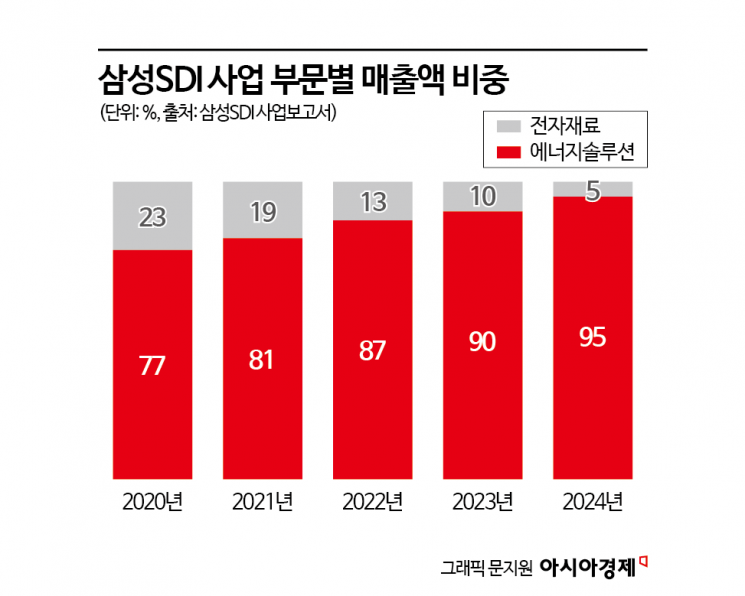

Last Year, Battery Business Accounted for 95% of Sales

"Securing Competitiveness Through Technology Development"

Samsung SDI's battery business division has achieved record-high sales revenue proportion and research and development (R&D) expenses. This is interpreted as a move to strengthen its identity as a specialized battery company amid a market situation where the electric vehicle chasm (Chasm: temporary demand stagnation) continues.

According to the business report Samsung SDI disclosed on the Financial Supervisory Service's electronic disclosure system on the 19th, Samsung SDI's energy solutions business division recorded sales of 15.6912 trillion KRW last year, accounting for about 95% of total sales. This is not only an 18 percentage point increase compared to 77% in 2020 but also the highest proportion ever. The energy solutions division produces small, medium, and large batteries including electric vehicle batteries, which is interpreted as reinforcing its identity as a 'battery company.' According to each company's business reports, last year LG Energy Solution and SK On's secondary battery sales proportions were both 100%, indicating that these companies are dedicating all their resources and personnel to the battery sector.

On the other hand, sales from the electronic materials business division, which produces semiconductor materials, liquid crystal display (LCD) materials, and organic light-emitting diode (OLED) films, steadily declined to 901 billion KRW last year. The electronic materials business sales proportion, which was 23% in 2020, dropped to a single-digit 5% last year.

Samsung SDI's business is divided into the energy solutions and electronic materials divisions. In the past, electronic materials accounted for a significant portion of the company's sales. In 2011, the energy division and the display and other divisions accounted for 51% and 49%, respectively. Since the merger with Cheil Industries and the sale of the chemical division, the electronic materials division accounted for 34% of sales in 2016 but has continuously decreased since then.

Recently, the company appears to be further intensifying its future strategy centered on battery technology. Professor Kim Pil-su of Daelim University’s Department of Automotive Engineering said, “Samsung SDI is evaluated to have had relatively efficient investments and results,” adding, “As a high-performance battery technology company, it should clarify its direction and prioritize implementing low-cost, high-quality batteries through R&D.”

Samsung SDI's LFP+ battery showcased at 'IAA Transportation 2024,' the world's largest commercial vehicle exhibition held in Hanover, Germany, last September. Provided by Samsung SDI. Photo by Yonhap News.

Samsung SDI's LFP+ battery showcased at 'IAA Transportation 2024,' the world's largest commercial vehicle exhibition held in Hanover, Germany, last September. Provided by Samsung SDI. Photo by Yonhap News.

Looking at Samsung SDI's investments so far, there has been a strong focus on the high-performance battery business. On the 14th, Samsung SDI signed an energy storage system (ESS) supply contract worth about 400 billion KRW with U.S. energy company NextEra Energy. In August last year, it announced the establishment of a joint venture for electric vehicle batteries in the U.S. with General Motors (GM), investing approximately 3.5 billion USD (about 5 trillion KRW).

Samsung SDI's R&D scale also reached an all-time high. Last year, Samsung SDI's R&D expenses amounted to 1.2976 trillion KRW, a 14.2% increase compared to 1.1364 trillion KRW in 2023. This is the highest amount ever recorded.

Samsung SDI plans to focus on technology development aiming for mass production of lithium iron phosphate (LFP) batteries in 2026 and solid-state batteries in 2027. A company official stated, “Despite difficult conditions, we believe that the only way to maintain competitiveness is through technology development,” adding, “We will continue to develop next-generation batteries and materials steadily.” Professor Moon Hak-hoon of Osan University’s Department of Future Electric Vehicles said, “Although there is talk of an electric vehicle chasm, actual electric vehicle sales are increasing,” and emphasized, “Development and investment must be made in advance to respond when electric vehicle sales rapidly increase.”

However, some voices express concerns that business diversification might be necessary. An industry insider pointed out, “If the battery market grows more slowly than expected or price competition intensifies, the burden of securing profitability could increase.” Professor Park Jung-eun of Ewha Womans University’s College of Business said, “The relative increase in proportion due to the decline in sales of other business divisions cannot be seen as positive from an overall management performance perspective.” She added, “Starting new businesses also carries risks,” and emphasized, “Currently, investments should be concentrated in promising areas to maximize profits and later create other revenue streams in a cyclical manner.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.