Many Support Introduction of Distributed Power Systems in the AI Era

Rising Industrial Electricity Rates Force Companies to Rethink Investment Plans

Forty percent of manufacturing companies are considering changes to their power procurement methods due to industrial electricity rate increases. They are seeking new alternatives other than Korea Electric Power Corporation (KEPCO), such as self-generation or direct purchases from the electricity wholesale market. More than 70% also expressed the opinion that a distributed power system should be introduced in line with the development of the artificial intelligence (AI) industry.

The Korea Chamber of Commerce and Industry (KCCI) recently announced on the 3rd the results of a survey conducted on 300 domestic manufacturing companies regarding 'Corporate Opinions on Electricity Rates and Power Systems.' When asked whether they would try relatively cheaper options such as building self-power plants or purchasing electricity from the wholesale market due to the increase in KEPCO rates caused by industrial electricity rate hikes, 11.7% of companies responded "Yes," and 27.7% said "Not now, but will if rates rise further." Meanwhile, 60.6% said they would continue to use KEPCO electricity.

KCCI analyzed these survey results as reflecting that continuous increases in industrial electricity rates have made it cheaper in some cases to build self-power plants or purchase electricity at the System Marginal Price (SMP) from the wholesale market. There are concerns that if companies' 'de-KEPCO' movement becomes full-fledged, KEPCO's position will narrow, and the impact could spread throughout the power industry.

Looking at the trend of electricity rate increases from 2000 to December last year, while residential rates rose by 42%, industrial rates increased by 227%. Originally, industrial rates were set lower than residential rates considering the role of companies as the source of growth. However, since 2000, with a total of 24 rate hikes concentrated on industrial rates (19 times), industrial electricity rates surpassed residential rates in 2023.

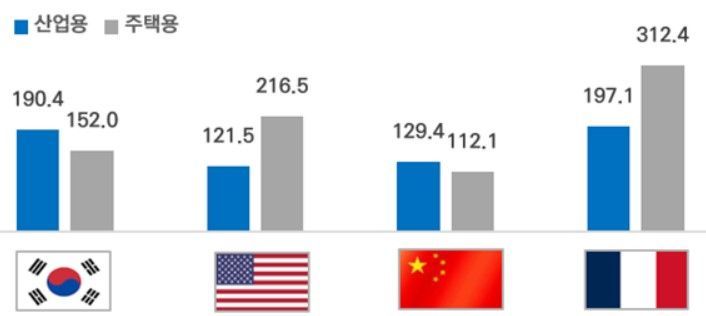

Examining electricity rates in major countries, industrial rates are relatively cheaper than residential rates, whereas in South Korea, industrial electricity rates are the highest among all usage categories. In particular, South Korea's industrial rates (as of December 2024) are higher than those of the United States and China and are at a similar level to France (64.2%), which has twice the share of nuclear power with a lower generation cost compared to Korea (29.9%).

Major countries' electricity rates (KRW/kWh) reprocessed from Korea Electric Power Corporation data by the Korea Chamber of Commerce and Industry. Provided by the Korea Chamber of Commerce and Industry.

Major countries' electricity rates (KRW/kWh) reprocessed from Korea Electric Power Corporation data by the Korea Chamber of Commerce and Industry. Provided by the Korea Chamber of Commerce and Industry.

With the development of AI, the number of data centers and semiconductor factories that consume large amounts of electricity is increasing. In response, 74.3% of companies agreed with the introduction of a 'distributed power system' that produces and uses necessary electricity locally. When asked about the primary considerations if electricity is directly traded within the region through the introduction of a distributed power system, companies answered in order: supply stability (49.3%), sales price (39.3%), eco-friendliness of the energy source for electricity production (9.7%), and contract period (1.7%). Additionally, 84.7% of companies responded that separate support measures such as discounted rates and timely power supply should be prepared for future advanced industries like semiconductors and AI.

Professor Kim Jin-su of Hanyang University's Department of Resources and Environmental Engineering advised, "Major countries such as the U.S. and China are government-led in building power infrastructure to secure AI and semiconductor supremacy. We also need stable power supply and strong support measures for advanced industries to avoid falling behind in the AI revolution and future survival competition."

Furthermore, when asked about the burden felt regarding the current level of industrial electricity rates, 78.7% responded that the burden is significant. Among them, 46.4% said the burden is very large enough to shrink business activities.

In particular, 79.7% of respondent companies said their operating profits decreased due to electricity rate hikes. This is because intense price competition makes it difficult to pass on the increased costs from electricity rate hikes to sales prices.

Petrochemical company A said, "We cannot raise sales prices due to China's low-price offensive," and lamented, "Due to the nature of the process, electricity must be used 24 hours a day, and it is impossible to reduce consumption." Steel company B expressed the burden, saying, "Due to the rate hike in the fourth quarter of last year, we have to pay an amount equivalent to 80% of operating profit as additional electricity charges."

Regarding further increases, 74.0% expressed concern that they have "no countermeasures." Among the 26.0% who said they do have countermeasures, energy use diagnosis and savings (55.1%) and efficiency investments such as equipment replacement (50.0%) were cited.

As policy tasks necessary to alleviate the electricity rate burden, the survey found the following priorities: expanding low-cost energy sources (71.0%), expanding financial support and tax credits for energy-efficient facilities (51.7%), diversifying rate plans to expand consumer choice (43.3%), and alleviating power grid investment burdens through the introduction of distributed power systems (23.0%).

For policies to introduce distributed power systems, responses were as follows: drastic regulatory reforms and tax benefits for regional relocation (29.7%), regional differentiation of electricity sales rates (22.0%), introduction of AI power grid technology for efficient operation of distributed power (19.0%), ensuring network neutrality so that distributed power operators are not discriminated against in power grid use (15.0%), and establishment of related infrastructure such as ESS installation and activation of VPP operators (14.3%).

Cho Young-jun, Director of the KCCI Sustainable Management Institute, said, "As a country that imports almost all energy and relies heavily on exports, sustainable growth is possible only if the power market supports energy efficiency improvements and industrial activities," adding, "We need to consider electricity rate setting and power system construction to promote advanced industry development and enhance competitiveness."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)