$1.8 Billion Drop in Foreign Exchange Reserves at End of February

Lowest Level in 4 Years and 9 Months Since May 2020

Impact of NPS Foreign Exchange Swap and Measures to Ease Market Volatility

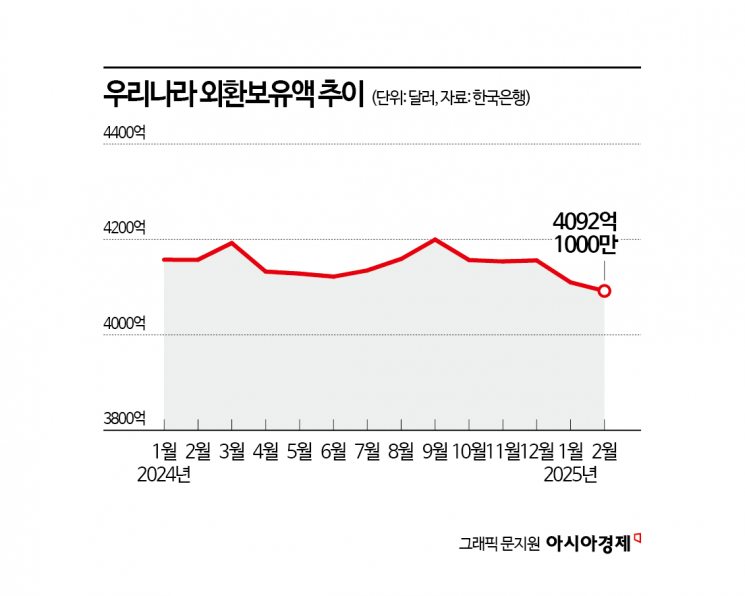

South Korea's foreign exchange reserves have decreased for the second consecutive month, falling to around $409 billion. This is the lowest level since May 2020 ($407.31 billion), approaching the psychological threshold of $400 billion. The decline in foreign exchange reserves last month was influenced by an expansion in the foreign exchange swap agreement with the National Pension Service (NPS), among other factors.

According to the Bank of Korea on the 6th, as of the end of last month, South Korea's foreign exchange reserves stood at $409.21 billion, down $1.8 billion from $411.01 billion at the end of the previous month. This is the first time in 4 years and 9 months that the reserves have fallen below $410 billion since recording $407.31 billion in May 2020.

South Korea's foreign exchange reserves steadily increased until the second half of 2021. The reserves, which reached $469.2 billion at the end of October 2021, began to shrink due to the Federal Reserve's policy rate hikes that started in 2022. Last year, the reserves hovered between $412.2 billion and $419.9 billion at month-end. In October and November last year, the reserves decreased for two consecutive months. This was due to the foreign exchange authorities selling dollars to defend the exchange rate amid increased volatility caused by the strong dollar amid uncertainties in U.S. trade policies under Trump. In December last year, foreign exchange reserves increased as foreign exchange banks concentrated dollar deposits at the Bank of Korea to meet the Bank for International Settlements (BIS) ratio at the end of the quarter. However, this year, the reserves have declined for two consecutive months, falling to around $409 billion.

The decrease in foreign exchange reserves last month was influenced by the expansion of the foreign exchange swap agreement with the National Pension Service. A foreign exchange swap is a short-term funding contract using currency exchange. When the foreign exchange market is unstable, the foreign exchange authorities can absorb the NPS's demand for spot foreign exchange purchases through swap transactions to stabilize the market. The NPS can reduce exchange rate risk when investing overseas by hedging foreign exchange risk through swaps. Since signing a $10 billion foreign exchange swap agreement with the NPS in September 2022, the foreign exchange authorities have continuously increased its scale. At the end of last year, the foreign exchange authorities extended the swap agreement with the NPS until the end of this year and raised the limit from $50 billion to $65 billion. A Bank of Korea official explained, "During the swap transaction period, foreign exchange reserves decrease by the transaction amount, but since the funds are fully returned upon maturity, the decrease in foreign exchange reserves due to this is temporary."

Meanwhile, the U.S. dollar index, which had been strong, fell about 0.5% in February. The dollar index against six major currencies dropped from 107.80 at the end of January to 107.24 at the end of February. The weaker dollar increased the dollar-equivalent value of foreign currency assets in other currencies, helping to reduce the scale of the decline in foreign exchange reserves. The foreign exchange authorities' measures to ease market volatility also partially influenced the decrease in foreign exchange reserves. A Bank of Korea official said, "Although the dollar's strength weakened at the end of the month, the foreign exchange authorities defended the exchange rate when sharp fluctuations occurred during February."

Among the components of foreign exchange reserves, securities including government bonds, corporate bonds, and government agency bonds decreased by $4.64 billion from the previous month to $357.38 billion. Securities account for 87.3% of total foreign exchange reserves. Deposits increased by $2.71 billion to $28.01 billion, accounting for 6.8% of the total. Additionally, special drawing rights (SDR) with the International Monetary Fund (IMF) amounted to $14.84 billion at the end of last month, accounting for 3.6%, gold was $4.79 billion (1.2%), and the IMF position was $4.19 billion (1.0%).

As of the end of January, South Korea ranked 9th globally in terms of foreign exchange reserves. China ranked first with $3.209 trillion in reserves. Japan was second with $1.2406 trillion, and Switzerland third with $917.3 billion. India ($630.6 billion), Russia ($620.8 billion), Taiwan ($577.6 billion), Saudi Arabia ($434.3 billion), and Hong Kong ($421.5 billion) followed. Among the top 9 countries, only India (-$5.1 billion), Saudi Arabia (-$2.3 billion), and South Korea (-$4.6 billion) saw a decrease in foreign exchange reserves compared to the previous month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.