Publication of the 9th Issue of ‘Corporate Governance Insights’

Comparative Analysis Shows Stronger Financial Performance in Companies with Excellent Governance

Report Highlights Need for Continuous Audit Committee Training and Board Education

Emphasis on CEO and Board Chair Separation and Designated Outside Director System

Recommendations for Enhancing Internal Controls and Preventing Fraud

The Korea Deloitte Group Corporate Governance Development Center announced that “it highlighted the impact of governance on corporate financial performance through a comparative analysis of the financial results of companies with excellent governance and those with weak governance.”

On the 27th, the Corporate Governance Development Center published the 9th issue of ‘Corporate Governance Insights’ and conveyed this.

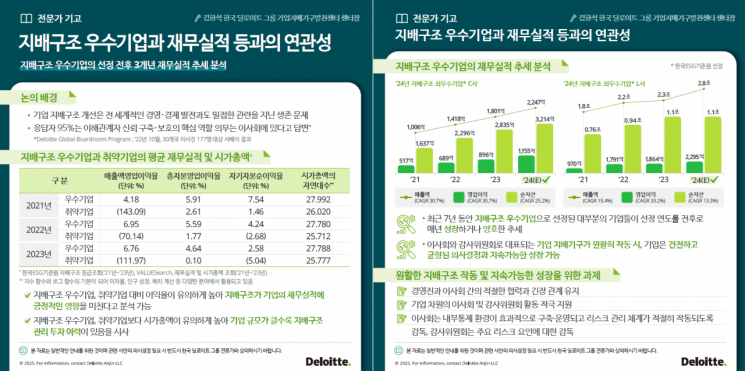

As a result of a comparative analysis of the financial performance of companies with excellent governance and weak governance selected by the Korea ESG Standards Institute over the past three years (2021?2023), it was found that the profit margins of excellent companies were significantly higher than those of weak companies. This suggests that governance has a positive impact on corporate financial performance.

In addition, the average market capitalization of companies with excellent governance was higher than that of weak companies. This shows that the larger the company, the greater the capacity to invest in governance maintenance and management. In particular, most companies selected as excellent governance companies over the past seven years showed continuous growth or favorable trends in sales, operating profit, and net assets around the year of selection.

Han-Seok Kim, head of the Korea Deloitte Group Corporate Governance Development Center, stated in an expert article, “For sustainable corporate growth, the maintenance and stable operation of governance are essential,” and added, “To this end, ▲ maintaining an appropriate cooperative and tension relationship between management and the board of directors ▲ actively supporting board and audit committee activities at the corporate level ▲ board supervision for the establishment and operation of an effective internal control environment by management ▲ close inspection and supervision of major risk factors by the audit committee are necessary.”

The report also emphasized the need for systematic education to continuously strengthen the capabilities of audit committees. An analysis of the audit committee education status of KOSPI 200 companies showed that the number of audit committee training sessions in the 2023 fiscal year averaged 3.16 times per year. Companies that provided training three times a year accounted for the largest share at 37%. The main training topics included supervision of internal accounting control systems (15.8%), roles and operations of audit committees (15.5%), and supervision of financial reporting (15.4%). 76.6% of the training was provided by external organizations (accounting firms, associations, academic societies, etc.). Training hosted by accounting firms accounted for the highest proportion at 45%.

The report noted that global boards of directors and audit committees cover various topics such as cybersecurity and geopolitical risks, with 68% of companies conducting training during regular board meetings, indicating that board education has become a regularized learning opportunity. Additionally, 74% of companies support the costs of attending external training programs, and some cases were introduced where education participation by the board is systematically managed through tracking and reporting.

The report suggested that domestic audit committee education should avoid short-term provision and operate as a professional development program that supports continuous capability enhancement.

Meanwhile, the report also highlighted the status of CEO and board chair separation and the introduction of the designated outside director system in listed companies on the Korea Stock Exchange. As of the 2023 fiscal year, among 488 listed companies that submitted corporate governance reports, 63 companies (12.9%) had outside directors serving as board chairs. Among companies with total assets of 2 trillion won or more, 44 companies recorded this ratio, indicating a relatively high proportion of outside directors serving as board chairs. Thirty-two companies (6.6%) had introduced the designated outside director system, which is used as a measure to enhance the objectivity and fairness of board decision-making.

Furthermore, designated outside directors are recommended to have the authority to convene outside director meetings independently and to act as a bridge between management and outside directors by requesting reports on current issues from management. The report explained that although the adoption rate of this system in domestic companies is lower than that of global companies, appropriate application considering each company’s governance environment is necessary.

In addition, the report introduced an analysis by No-Junhwa, professor of business administration at Chungnam National University and advisory committee member of the center, on domestic fraud occurrence patterns and internal controls to prevent fraud, a translated version of Deloitte Global’s report titled ‘AI Governance: Key Challenges Facing Boards,’ and ‘2024 Disclosure Violation Measures and Precautions.’

The full report, card news, and video news can be accessed on the Korea Deloitte Group website, where materials can be downloaded free of charge.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.