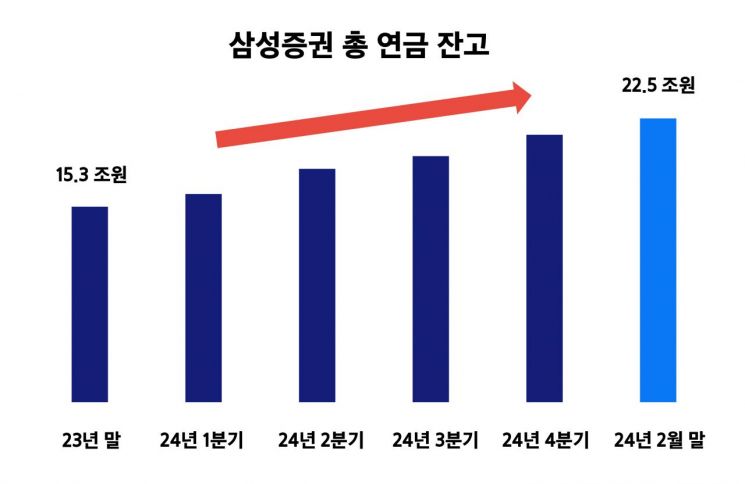

Samsung Securities is showing rapid growth as the total pension balance (based on valuation) combining retirement pensions and individual pension savings has surpassed 22.5 trillion KRW.

According to Samsung Securities on the 24th, the total pension balance of Samsung Securities grew approximately 5.9%, rising from around 21.3 trillion KRW at the end of 2024 to over 22.5 trillion KRW as of the end of February 2025.

The balances of defined contribution (DC) plans and individual retirement pensions (IRP), which individuals can directly manage, increased by 5.1% and 9.8%, respectively, over the same period.

Based on the total retirement pension balance (DB+DC+IRP), the balance grew 5.6% during the same period, ranking first in growth rate among securities firms with retirement pension balances exceeding 1 trillion KRW.

Samsung Securities also shows excellent performance in retirement pension default option returns. According to fund rating agency FnGuide on March 14, as of the end of February, Samsung Securities’ Default Option High-Risk Portfolio 2 ranked first in 1-month returns among high-risk groups. In the low-risk product category, Samsung Securities’ Default Option Low-Risk Portfolio 2 ranked first in 1-year returns.

The rapid growth of Samsung Securities’ pension balance is attributed to subscriber-centered pension services. First, Samsung Securities revolutionized the retirement pension fee system by introducing the industry’s first fee-free operation and asset management service for retirement pensions in 2021 with “Direct IRP” (excluding separate fees such as fund charges). It also launched the “3-Minute Pension” service, which greatly enhances subscriber convenience by eliminating the need for completing and sending subscription documents (excluding time for providing personal information and reviewing terms).

Additionally, Samsung Securities offers the “Pension S-Tock” service through its official MTS, mPOP, allowing users to manage their pensions quickly and comfortably.

Samsung Securities also became the first in the industry to establish dedicated pension centers, currently operating three centers in Seoul, Suwon, and Daegu. These pension centers provide specialized pension consultation services staffed by experienced personnel with over 10 years of PB experience.

The Samsung Securities Pension Centers support not only consultations for pension subscribers but also explanatory sessions for corporations introducing retirement pensions. Last year alone, they conducted over 200 seminars.

Lee Sung-joo, Executive Director of Samsung Securities’ Pension Headquarters, stated, “It is important to manage retirement pensions systematically with a long-term perspective. Samsung Securities will do its best to be a reliable pension partner for customers by providing optimal pension management services.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)