The Stated Goal is "Increasing Shareholder Returns"

Some View Dividend Expansion as a Way to Fill Tax Revenue Shortfall

Last Year's National Tax Revenue Fell Short by 31 Trillion KRW

IBK Industrial Bank of Korea is expected to expand its dividend payout ratio to around 35% in 2024. While the bank stated this is part of an effort to increase shareholder returns, there is also a view that the government raised the dividend payout ratio to cover last year's tax revenue shortfall.

Seoul Jung-gu Euljiro IBK Industrial Bank of Korea Headquarters Building Exterior. Provided by Industrial Bank of Korea

Seoul Jung-gu Euljiro IBK Industrial Bank of Korea Headquarters Building Exterior. Provided by Industrial Bank of Korea

According to the Ministry of Economy and Finance on the 27th, government departments including the Ministry of Economy and Finance and the Financial Services Commission held a dividend consultation meeting at 11 a.m. on the 25th at the Government Seoul Office in Jongno-gu to discuss the dividend payout ratios and dividends per share of government-invested institutions, including IBK Industrial Bank of Korea, as of the end of last year.

When IBK Industrial Bank of Korea submits its policy target fund expenditures and Common Equity Tier 1 (CET1) capital ratio and other soundness ratios to the Ministry of Economy and Finance, the ministry refers to these and decides the dividend payout ratio through interdepartmental consultations. A ministry official said, "Relevant departments gathered to comprehensively consider various factors such as debt ratio and financial soundness indicators to decide last year's dividends for the invested institutions and notified the institutions accordingly."

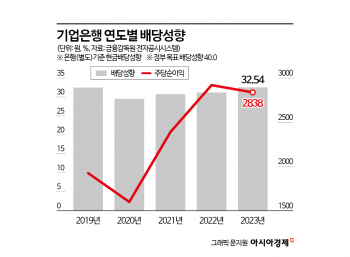

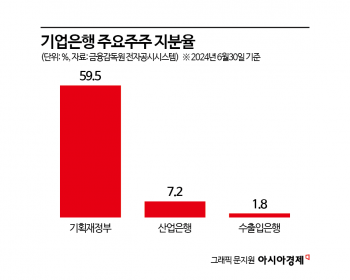

The Ministry of Economy and Finance is the largest shareholder, holding 59.5% of IBK Industrial Bank of Korea's shares. If the bank expands its dividend payout ratio, the government's dividend income will increase. IBK Industrial Bank of Korea's dividend payout ratios were 32.48% in 2019, 29.52% in 2020, 30.73% in 2021, 31.19% in 2022, and 32.54% in 2023. The dividend payout ratio has also been expanding since the COVID-19 pandemic, during which fiscal spending increased significantly.

The government set a medium-term dividend payout ratio target of 40% for invested institutions such as IBK Industrial Bank of Korea, Korea Development Bank, Export-Import Bank of Korea, Korea Asset Management Corporation (KAMCO), and Korea Housing Finance Corporation in 2020. In the case of IBK Industrial Bank of Korea, since its CET1 ratio is around 11.33%, the plan is to expand the shareholder return rate to 35%, with a goal to raise the dividend payout ratio to 40% if the CET1 exceeds 12.0%.

An IBK Industrial Bank of Korea official said, "We plan to approve the dividend-related agenda received from the government at the board meeting as early as the 27th and disclose it before the regular general shareholders' meeting. Since we announced through voluntary disclosure at the end of last year that we would gradually raise the dividend payout ratio up to 40%, we will strive to comply with this."

The dividend amount the government is expected to receive from IBK Industrial Bank of Korea is estimated at about 500 billion KRW. Multiplying the total number of issued shares of IBK Industrial Bank of Korea (797,425,869 shares) by the estimated dividend per share of 1,040 KRW and the Ministry of Economy and Finance's shareholding ratio of 59.5% results in 493.4 billion KRW. If the dividend per share exceeds the securities market's estimate (1,040 KRW), the dividend cost that IBK Industrial Bank of Korea must bear will increase.

Some critics argue that the government significantly raised IBK Industrial Bank of Korea's dividend payout ratio to cover its tax revenue shortfall. Last year, national tax revenue was 336.5 trillion KRW, which is 30.8 trillion KRW less than the projected tax revenue of 367.3 trillion KRW at the time of budget formulation.

Regarding this, a Ministry of Economy and Finance official explained, "In this meeting, we only discussed dividend figures for invested institutions that were judged to have sufficient dividend capacity due to high net income." IBK Industrial Bank of Korea recorded a net income of 2.6738 trillion KRW last year, maintaining the record-high level of 2023 (2.6752 trillion KRW).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)