Sales Surpass 2 Trillion KRW for the First Time Last Year

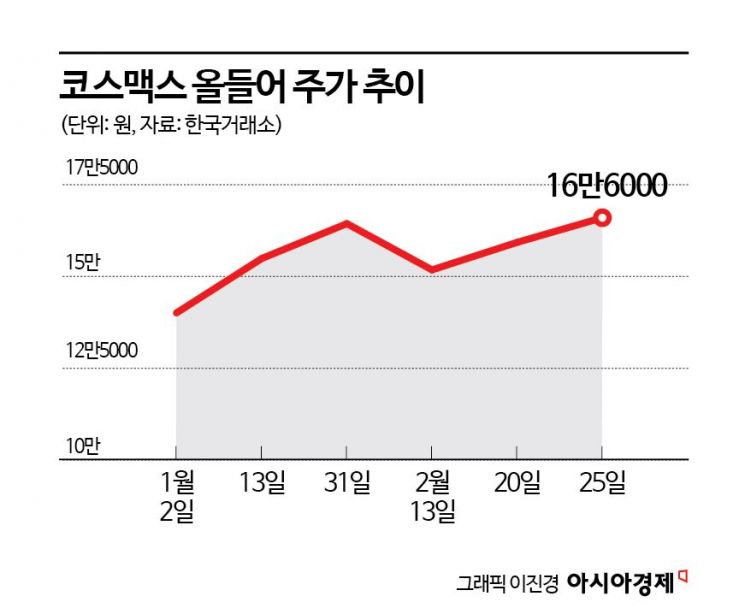

Stock Price Up 18% This Year

Strong Earnings Growth Expected... Brokerages Raise Target Prices

Following last year's record-breaking performance, Cosmax's stock price continues to rise. The securities industry expects strong growth in earnings to continue this year, raising their outlook on Cosmax.

According to the Korea Exchange on the 26th, Cosmax closed at 166,000 KRW, up 8% from the previous day. It showed an upward trend on all but two of the last 10 trading days.

This stock price surge is attributed to last year's record-breaking performance. Cosmax's sales last year reached 2.1661 trillion KRW, a 21.9% increase from the previous year, surpassing 2 trillion KRW for the first time. Operating profit during the same period rose 51.6% to 175.4 billion KRW. In the fourth quarter of last year, sales increased 27.8% year-on-year to 558 billion KRW, and operating profit rose 76.8% to 39.8 billion KRW.

Kim Myung-joo, a researcher at Korea Investment & Securities, analyzed, "Fourth-quarter sales and operating profit exceeded market expectations by 8.0% and 3.9%, respectively. The domestic subsidiary's performance was better than expected, and Indonesia and Thailand also performed well following the third quarter. It is impressive that the Chinese subsidiary's sales slightly increased this quarter, contrary to expectations." Park Hyun-jin, a researcher at Shinhan Investment Corp., said, "Growth in indirect exports to the U.S. and Japan continued, with exports to the U.S. increasing by 37% and to Japan by 42%. As a result, the operating leverage effect is being maximized, and the domestic operating profit margin reached a record high of 10%."

Strong earnings growth is expected to continue this year. Jung Han-sol, a researcher at Daishin Securities, forecasted, "Based on the increased global penetration of K-beauty, exports of indie brands are expected to continue to perform well, leading to steady growth in the domestic subsidiary's scale. China and the U.S., which underperformed last year, are expected to gradually improve this year, resulting in a pattern of lower earnings in the first half and higher in the second half for overseas performance."

Considering the stable earnings growth, securities firms have consecutively raised their target prices for Cosmax. Korea Investment & Securities raised its target from 200,000 KRW to 230,000 KRW. Daishin Securities and Hyundai Motor Securities each raised theirs from 180,000 KRW to 210,000 KRW, while Hana Securities and Kyobo Securities increased theirs from 200,000 KRW to 220,000 KRW. Mirae Asset Securities raised its target from 170,000 KRW to 200,000 KRW. Researcher Kim explained, "Cosmax's Korean subsidiary has the largest number of clients among OEM and ODM manufacturers, which reduces dependence on any specific brand and enhances earnings stability. Although investment sentiment in the cosmetics sector has weakened compared to the first half of last year, Cosmax's stock price is expected to recover with stable earnings growth."

There is an analysis that the Chinese market, which had been a source of uncertainty, has passed its bottom. Baek Song, a researcher at Mirae Asset Securities, said, "While domestic and Southeast Asian markets continue to perform well, we believe China, which had been in an uncertain phase, has passed its bottom, leading us to raise earnings forecasts. The Chinese cosmetics market had stalled in the previous quarter but returned to growth in the fourth quarter. Cosmax has set a target of double-digit growth in China this year based on improved operating rates in Shanghai and growth in the Guangzhou E-Sen joint venture volume."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.