Knowledge-Intensive and Digital Transactions: 'Knowledge Services' as a New Growth Engine for Exports

Urgent Need to Secure Competitiveness in R&D-Based Intellectual Property Rights and Core Technologies

K-Content Gaining Global Attention Must Secure IP Despite Risks

Limitations of Domestic Capital and Technology... Need to Strengthen Advanced Country R&D Investment and Global Partnerships

Bold Regulatory Easing by the Government Must Also Support These Efforts

"K-content produced by global platforms that hold intellectual property rights (IP), such as the Netflix original 'Ojingeo Game' (Squid Game), means that all profits from related theme parks and other content-related ventures belong entirely to the global platforms."

On the 20th, the Bank of Korea (BOK) stated in its BOK Issue Note titled 'Current Status and Future Directions of South Korea's Service Exports' that video content, a leading example of K-content recently gaining attention, is mainly produced through direct investment by global platforms such as Netflix and Disney Plus. This sales method limits the securing of intellectual property rights and, consequently, the expansion of content and high-profit generation. The report emphasized that a structural shift is needed to diversify revenue streams by securing intellectual property rights, and bold regulatory easing by the government is also necessary to achieve this.

A promotional banner for the Netflix original series 'Squid Game 2' was installed on a building in Gwanghwamun Square, Jongno-gu, Seoul, on the 26th, the release date. Photo by Kang Jin-hyung

A promotional banner for the Netflix original series 'Squid Game 2' was installed on a building in Gwanghwamun Square, Jongno-gu, Seoul, on the 26th, the release date. Photo by Kang Jin-hyung

Knowledge-Intensive and Digital Transactions: 'Knowledge Services' as a New Growth Engine for Exports...

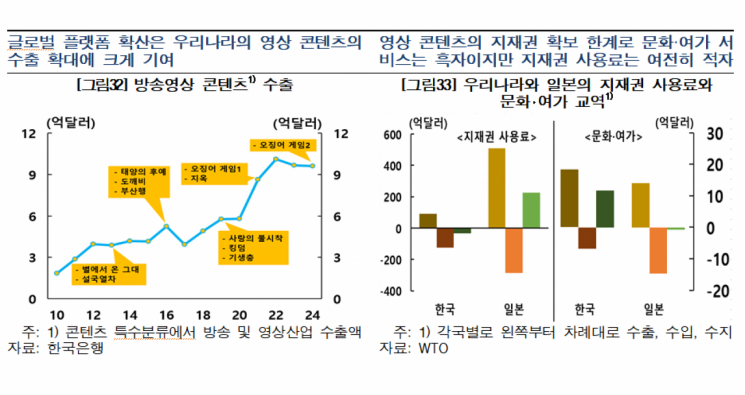

Since the global financial crisis, the share of services in world trade has increased, making service exports a new growth engine. In particular, exports in the 'knowledge services' sector, which are knowledge-intensive and primarily traded in digital form, have been rapidly increasing. According to the newly compiled and released knowledge services trade statistics by BOK this month, South Korea's knowledge services exports grew at an average annual rate of 13.4% from 2010 to 2024, driving the overall service export growth of 3.8%. Knowledge services exports are categorized into intellectual property royalties (54.0% of total knowledge services), professional and business services (27.0%), information and communication services (14.1%), and cultural and leisure services (4.9%), all showing double-digit growth rates.

The strong growth in our knowledge services exports is largely due to ▲ the spread of convergence trends between manufacturing and services ▲ the enhancement of global competitiveness of cultural content such as K-pop, webtoons, and games. Choi Jun, head of the macro analysis team at BOK's Research Department, explained, "In South Korea, convergence between manufacturing products and services, such as autonomous driving in automobiles and subscription services for information and communication functions, is actively progressing in key manufacturing sectors like electronics, resulting in high added value for products," adding, "Separately, creative producers, singers, and actors in the cultural and artistic content fields are also gaining attention and achieving significant success in the global market."

However, for our service exports to firmly establish themselves as a new growth engine in the future, a structural transformation of R&D-based intellectual property rights and breaking free from dependence on global platforms for K-content are essential.

Urgent Need to Secure Competitiveness in R&D-Based Intellectual Property Rights and Core Technologies

R&D-based intellectual property rights exported by South Korean manufacturing companies largely involve transactions between domestic headquarters and overseas subsidiaries aimed at overseas production and market entry by large corporations. The proportion of core technology-based intellectual property rights that can be supplied to other domestic and foreign companies is limited.

According to the Organisation for Economic Co-operation and Development (OECD), as of 2022, South Korea's R&D expenditure as a percentage of gross domestic product (GDP) was 5.2%, ranking second globally after Israel (6.0%), indicating a high level. However, competitiveness in core technologies remains insufficient. As a result, royalties for R&D-based intellectual property rights necessary for manufacturing production activities heavily rely on imports.

Looking at industrial property exports by region, royalties for R&D-based intellectual property rights closely related to production activities were mainly exported to China in the past but have been primarily exported to Southeast Asia since the mid-2010s. In contrast, trademarks and franchise rights related to sales and distribution activities have been exported to the United States, where overseas direct investment in manufacturing surged in the 2020s. Choi noted, "A significant portion of South Korea's industrial property rights transactions occur between overseas subsidiaries and domestic headquarters for the purpose of overseas production and local market entry, which is a limitation."

K-Content Gaining Global Attention Must Secure IP Despite Risks

Regarding video content, a leading example of recently spotlighted K-content, it is mainly sold through production methods directly invested in by global platforms such as Netflix and Disney Plus, limiting the securing of intellectual property rights, content expansion, and high-profit generation. For example, since Netflix holds the intellectual property rights for Ojingeo Game, the export (+) in South Korea's knowledge services trade statistics is recorded not under 'intellectual property royalties' but under 'multimedia production' in the 'cultural and leisure services' category. Only the payment for delivery to the global platform is recorded. Last year, multimedia production exports amounted to only $710 million. If a South Korean company creates and operates an Ojingeo Game theme park, the related intellectual property royalties are recorded as imports (-).

If domestic production companies receive direct investment and produce content that enters global platforms, the related intellectual property revenue is recorded domestically, allowing for a more diversified revenue structure. In fact, Japan, which holds numerous intellectual property rights related to animation and characters, records significant surpluses in intellectual property royalties. For example, 'Pok?mon' is not structured as a global platform investing and holding IP rights but rather as Nintendo establishing overseas subsidiaries and directly publishing and servicing the content. Choi pointed out, "If the structure relying solely on global platforms continues, the foundation for original creative production domestically will inevitably weaken."

The gaming industry, which has global competitiveness, faces various regulatory issues. He said, "South Korean games account for the largest share of content exports (61% last year) and computer and mobile software exports (85%)," adding, "Despite negative perceptions and lack of policy support, remarkable growth has been achieved, but the industry points out that regulations such as the pre-review system applied only to games remain obstacles to industrial development."

Limitations of Domestic Capital and Technology... Need to Strengthen Advanced Country R&D Investment and Global Partnerships

To expand service exports, companies must reassess the value of intangible assets such as data and intellectual property rights and actively increase investment in these areas, moving away from the traditional focus on manufacturing facilities and construction sectors. Choi emphasized, "Manufacturing companies need to recognize that investment in intangible assets such as data analysis capabilities, artificial intelligence utilization, and content creation is essential not to replace existing manufacturing but to enhance the value of manufactured products."

However, there are limits to developing and accumulating intangible assets with domestic capital and technology alone, posing a significant risk of falling behind in global competition. Therefore, it is necessary to actively utilize South Korea's unique strengths?talent, stable and efficient production facilities, advanced IT infrastructure, and high-quality manufacturing and medical data?to attract R&D investment from advanced countries and strengthen global partnerships. Choi said, "South Korea's strengths lie in its developed manufacturing sector with abundant related data and in healthcare, where advanced national medical services have accumulated data," adding, "we need to consider ways to effectively leverage foreign direct investment from advanced countries based on our strengths and their experience."

He also stressed that bold regulatory easing by the government must support these efforts. Regulations that hinder convergence between industries need to be decisively improved. Choi said, "The servitization of manufacturing has become an essential strategy for companies to increase added value in the global market, but currently, it is not difficult to find regulations in South Korea that obstruct such synergies." For example, under the current system that clearly separates manufacturing and service industries, companies registered as manufacturers must undergo separate licensing procedures when adding services. If they switch industries, they may lose existing government support benefits. Such regulations inevitably make it difficult for companies to find innovative business models.

Choi concluded, "To activate convergence between manufacturing and services, it is necessary to break down boundaries between industries and provide many opportunities for companies to engage in active convergence activities and discover new businesses," adding, "It is also important to early identify, support, and nurture talents who will excel in core technology R&D, cultural and artistic creation, and other fields."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.