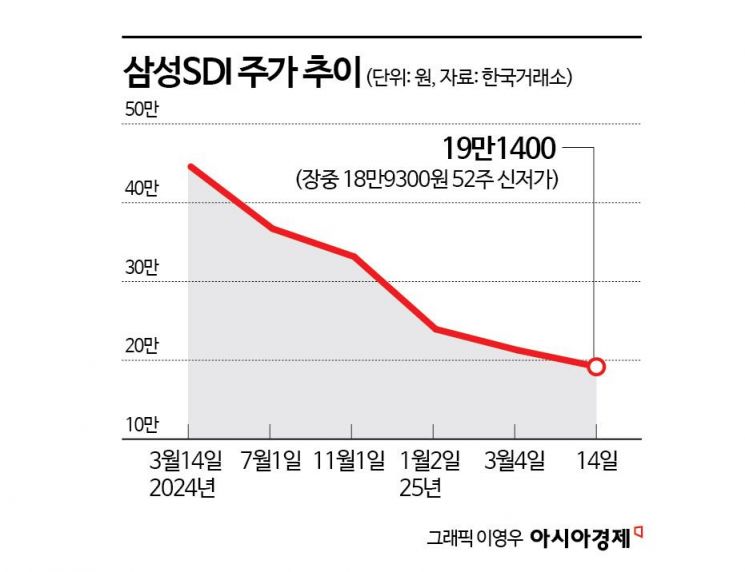

Stock Price Drops Over 6% on the 14th... Hits 52-Week Low During Session

Share Price Halved Compared to a Year Ago... Down About 23% This Year Alone

With No Signs of Recovery, Large-Scale Rights Offering Brings Shareholders to Tears

Poor Performance Expected Again This Year

The stock price of Samsung SDI has fallen below the 200,000 won mark, halving compared to a year ago. With no signs of recovery in the stock price, the large-scale rights offering has deepened the worries of individual investors.

According to the Korea Exchange on the 17th, Samsung SDI closed at 191,400 won on the 14th, down 6.18% from the previous day. During the session, it dropped to as low as 189,300 won, setting a new 52-week low. This is the first time in five years since March 2020 that Samsung SDI's stock price has fallen below the 200,000 won level.

The news of the rights offering dragged the stock price down. On the 14th, Samsung SDI held a board meeting and announced that it had resolved to raise 2 trillion won through a rights offering to secure funds for facility investment. The number of shares to be issued in this rights offering, conducted through a shareholder allocation followed by a general public offering of unsubscribed shares, is 11,821,000 shares, representing a 16.8% increase. Samsung SDI plans to use the funds raised through this rights offering for investments in the joint venture with the U.S. company General Motors (GM), expansion of production capacity at its plant in Hungary, Europe, and facility investments for domestic all-solid-state battery lines. Samsung SDI explained that the decision for this rights offering was made considering the mid- to long-term growth prospects of the electric vehicle battery market and the characteristics of the battery business, which requires 2 to 3 years from facility investment to mass production.

Small shareholders are protesting the large-scale rights offering decision. The stock discussion boards on portal sites are filled with shareholders' critical voices. One investor lamented, "The stock price is halved, and now with the rights offering, are they trying to kill the retail investors?" Another investor expressed frustration, saying, "Is this the result of long-term investment?" Another criticized, "Why are they trying to take money from retail investors? Even when there were profits, dividends were negligible, and now they are asking retail investors for help for future growth. Is this right?"

Such backlash from shareholders stems from the fact that Samsung SDI's stock price has already fallen significantly and is unlikely to recover quickly, and the large-scale rights offering raises concerns about dilution of their equity value.

Samsung SDI's stock price, which was in the 400,000 won range a year ago, has halved. It has fallen 22.67% just this year.

The worsening market conditions due to the electric vehicle chasm (temporary demand stagnation) still show no signs of recovery. Accordingly, the securities industry expects Samsung SDI to continue posting losses in the first quarter of this year. According to financial information provider FnGuide, the consensus for Samsung SDI's first-quarter performance this year (average forecast by securities firms) is sales of 2.8537 trillion won, down 44.38% year-on-year, and an operating loss of 269.1 billion won. Securities firms expect results to fall short of this. Jinsoo Jung, a researcher at Heungkuk Securities, said, "Expectations for new plant operations are being diluted amid a negative market environment," adding, "Operating loss in the first quarter is expected to widen to 418.6 billion won."

A year-on-year contraction is also expected for the full year. Kyunghee Jung, a researcher at LS Securities, said, "Sales of medium- and large-sized electric vehicle (EV) batteries are expected to decrease by 15% year-on-year due to a sharp drop in sales to Rivian," adding, "With the increase in market share of Chinese lithium iron phosphate (LFP) prismatic batteries, the decline in sales to Rivian, and early operation of the U.S. Stellantis joint venture, it is expected that utilization rates will not improve easily within the year. Accordingly, operating profit is expected to decrease year-on-year due to increased fixed costs per unit."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.