The number of applicants for the 'Saechulbal Fund,' a debt adjustment program for small business owners and self-employed individuals, increased by about 5,500 within a month. The amount of debt applied for also rose by more than 900 billion KRW.

Korea Asset Management Corporation (KAMCO) and the Credit Counseling and Recovery Service announced on the 12th that as of the end of February this year, the cumulative number of applicants for the Saechulbal Fund debt adjustment reached 113,897. This is an increase of 5,510 from the end of January (108,387). The amount of debt applied for was 18.4064 trillion KRW, up 906 billion KRW from 17.5004 trillion KRW at the end of January.

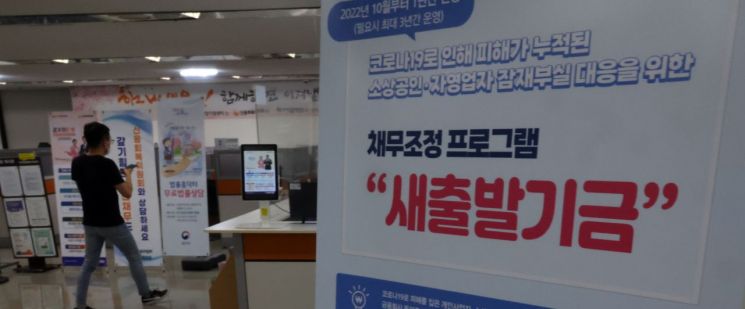

The Saechulbal Fund is a program introduced in 2022 to alleviate the debt burden of self-employed individuals and small business owners following COVID-19. It provides support such as principal reduction, repayment deferral, and interest reduction depending on the delinquency status.

As of the end of February, 31,435 people had signed agreements under the 'purchase-type debt adjustment,' where the Saechulbal Fund purchases the bonds and directly adjusts the debt. The principal debt amounted to 2.7346 trillion KRW, with an average principal reduction rate of about 70%.

Under the 'intermediary-type debt adjustment,' which adjusts interest rates and repayment periods without principal reduction, 34,216 people had finalized their debt adjustments by the end of February. Their debt amounted to 2.5717 trillion KRW, with an average interest rate reduction of approximately 4.7 percentage points.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.