South Korea showed the highest market share in patent applications related to hair loss cosmetics among major countries. Hair loss cosmetics refer to functional cosmetics primarily used on the scalp and hair. The global hair loss cosmetics market size is expected to reach 31 trillion KRW this year. If the current trend continues, a blue ocean led by South Korea is anticipated.

On the 16th, the Korean Intellectual Property Office (KIPO) announced that an analysis of patent applications related to hair loss cosmetics from 2002 to 2023 in major countries including South Korea, the United States, China, Europe, and Japan (IP5) revealed that South Korean applicants held the highest share at 42.9%, ranking first worldwide.

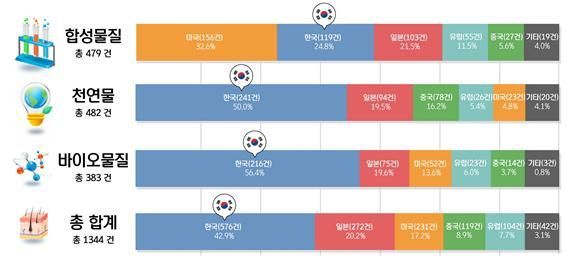

A graph showing the proportion of ingredient types occupied by Korea in major countries' patent applications related to hair loss cosmetics. Provided by the Korean Intellectual Property Office.

A graph showing the proportion of ingredient types occupied by Korea in major countries' patent applications related to hair loss cosmetics. Provided by the Korean Intellectual Property Office.

According to the analysis of application trends by nationality, South Korea accounted for the largest share at 42.9% (576 cases), followed by Japan at 20.2% (272 cases), the United States at 17.2% (231 cases), China at 8.9% (119 cases), and Europe at 7.7% (104 cases).

In terms of application trends by ingredient type, South Korea showed strength in natural and bio sectors, while the United States led in synthetic substances. Based on active ingredients, they can be classified into natural and bio substances (such as herbal extracts and stem cell-derived proteins) and synthetic substances (such as minoxidil). South Korea excelled in the former, and the United States in the latter.

Looking at the actual patent application status by ingredient type, South Korea ranked first in the natural and bio substance fields with shares of 50.0% (241 cases) and 56.4% (216 cases), respectively. Conversely, in the synthetic substance field, the United States held the top position with a 32.6% share (156 cases), followed by South Korea (24.8%, 119 cases) and Japan (21.5%, 103 cases).

Most active ingredients in hair loss cosmetics are discovered through basic research processes similar to those for pharmaceuticals, but some are developed by drawing ideas from classical texts such as Donguibogam and Bonchogangmok or traditional medicinal herbs.

Among the top 10 patent applicants related to hair loss cosmetics (overall ranking), three South Korean companies?Caregen Co., Ltd. (1st), Amorepacific Corporation (2nd), and LG Household & Health Care (4th)?were included.

When classifying the ingredient types in the patent applications of these companies, Amorepacific ranked first in the natural substances field, and Caregen ranked first in the bio substances field, indicating that domestic companies have secured an advantage in the natural and bio substance sectors.

Lim Young-hee, Director of the Chemical and Life Sciences Examination Bureau at the Korean Intellectual Property Office, stated, “Through patent analysis, we confirmed that the hair loss cosmetics market is a blue ocean that South Korea can dominate with technological superiority. The Korean Intellectual Property Office will share patent documents and results with the industry to help domestic companies lead the global hair loss cosmetics market and will continue communication to enable the cosmetics industry to grow based on intellectual property.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.