If General Corporations Are Included, the Total Reaches 540 Billion KRW

The scale of short-term bonds sold to individual investors by Homeplus has reached around 200 billion KRW. The total retail sales volume, including sales to general corporations, is approximately 540 billion KRW. It has also been identified that a significant amount of individual investors' funds are tied up in Homeplus store-backed REITs (Real Estate Investment Trusts) and real estate funds worth over 1 trillion KRW.

According to data submitted by the Financial Supervisory Service and the financial investment industry to the office of Kang Min-guk, a member of the National Assembly's Political Affairs Committee from the People Power Party, as of the 3rd of this month, the outstanding balance of Homeplus corporate commercial paper (CP), card payment-backed asset-backed securities (ABSTB - asset-backed electronic short-term bonds), and other short-term bonds totals 594.9 billion KRW.

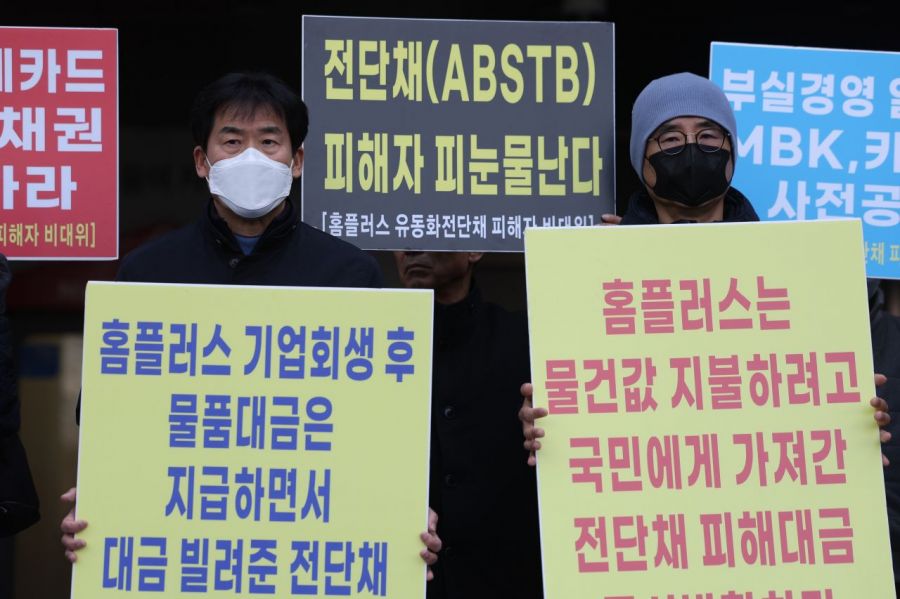

The amount sold to individual investors through securities firms' frontline branches is 207.5 billion KRW (676 cases). The amount sold to general corporations is 332.7 billion KRW (192 cases). The companies investing in these bonds are mainly small and medium-sized enterprises engaged in technology, electronics, and shipping industries.

By type, ABSTB issuance is the largest at 151.7 billion KRW (4 times), followed by short-term bonds at 16 billion KRW (4 times), and CP at 13 billion KRW (3 times).

Homeplus is under suspicion of issuing 82 billion KRW worth of ABSTB last month despite being aware of a credit rating downgrade from credit rating agencies.

Concerns have also been raised that individual investors may suffer losses in REITs or real estate funds that include Homeplus stores as assets. Homeplus has used a strategy of selling prime stores to liquidate cash and then borrowing again to operate. REITs that have incorporated such types of stores as assets have received rent from Homeplus and paid dividends to investors. However, if rent payments start to be withheld, investors may incur losses.

The government is reported to estimate the scale of REITs and funds based on Homeplus stores as underlying assets to be at the level of 1 trillion KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.