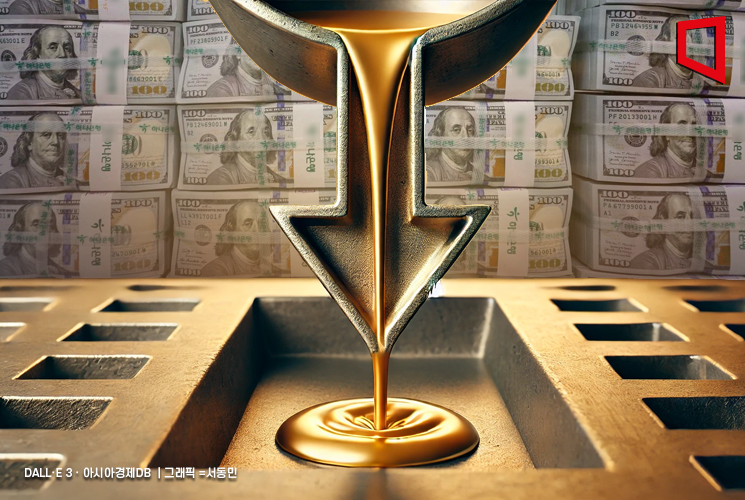

Domestic Gold Price Drops 15% in Two Weeks

International Gold Price Remains Steady

Gold Price Gap, Once at 24%, Narrows to 1% Range

The domestic gold price plummeted to more than 15 times below the international market price. This is analyzed to be due to the disappearance of the 'Kimchi Premium,' where the spot gold price traded domestically was higher than the international market price.

According to the Korea Exchange on the 4th, the price of 1g of 1kg gold spot (gold 99.99~1kg) on the KRX gold market closed at 139,030 KRW on the 28th of last month. This represents a sharp drop of 14.98% compared to the closing price of 163,530 KRW on the 14th of last month. On the 14th, the price reached an all-time high of 168,500 KRW during the session before showing a continuous downward trend.

In contrast, the international gold price remained flat during the same period. The international gold spot price, which the Korea Exchange converts into Korean won value and publishes per gram, fell only 0.95% over two weeks from 136,130 KRW on the 14th to 134,830 KRW on the 28th of last month.

The decline in gold prices on the KRX gold market is analyzed to be due to the subsiding 'Kimchi Premium' on gold. Previously, during the period of rapid gold price increase, the domestic gold price was more than 20% higher than the international gold price, meaning domestic investors who bought gold through the KRX gold market paid over 20% more than overseas prices. On the 14th of last month, the domestic gold price recorded 168,200 KRW, while the international gold price was around 135,000 KRW, with the price gap reaching about 24% at one point. Subsequently, concerns about the 'Kimchi Premium' on gold prices were raised, and the price gap on the KRX gold market gradually narrowed, falling to the 1% range on the morning of the 28th of last month.

The sudden disappearance of the gold price gap caused a short-term shock to the market, but it was found that most securities firms still do not provide investors with information about the gold price gap. As of the end of last month, among major firms, only Korea Investment & Securities, Samsung Securities, and Kiwoom Securities (offering through the domestic futures and options dedicated app) provide access to international prices or gold price gaps on their mobile trading systems (MTS). Industry insiders pointed out that due to this situation, many investors had no way to know how overvalued the gold they were buying was compared to international prices, which contributed to the expansion of the price gap.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.