Average Ex-Factory Price of 17 Brands to Rise 7.2% from the 17th

Profitability Expected to Improve on Strong Market Share

Rising Promotional Costs for New Product Expansion Remain a Concern

Nongshim, the leading company in the domestic ramen market, will raise product prices starting from the 17th. Amid recent profitability struggles and criticism from shareholders, the company is aiming for a turnaround by boosting profitability through price increases. Given Nongshim's strong market share, the price hike is expected to have a significant effect, but concerns remain that marketing costs related to expanding new products could still pose a burden.

According to industry sources on the 17th, Nongshim will increase the ex-factory prices of 17 brands out of a total of 56 ramen and snack brands by an average of 7.2%, effective from that day. This price increase comes after two years and six months since September 2022. Among the items being raised, 14 out of 31 ramen brands and 3 out of 25 snack brands are included. The main products' price increases based on ex-factory prices are Shin Ramyun by 5.3%, Neoguri by 4.4%, Ansungtangmyun by 5.4%, Chapagetti by 8.3%, Saewookkang by 6.7%, and Jjolbyeong Snack by 8.5%, among others.

Nongshim explained that the price increase is due to rising purchasing costs of key ramen raw materials such as palm oil, starches, and soup ingredients, as well as increased burdens from exchange rates and labor costs. A Nongshim official stated, "We have endured pressure to raise prices by pursuing cost reduction and management efficiency, considering the impact on consumer prices, but with rising raw material costs and exchange rates, price adjustment has become urgent," adding, "The decision was made urgently before business conditions deteriorate further."

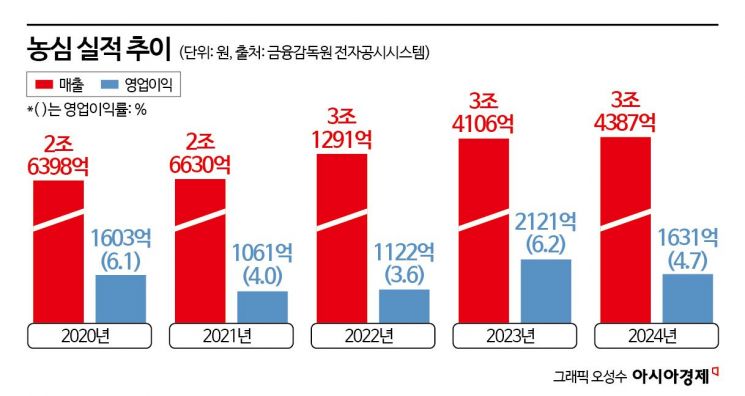

Last year, Nongshim recorded sales of 3.4387 trillion KRW and operating profit of 163.1 billion KRW. While sales slightly increased by 0.8% compared to the previous year, operating profit fell by 23.1%, resulting in an operating profit margin of 4.7%. This is a 1.5 percentage point drop from 6.2% the previous year. Sales growth was limited, but costs such as promotional expenses increased, lowering profitability. In contrast, Samyang Foods achieved an operating profit of 344.2 billion KRW with nearly a 20% operating profit margin, supported by strong overseas market performance. This has also been a factor pressuring the anonymous minority shareholder group 'Unlocking Value' to demand a corporate value enhancement plan recently.

Considering that Nongshim has shown high volatility in operating profit margin due to increased raw material and promotional costs since the second half of last year, this price increase is expected to contribute to improvements in both sales and operating profit. The effect of the price hike is likely to be reflected starting from the second quarter. Although short-term sales volume may decline due to the price increase, considering B2B demand for major brands like Shin Ramyun, it is evaluated that the improvement in operating profit margin will offset this.

Above all, Nongshim's overwhelming market share of over 50% in the domestic ramen market is cited as the background for maximizing the effect of this price increase. Nongshim's separate basis sales last year amounted to 2.7 trillion KRW, of which domestic ramen sales reached 1.6 trillion KRW. Hyunjung Son, a researcher at Yuanta Securities, said, "Since Shin Ramyun accounts for about 40% of domestic ramen sales (approximately 18% of total sales), the average domestic ramen selling price is expected to rise by about 2% due to this price increase," adding, "If the average domestic selling price rises by 2%, additional sales of about 30 billion KRW will occur, and if most of this translates into profit, the separate operating profit margin is expected to improve from the current 2-3% to around 3-4%."

However, for profitability improvement, the role of overseas markets alongside domestic market recovery is important, and in this process, additional costs such as marketing expenses are inevitable, posing a challenge. 'Shin Ramyun Tomba,' launched in September last year, successfully settled in the market by selling over 25 million units within four months of launch. Nongshim plans to continue the positive momentum by placing Shin Ramyun Tomba in major distribution channels in the U.S. market, which accounts for more than half of its overseas sales in the first half of this year. From Nongshim's perspective, it is unavoidable to actively spend on sales expenses to increase local consumer accessibility and enhance brand awareness through entry into major global distribution channels.

Eunji Kang, a researcher at Korea Investment & Securities, commented, "It is unfortunate that cost burdens continue," and added, "We need to watch whether the expansion effect of Walmart's shelves in the U.S. continues and the potential for overseas sales growth through the global launch performance of Shin Ramyun Tomba in the first half."

Moreover, as domestic consumer sentiment remains weak, promotional expenses for domestic business are expected to continue even after the price increase. Additionally, the investment in the Busan Noksan export-only factory, scheduled to begin construction in the first half of this year, is also a burden. Previously, in August last year, Nongshim announced an investment plan worth 191.8 billion KRW to strengthen production competitiveness in response to expanding export demand.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.