KFTC Releases '2024 Corporate Merger Review Trends'

Total Cases Down by 129, Merger Value Drops by 105 Trillion Won

SK Leads with 16 Mergers

Due to high interest rates and the impact of the economic downturn, the number of corporate mergers and acquisitions (M&A) transactions has decreased for the third consecutive year.

On the 26th, the Korea Fair Trade Commission (KFTC) announced the '2024 Corporate Merger Review Trends and Key Features' report containing this information. The analysis covers corporate merger cases reviewed by the KFTC last year, including those reported before last year but processed during last year.

According to the KFTC, the number of corporate merger reviews last year was 798, a decrease of 129 cases (13.9%) compared to the previous year, marking a decline for three consecutive years. The total merger amount also dropped by 105 trillion won (35.9%) to 276 trillion won.

This contrasts with the global M&A market, which showed signs of recovery with a slight increase in the number of corporate mergers following changes in monetary policy starting in the second half of last year.

The KFTC analyzed that the significant expansion of the exemption criteria for merger notifications in August last year partially contributed to the overall decrease in the number (and amount) of corporate mergers. After August last year, the number of merger notifications received decreased by 119 cases compared to the same period the previous year, accounting for about 92% of the total decline.

Regarding the larger decrease in the merger amount compared to the number of cases, the KFTC explained that "the increase in merger amounts was significantly influenced by large-scale acquisitions by foreign companies, such as Microsoft's acquisition of Activision Blizzard in 2023."

The number of corporate mergers by domestic companies was 622, accounting for 77.9% of the total, with the merger amount totaling 55.2 trillion won (20.0%).

In particular, the decrease in mergers by large business groups subject to disclosure, with assets exceeding 5 trillion won, was notable. The number of mergers by large business groups decreased by 34 cases (-14.7%) compared to the previous year, and the merger amount also declined by 1.8 trillion won (-6.0%).

Specifically, mergers between affiliates within a business group, which indicate simple structural reorganizations, accounted for 73 cases, representing 37.1% of mergers by disclosed business groups, while mergers with non-affiliates accounted for 124 cases, or 62.9%.

By business group, SK had the highest number with 16 cases, followed by Hyundai Motor (12 cases), Hanwha (10 cases), Jungheung Construction, Mirae Asset, and Wonik (each 9 cases), NongHyup, LS, and SM (each 7 cases), and LG, Shinsegae, and Kakao (each 6 cases).

Excluding mergers between affiliates, the order was SK (10 cases), Jungheung Construction and Mirae Asset (each 9 cases), Hyundai Motor (8 cases), NongHyup, LS, and Wonik (each 7 cases), followed by POSCO, Hanwha, and Eugene (each 5 cases).

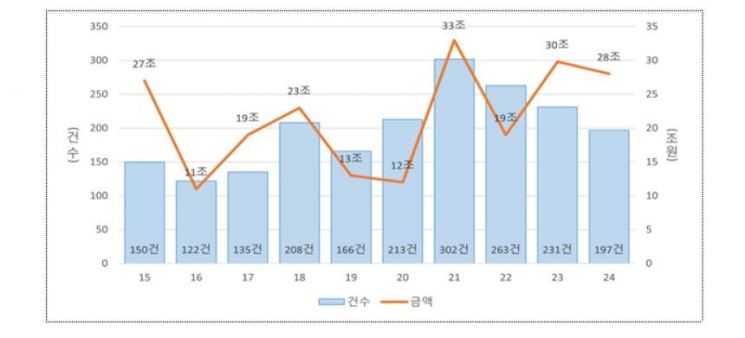

Trends in the Number (Amount) of Corporate Mergers by Large Business Groups (Source: Korea Fair Trade Commission)

Trends in the Number (Amount) of Corporate Mergers by Large Business Groups (Source: Korea Fair Trade Commission)

In the manufacturing sector, despite concerns over sluggish demand, corporate mergers in semiconductor and automobile-related materials, parts, and equipment fields (28 cases) were active. Representative examples include OCI's establishment of a joint venture in Tokuyama and Motrex's acquisition of Hanmin Interior shares.

In the medical and beauty sectors, numerous mergers occurred in cosmetics (11 cases), medical devices, and pharmaceuticals (16 cases). Examples include Amorepacific's acquisition of COSRX shares and Shinsegae International's acquisition of Amuse shares.

In the service industry, except for construction, the number of corporate mergers decreased compared to 2023, while the construction sector maintained a similar level.

In the financial sector, the establishment of private equity funds (PEF) was the most frequent with 65 cases, and in the information and communication broadcasting sector, system/application software and game development and supply businesses led with 31 cases.

The KFTC conducted in-depth reviews on 36 corporate mergers deemed to pose significant risks of hindering competition due to monopolies or oligopolies after the merger. It imposed corrective measures on two cases, including HD Hyundai Heavy Industries' acquisition of STX Heavy Industries and Kakao's acquisition of SM Entertainment. For Megastudy's acquisition of Gongdangi, the KFTC judged that corrective measures alone would not alleviate concerns and thus disallowed the merger. Additionally, fines totaling 420 million won were imposed on 42 cases for violating merger notification obligations.

The KFTC stated, "New types of corporate mergers are emerging in new industries such as artificial intelligence (AI), involving the recruitment of key personnel. We plan to review the need for institutional improvements to effectively respond to these changes."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)