Government Announces "Measures to Improve Fraudulent Claims in Automobile Insurance" on the 26th

Minor Injury Patients Must Submit Additional Documents for Hospitalization Beyond 8 Weeks

Measures Introduced to Prevent "Double Claiming" of Future Medical Expenses

The government is set to improve automobile insurance, which suffers from serious insurance payout leakage due to the so-called moral hazard of 'nai-ron patients' (patients feigning injury). For bodily injury insurance payments, it has been decided to prohibit future medical expense payments (settlement money) to minor injury patients classified as injury grades 12 to 14. (▶Refer to our February 14th issue, page 1, '[Exclusive] Automobile Insurance Improvement Measures to Prohibit Future Medical Expenses for Minor Injury Patients').

The Ministry of Land, Infrastructure and Transport, the Financial Services Commission, and the Financial Supervisory Service announced on the 26th that they have prepared 'Measures to Improve Fraudulent Claims in Automobile Insurance.' Automobile insurance, which is mandatory, was created to maximize coverage for accident victims' medical treatment. However, some patients and hospitals have abused the system, leading to issues such as fraudulent claims, insurance fraud, and excessive settlement payments, which have rapidly worsened the financial status of automobile insurance. The Board of Audit and Inspection has also continuously pointed out these problems. The government has viewed automobile insurance, along with indemnity insurance, as suffering from serious medical shopping and overtreatment issues and has been preparing countermeasures confidentially since last year.

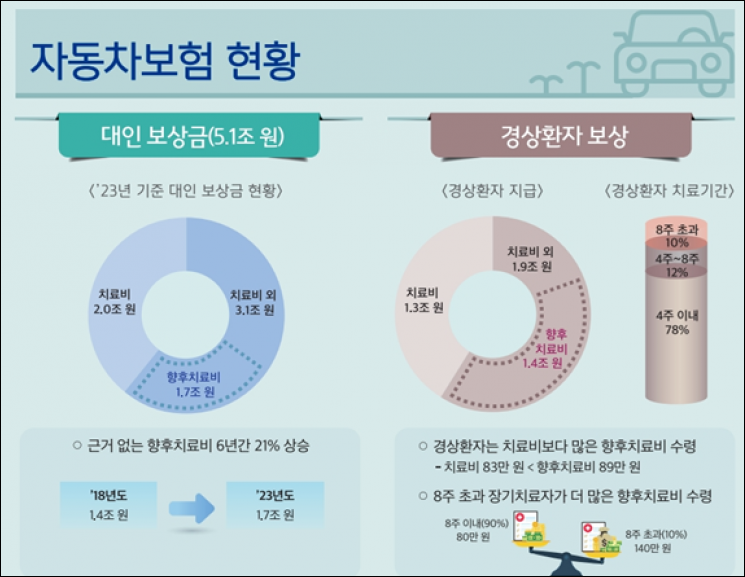

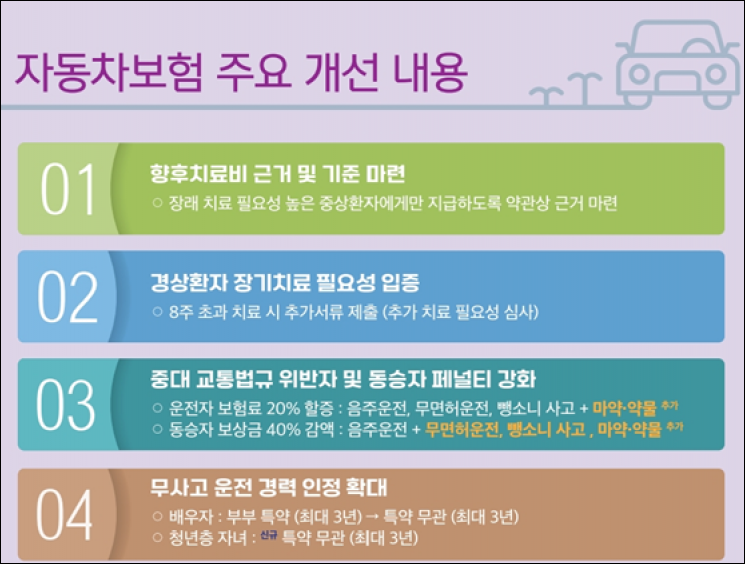

The core of the government's newly announced improvement plan is to prohibit future medical expense payments to minor injury patients classified as injury grades 12 to 14. Future medical expenses are a type of settlement money paid in advance by the insurer at the time of agreement with the victim, estimating the medical costs expected to be incurred in the future. This has been customarily paid by insurers to prevent 'nai-ron patients' who stay long-term in hospitals aiming for large insurance payouts rather than treatment. However, due to the lack of clear standards, future medical expenses have grown increasingly large, causing a vicious cycle of insurance payout leakage, rising loss ratios, and premium increases. As of 2023, future medical expenses paid to minor injury patients amounted to 1.4 trillion won, exceeding the treatment costs paid to them (1.3 trillion won).

Once the improvement measures are implemented, minor injury patients involved in automobile accidents will need to claim insurance payments after receiving treatment at hospitals or clinics. With the revision of automobile insurance terms and conditions, treatment for minor injury patients will be covered for up to 4 weeks from the date of the accident starting January 2023. If treatment is still necessary after 4 weeks, a medical certificate must be submitted to the insurer every 2 weeks. However, some hospitals have been issuing medical certificates too easily, leading to moral hazard such as overtreatment of minor injury patients. To address this, the government has included a preventive measure in the improvement plan requiring additional documentation if minor injury patients require long-term treatment.

If a minor injury patient wishes to continue treatment beyond 8 weeks, they must submit additional documents such as medical records to the insurer to verify the necessity of treatment. The insurer will review the additional documents and, if it judges the necessity of treatment to be low, may notify the patient in writing of a plan to suspend payment guarantees. If the patient disagrees with the insurer's plan or a dispute arises, an organization and procedure will be established to mediate the matter neutrally and objectively. The government plans to prepare and disclose mediation criteria that include medical and engineering aspects for transparent review.

For moderate to severe injury patients classified as injury grades 1 to 11, clear standards will be established for future medical expense payments, which were previously paid without clear grounds. This aims to prevent excessive claims and encourage compensation for medical expenses appropriate to the degree of injury. Research will also be conducted to revise compensation payment standards such as for lost income to reduce the economic burden on patients beyond primary treatment costs. Discussions will also be promoted regarding the legalization of compensation payment items stipulated in automobile insurance terms and conditions.

The government has also prepared measures to prevent and strengthen penalties for unhealthy practices related to automobile insurance. When moderate to severe injury patients receive future medical expenses, insurers will be required to inform them that they cannot receive duplicate treatment for the same symptoms under other insurances such as health insurance. Some patients have engaged in 'double claiming' by receiving future medical expenses and then obtaining benefits from health insurance, which has worsened the financial status of health insurance. Although legally, receiving health insurance treatment for the same injury after receiving future medical expenses limits benefits, there has been no practical way to verify this on the ground. Therefore, the government plans to support the detection of duplicate claims.

Regarding insurance fraud, administrative sanctions will be strengthened from the current 'business suspension' to 'business registration cancellation' for repair shops whose owners have been sentenced to imprisonment or higher. To prevent serious traffic law violations and raise public awareness, standards for premium surcharges (20%) will be established for drug and substance-impaired driving, similar to other serious traffic violations such as drunk driving. Compensation payments for drug and substance-impaired driving, unlicensed driving, and passengers in hit-and-run vehicles will also be reduced by 40%, similar to passengers in drunk driving vehicles.

The detailed operational methods of automobile insurance, such as premium rate calculation and payment guarantee procedures, will also be improved to reflect reality. From now on, the no-accident driving record of young drivers (aged 19 to 34) driving under their parents' insurance will be recognized. This is to reduce the insurance premium burden for young adults who are newly independent due to employment or marriage and are purchasing automobile insurance for the first time. Spouses will also have their no-accident driving record recognized for up to 3 years regardless of the type of driver limitation endorsement. Currently, no-accident driving records are only recognized if the spouse drives under the 'couple limitation endorsement.'

Since quality-certified parts under the Automobile Management Act are recognized as equivalent to Original Equipment Manufacturer (OEM) parts, the scope of new parts usable for vehicle repairs will explicitly include quality-certified parts in automobile insurance terms and conditions. This is to improve the high-cost repair structure centered on OEM parts.

Measures will also be introduced to enhance convenience for patients receiving treatment for automobile accidents and to improve the efficiency of medical institutions' administrative processes. The current payment guarantee procedure, where medical institutions contact insurers by phone and insurers send payment guarantees by fax, will be replaced by an electronic system.

Accounting results for mandatory automobile insurance will be submitted annually to the Ministry of Land, Infrastructure and Transport, and a reporting obligation will be newly established if necessary to protect subscribers and insured persons, thereby building a systematic management foundation for mandatory automobile insurance.

The main contents of this improvement plan, such as establishing grounds for future medical expenses and requiring additional documentation for long-term treatment of minor injury patients, will be completed by revising related laws and terms and conditions within this year. Other measures, such as expanding recognition of no-accident driving records and electronic payment guarantees, will be implemented by completing follow-up actions in the first half of this year. The government expects that these improvements will reduce unnecessary compensation payments and lower individual automobile insurance premiums by about 3%.

Kim So-young, Vice Chairman of the Financial Services Commission, said, "We expect this improvement plan to resolve the issue of unnecessary automobile insurance payout leakage," adding, "We will strengthen supervision with the Financial Supervisory Service to ensure that system improvements directly benefit policyholders by monitoring insurers' unjustified denial of insurance payments and the rationality of premium adjustments."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.