rising from the fees would reduce U.S. exports by about 12% and decrease the gross domestic product (GDP) by 0.25%.

Peter Friedman, director of the Agricultural Transportation Coalition, stated, "U.S. agricultural exporters have united in concern and opposition to this proposal," adding, "It removes the ability to sell agricultural products outside U.S. borders."

The impact on port-related jobs is also severe. According to the WSC, goods worth a total of $1.5 trillion annually are transported directly or indirectly by the liner shipping industry. The liner shipping business supports over 6.4 million U.S. jobs and contributes more than $1.1 trillion to the U.S. GDP.

Joe Kurmeck, chairman of the WSC, said that under the USTR’s proposed measures, an additional charge of $600 to $800 per container would be added, doubling the cost of transporting U.S. exports and hitting farmers particularly hard. He stated, "This proposal will only increase costs for U.S. exporters and consumers, cause supply chain inefficiencies, and will not serve as an effective incentive for China to change its policies or practices."

According to the USTR policy, an average-sized 6,600 TEU container ship would have to pay a fee of $6,350 per 40-foot container. CNBC explained that this is about twice the spot rate for exports and imports between New York, U.S., and Rotterdam, Netherlands.

There are concerns that reducing calls at U.S. ports will exacerbate congestion at large ports and put small- and medium-sized ports at risk of collapse. According to the WSC, container ships bound for the U.S. typically call at 3 to 4 U.S. ports per voyage, each incurring fees of $1 million to $3.5 million. Reducing calls at smaller ports would also impact jobs related to local dockworkers, trucking, rail, and warehousing. Kurmeck said, "As ship operators minimize the number of U.S. port calls, congestion will increase at large ports while services at smaller ports will decline."

Alan Murphy, CEO of shipping research firm Sea-Intelligence, told CNBC that carriers would shift more container handling to Canada. If this continues, the U.S. risks losing its position as a logistics hub.

Trade Partnership Worldwide stated that the USTR’s policy would reduce U.S. output and the Trump administration’s goal of 3% economic growth. It also predicted that U.S. exports would decline, worsening the trade deficit.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.