Dalba Global Nears IPO... Woori Venture Partners Expected to Gain Tenfold Returns if Successful

Rapid Growth Draws Attention to Fashion... Peace Peace Studio's Valuation Projected at 1 Trillion KRW

VC Fortunes Diverged Over APR Last Year... "This Year, Beauty and Fashion Will Also Determine Results"

Last year, the fortunes of the venture capital (VC) industry hinged on whether their investment portfolios included the beauty tech company APR. While the industry as a whole struggled with investment recoveries due to economic downturns and increased external uncertainties, those who invested in APR achieved a tenfold return on investment. This year, the fortunes of VCs are also expected to diverge depending on specific portfolios, particularly with 'Dalba' and '3ma'.

According to the VC industry on the 14th, the sectors responsible for investment recoveries this year are expected to be beauty and fashion. Among them, the beauty startup Dalba Global and the casual fashion brands Matin Kim, Mardi Mercredi, and Marithe Francois Girbaud, collectively known as '3ma', are drawing attention.

Dalba, which grew with the 'Flight Attendant Mist,' estimated to have a market capitalization exceeding 500 billion KRW after listing

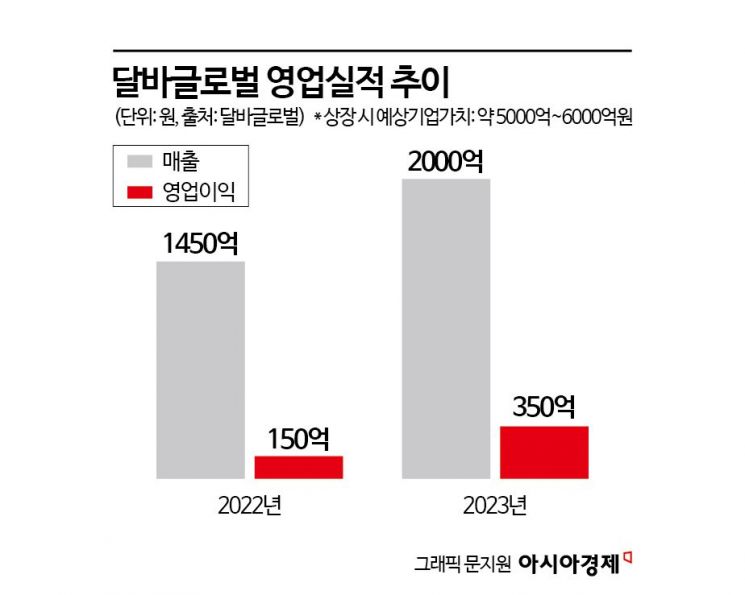

Dalba Global is a beauty startup founded in 2016. It quickly established itself in the market with the core keywords 'luxury' and 'vegan.' Its sales surged from 69.2 billion KRW in 2021 to 145.2 billion KRW in 2022, and 200.8 billion KRW in 2023. Operating profit also rose from 2.4 billion KRW in 2021 to 14.6 billion KRW in 2022, and 32.4 billion KRW in 2023. Last year, it gained popularity overseas, including in the United States, generating 140 billion KRW in overseas sales alone.

Riding this steep growth, Dalba Global received preliminary approval for listing from the Korea Exchange's KOSPI Market Division in January and is preparing for a public offering. The industry estimates its post-listing market capitalization to be around 500 to 600 billion KRW. The company's valuation, which was about 50 billion KRW in 2020, has grown more than tenfold in five years. This has drawn attention to the investing companies.

If Dalba Global succeeds in going public, the biggest beneficiary will be Woori Venture Partners, which invested from the early stages of Dalba Global and became the second-largest shareholder with 13.4%. Other investors such as DSC Investment, HB Investment, Union Investment Partners, Bokwang Investment, and SL Investment also participated through secondary share purchases.

A VC industry insider explained, "Large beauty companies experienced a slump after China's ban on Korean content, and investments were quiet for a while. However, after the success of brands like Manyo Factory, K-beauty has rapidly risen again, attracting renewed VC interest. What used to be a discount factor globally, 'Made in Korea,' has now become a premium."

VC industry’s fortunes diverged over APR last year

The reason the VC industry cannot help but focus on beauty startups’ IPOs is due to APR’s success story last year. The fortunes of major domestic VCs diverged depending on whether they invested in APR. APR began receiving institutional investments in 2017, its third year since establishment, and raised funds three times before its IPO. Each VC realized about 8 to 10 times returns through share sales around APR’s IPO. APR entered the KOSPI market in February last year with an offering price of 250,000 KRW (pre-stock split basis). On the first day of listing, its stock price soared to 467,500 KRW and closed the day at 317,500 KRW, 27% (67,500 KRW) above the offering price.

In particular, Mirae Asset Venture Investment invested about 14 billion KRW from 2018 and achieved a 7.8 times return through share sales. IMM Investment also invested about 4.5 billion KRW and sold all its shares by the end of 2019, reportedly recovering about 10 times its investment. Other investors included Hana Ventures, Shinhan Venture Investment, Intervest, Lotte Ventures, Spring Partners, SJ Investment Partners, Suin Investment, SV Investment, S&S Investment, BM Ventures, and Tigris Investment. Some VCs that did not sell their shares after APR’s IPO were able to enjoy even greater profits through stock price appreciation.

APR’s success was a representative case proving the growth potential of the beauty tech market even during last year’s domestic stock market downturn, and it sparked increased investment enthusiasm in K-beauty startups. Conversely, VCs that did not include APR in their portfolios were inevitably excluded from this recovery bonanza.

After beauty, fashion... spotlight on '3ma'

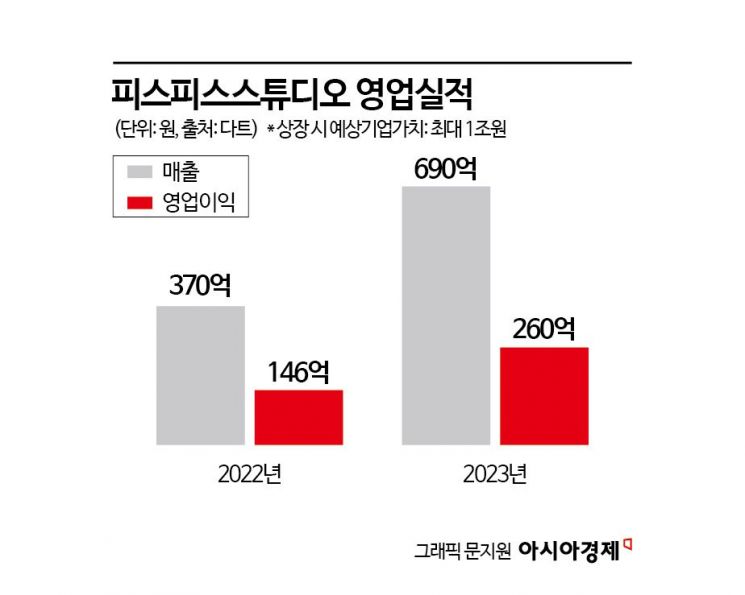

Fashion companies are also gaining attention. Especially, '3ma,' which is experiencing rapid growth fueled by the support of the MZ generation (Millennials + Generation Z), is in the spotlight. Among the three, Peace Peace Studio, which operates Mardi Mercredi, recently selected NH Investment & Securities and Mirae Asset Securities as lead underwriters and is preparing for an IPO. There are forecasts that its post-listing corporate value will approach 1 trillion KRW, based on applying a price-to-earnings ratio (PER) of 10 to 15 times to next year’s expected net profit.

Peace Peace Studio’s operating profit grew from 200 million KRW in 2020 to 25.7 billion KRW in 2023, an increase of more than 100 times. During the same period, sales expanded from about 860 million KRW to 68.6 billion KRW, roughly an 80-fold increase.

Peace Peace Studio has raised over 30 billion KRW in external funding so far. The start was a seed investment in 2021 by Musinsa Partners, the corporate venture capital (CVC) of Musinsa. Other participants included Korea Investment Partners, KB Investment, IMM Investment, E&Investment, Mirae Asset Venture Investment, We Ventures, SL Investment, and Stonebridge Ventures.

Matin Kim, operated by Hagohouse, an affiliate of Daemyung Chemical Group, grew its sales from 5 billion KRW in 2020 to 150 billion KRW last year, with a target of 200 billion KRW this year. The brand Marithe Francois Girbaud, operated by Layer, also achieved 150 billion KRW in sales last year, five years after its launch, and aims for 230 billion KRW this year, continuing its steep growth.

A VC who invested in '3ma' said, "K-fashion meets both key VC investment indicators: sales growth and overseas expansion. As brand value rises, profitability through secondary share sales can also be secured, so many VCs are paying close attention to the fashion sector."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)