Some Commercial Banks Exhaust Non-Face-to-Face Mortgage Loan Quotas Right After Opening Hours

Loan Cliff Persists for Genuine Borrowers Despite Interest Rate Cuts

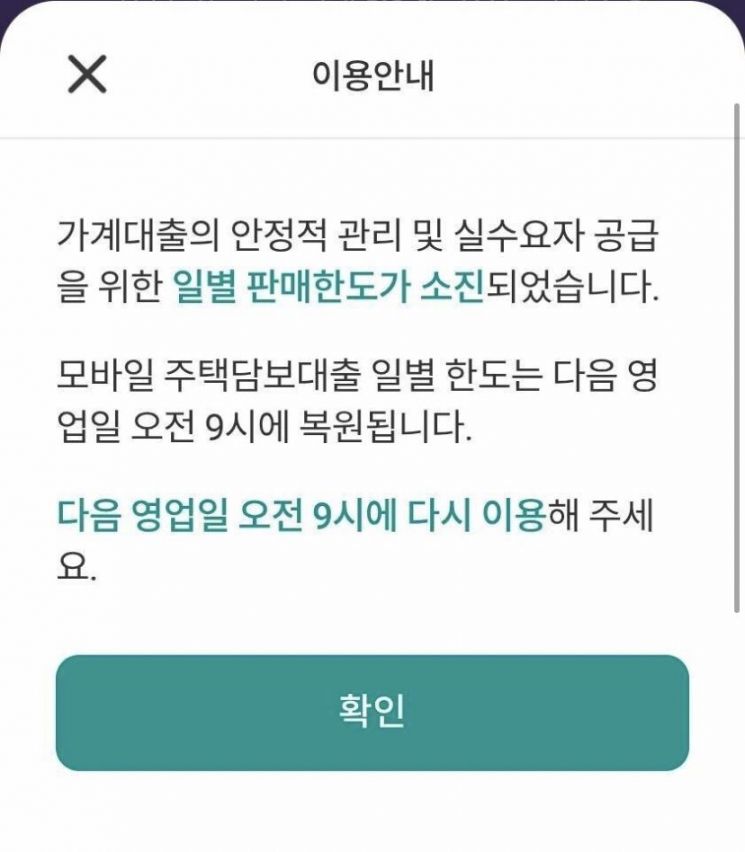

▲A major commercial bank's non-face-to-face mobile mortgage loan product is notifying that the daily sales limit has been reached. Photo by Kwon Jaehee.

▲A major commercial bank's non-face-to-face mobile mortgage loan product is notifying that the daily sales limit has been reached. Photo by Kwon Jaehee.

Recently, despite efforts by genuine borrowers to secure non-face-to-face mobile mortgage loans through an 'open run' (rushing in as soon as it opens), there have been cases where loans could not be obtained. This is because banks, which traditionally managed loan limits on an annual basis, have started managing them on a daily basis. Although commercial banks have lowered loan interest rates this year reflecting the base rate cuts, there are still criticisms that the perceived loan threshold for genuine borrowers remains high.

According to the financial sector on the 13th, some commercial banks' mobile loan products were closed shortly after the start of business hours. One commercial bank's non-face-to-face mortgage loan product announced early closure with a message stating that the 'daily sales quota has been exhausted' as soon as the business hours began at 9 a.m. Additionally, iM Bank also stopped accepting loan applications from the 6th, managing non-face-to-face mortgage loans on a daily basis. Typically, loan open runs frequently occurred mainly at major internet banks without face-to-face counters, but recently this phenomenon has spread to commercial banks.

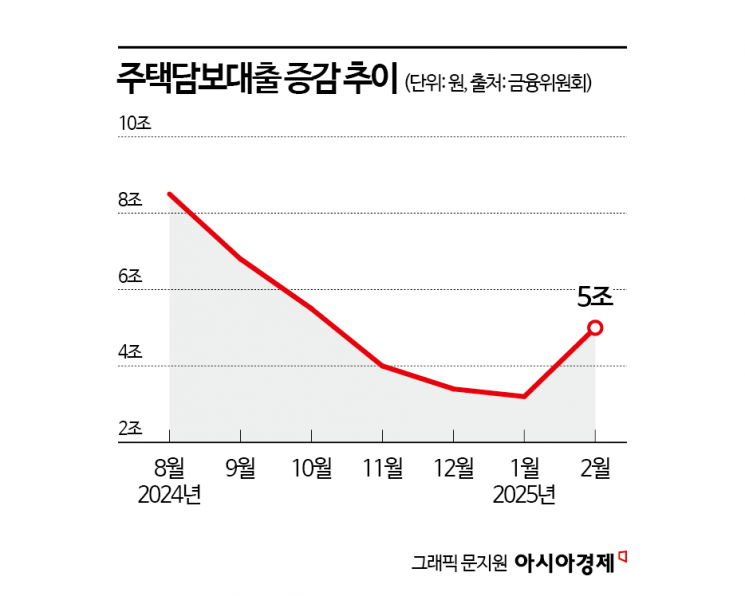

This is because commercial banks have started managing their loan targets, which were usually managed annually, on a daily basis. The reason the banking sector has shifted to daily limit management instead of quarterly or monthly management is that the recent decline in household loans has turned into an increase again. According to the Financial Services Commission's 'Household Loan Trends in February,' household loans increased by 4.3 trillion KRW in February, reversing the previous month's (9 billion KRW decrease) trend to an increase. It turned to an upward trend just one month after household loans in the financial sector had declined. In particular, the increase in mortgage loans was overwhelmingly large. It rose by 5 trillion KRW compared to the previous month, which is a significant expansion compared to the January increase of 3.2 trillion KRW.

Given this situation, despite banks' moves to lower interest rates, there are complaints that the perceived loan threshold for genuine borrowers remains high. Woori Bank lowered the additional interest rate on its 5-year variable (periodic) mortgage loan product by 0.25 percentage points starting from the 28th of last month. NH Nonghyup Bank also reduced interest rates on non-face-to-face mortgage loans and personal credit loans by up to 0.40 percentage points from the 6th. Hana Bank lowered the additional interest rate on face-to-face mortgage loans (hybrid type) by 0.15 percentage points starting from the 10th. Shinhan Bank plans to lower the interest rates on mortgage loans for home purchase funds and living stabilization funds (limited to financial bond 5-year and 10-year benchmark rate products) by 0.10 percentage points from the 14th, and also reduce interest rates on seven types of credit loan products by 0.10 to 0.20 percentage points through the introduction of preferential interest rates.

A representative from a commercial bank said, "Typically, non-face-to-face products have smaller limits and fewer loan cases than loans conducted at counters, so it may seem difficult to get a loan, but this differs somewhat from the atmosphere felt on the ground." However, they added, "From the second half of the year, the third phase of the Debt Service Ratio (DSR) implementation is scheduled, which may cause loan demand to increase more in the first half, and there could be situations like last year where loan operations cannot be conducted at the end of the year. Therefore, this year, total loan volume management has been in place since the beginning of the year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.