Public and Private Sectors Both Contract: "No Profit, No Participation"

Construction Performance Also Declines... Downward Outlook for Investment

Overseas Orders Double, Signaling a Green Light for $50 Billion Target

The domestic construction order amount has fallen below 10 trillion won for the first time in 17 months. It is analyzed that the combined effects of real estate project financing (PF) risks, an increase in unsold units, and political uncertainty are causing hesitation in launching new projects. On the other hand, overseas construction orders are showing an increasing trend, partially offsetting the domestic slump. As domestic construction contracts shrink, construction companies' efforts to find breakthroughs overseas are expected to intensify.

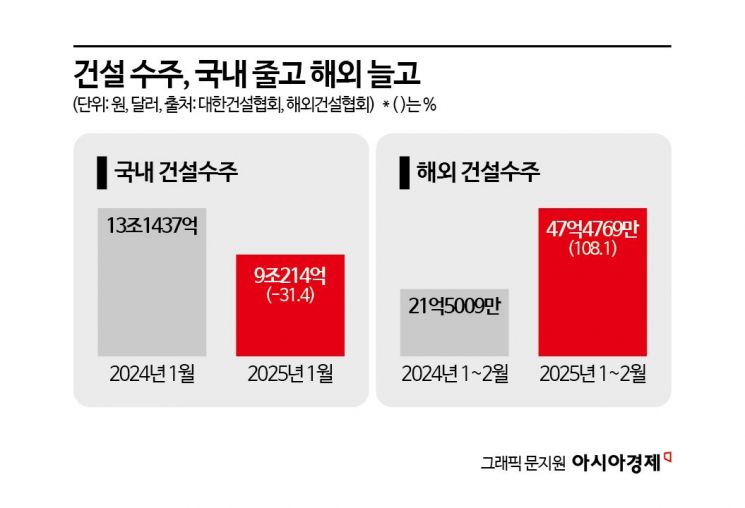

According to the Korea Construction Association's "Domestic Construction Economic Trend Report" on the 13th, the domestic construction order amount in January was 9.0214 trillion won. This represents a 31.4% decrease compared to 13.1437 trillion won in the same period last year. It is the first time in 17 months since August 2023 (9.9184 trillion won) that the monthly amount fell below 10 trillion won. Meanwhile, overseas construction orders from January to February amounted to $4.74769 billion, a 108.1% increase compared to $2.15009 billion in the same period last year. This is the largest scale since 2020.

Public and Private Sectors Both Slump... Clear 'Selective Ordering'

Domestic construction orders have contracted in both the public and private sectors. Compared to the same period last year, public orders decreased by 34.2%, and private orders by 30.2%. In particular, the private sector saw declines across all segments, including new housing (-56.6%), redevelopment (-28.3%), and reconstruction (-59.6%). This appears to be due to construction companies strengthening their 'selective ordering' policy, avoiding projects that are not very profitable. In fact, recent bidding for maintenance projects has frequently resulted in failed contractor selections or switching to negotiated contracts. Representative examples include the repeated failures of single bids in the reconstruction tenders for Gaepo Jugong 6 and 7 complexes and Jamsil Woosung 1, 2, and 3 complexes, where competitive bidding was expected.

The construction industry is sinking deeper into a recession. Not only have orders decreased, but construction performance has also plummeted. Construction performance in January was 10.6661 trillion won, down 26.8% compared to the same period last year. The 'real construction performance amount,' which indicates the change in performance amount compared to the previous year, has been declining for nine consecutive months. As the construction market downturn deepens, the Bank of Korea recently lowered its construction investment forecast for this year from -1.3% to -2.8%.

The Korea Construction Association explained, "The construction market has contracted due to high interest rates, rising construction costs, and PF risks," adding, "The recent increase in unsold units and contraction of new projects, coupled with domestic political situations, are further increasing market uncertainty."

Overseas Orders Double... Positive Signs for Annual $50 Billion Target

The overseas market shows the opposite trend. According to the Overseas Construction Association's order statistics, overseas construction orders recorded $4.74769 billion in January and February, the largest scale since 2020 ($9.37 billion). The number of orders also increased by 35.4% compared to the same period last year. The main contract for the Czech nuclear power plant project, the biggest positive factor this year, is expected to be signed by the end of this month or early April, indicating that overseas orders will gain momentum. This project involves Korea Hydro & Nuclear Power as the lead, along with Daewoo E&C and Doosan Enerbility. The expected project cost reaches 24 trillion won. Winning this project would signal a 'green light' for the government’s annual overseas order target of $50 billion this year.

By region, the Middle East accounted for 54.3% of total orders ($2.57726 billion). North America & Pacific ($820.78 million), Asia ($595.83 million), Africa ($404.46 million), Latin America ($325.21 million), and Europe ($24.13 million) followed. Among major contracts concluded this year, Samsung E&A secured a $1.69 billion methanol plant project in the United Arab Emirates, and Hyundai Engineering & Construction won two solar power-linked 80kV transmission projects in Saudi Arabia. The combined contract value of these two projects is $388.26 million.

Lee Eun-hyung, a research fellow at the Korea Construction Policy Institute, said, "The overall downturn in the construction industry, which has entered a downward cycle, will continue until next year," adding, "As in past crises, the market is expected to be reorganized around strong companies with definite self-help measures such as overseas orders."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)