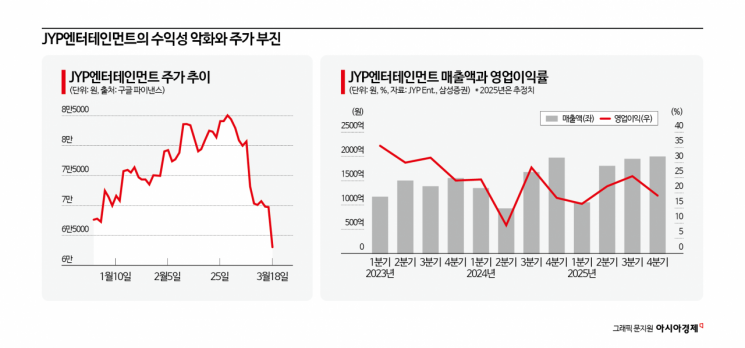

The stock price of JYP Entertainment (hereafter JYP), which had attracted attention as a tariff-free zone and due to the lifting of China's ban on Korean content, is facing difficulties. Amid disappointing earnings that fell short of expectations, major securities firms have consecutively lowered their target prices, and JYP is the only one among the four major entertainment companies whose stock price has continued to decline since the beginning of the year, raising concerns that it might be left behind in the 'entertainment stock rally.'

According to the Korea Exchange on the 18th, JYP's stock price closed at 63,000 KRW, plunging 9.61% (6,700 KRW) compared to the previous session. On that day alone, foreigners and institutions sold 47.8 billion KRW and 46 billion KRW worth of shares respectively (ranking first in net selling), driving the stock price down. This level is 26% lower than the 52-week high (85,100 KRW) and has fallen 6.8% since the start of the year. In contrast, during the same period, SM (+31%), HYBE (+16%), and YG Entertainment (+39%) have recorded double-digit returns.

The cooling of investor sentiment was caused by JYP's poor profitability. JYP increased its size with sales of 199.1 billion KRW in the fourth quarter of last year (a 27% increase compared to the same period last year), but operating profit (36.9 billion KRW) decreased by 3%, slightly missing market expectations (38.9 billion KRW). Lee Ki-hoon, a researcher at Hana Securities, said, "From 2024, Chinese music sales (about 11 billion KRW), which had been allocated and reflected gradually, were reflected all at once, resulting in a sales surprise," adding, "Considering this surprise performance, the operating profit is at a disappointing level."

What hampered JYP's margin was the business expansion of its subsidiaries. In particular, Blue Garage, which is responsible for JYP's MD (merchandise planning) and commerce, IP (intellectual property)-based businesses, recorded sales of 28.9 billion KRW in the fourth quarter of last year but posted an operating loss of 1.2 billion KRW, damaging profitability. Accordingly, Hana Securities lowered JYP's target price to 90,000 KRW, and Samsung, Hanwha, and Heungkuk Securities also consecutively downgraded their target prices to the 80,000 KRW range.

Park Soo-young, a researcher at Hanwha Investment & Securities, said, "With the fourth-quarter results last year, we once again confirmed the increased dependence on high-experience IP and the decline in margin due to business expansion," adding, "In particular, the expansion of Blue Garage's MD sales seems to cause increases in purchase costs, popup and platform operation-related expenses, and other payment fees such as delivery and payment." It is pointed out that the MD business, known as a cash cow for entertainment companies, is not playing that role for JYP.

However, there is also optimism that despite the slowdown in MD growth compared to competitors, the main artists are expected to drive earnings. Lee Hwa-jung of NH Investment & Securities said, "We expect earnings growth in 2025 due to the expansion of tours by main artists and the entry of rookie artists into the monetization phase," adding, "It is also a positive factor that 5th generation artists NEXZ and Kickflip are entering the full monetization phase." In the industry, it is predicted that Stray Kids, who are preparing for large-scale North and South American tours, will achieve a record-high K-pop tour attendance with an expected total audience of 2.2 million people.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.