About 15% Cheaper Than Name Brands

Expanding Product Lineup and Diversifying Sourcing

Convenience Stores Strengthen Competitiveness of Exclusive PB Products

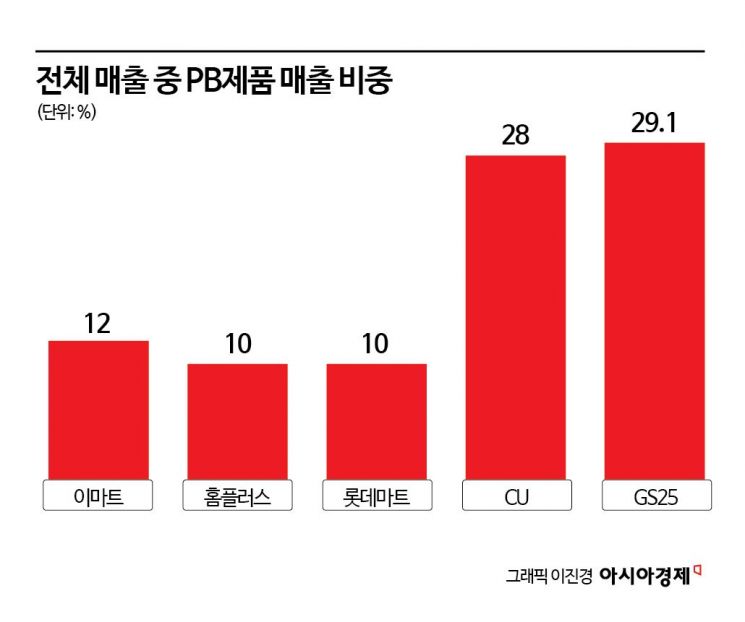

The distribution industry has started expanding its private brand (PB) products. PB products are those launched by distribution companies themselves and are priced about 10-15% lower than manufacturer-branded products (NB). As prolonged high inflation has tightened consumers' wallets, distribution companies are using PB products as a strategy to attract customers.

According to the distribution industry on the 25th, Emart's PB brands 'No Brand' and 'Peacock' account for 12% of total sales (processed goods and daily necessities sectors). No Brand pursues 'ultra-low price cost-effectiveness,' while Peacock aims for 'premium cost-effectiveness.' Emart has been releasing PB products earlier than competitors since 2015. Although the sales growth rate has not been steep, the upward trend continues. Last year, No Brand's sales reached 1.09 trillion won, a 0.7% increase compared to 2023 sales.

Emart Gwacheon Branch No Brand

Emart Gwacheon Branch No Brand

It is analyzed that positive evaluations of price and quality shared on social networking services (SNS) such as YouTube and Instagram have driven the sales increase. No Brand adheres to the principle of not doing marketing and producing its own packaging and design to sell at low prices.

This year, No Brand plans to introduce more products that satisfy cost-effectiveness by newly discovering sourcing locations in various countries. In particular, it will showcase products directly sourced from European countries such as Italy, Greece, and Malta in the snack category.

Peacock, which was newly renewed last year as a premium cost-effectiveness brand, saw its sales (407 billion won) slightly decrease compared to the previous year (420 billion won). An Emart official explained, "Peacock aims to turn around by developing about 200 new products this year," adding, "Sales have also shown an upward trend again this year."

Homeplus is also focusing on strengthening the competitiveness of its PB products. Recently, it integrated the PB brands that were operated separately as 'Signature' in the food sector and 'Simple Plus' in the non-food sector into 'Simple Plus.' This decision was made to firmly imprint Homeplus's PB 'Simple Plus' on customers and enhance product competitiveness. The PB sales growth rate last year was in the 5% range, and since October last year, the sales growth rate has increased to the 10% range. PB products account for 10% of total sales. Currently, about 1,400 PB products are being sold, and the plan is to expand the scale to over 2,000 products in the future.

Lotte Mart, which operates PB brands focused on ready meals (refrigerated and frozen) called 'Yorihada' and daily necessities called 'Oneul Joeun,' plans to increase new product launches this year. Currently, Lotte Mart sells about 2,000 PB products. PB products account for 10% of total sales.

Distribution companies are expanding PB products because they have a strong customer attraction effect. Recently, as NB manufacturers have successively raised prices, PB products are penetrating consumers' wallets by emphasizing price and quality. A large supermarket official explained, "PB products are exclusive products that cannot be found at other distribution companies, so they also have the effect of attracting consumers to the respective distribution channels."

The PB competition between the two major convenience stores, CU and GS25, is even fiercer. PB products account for nearly 30% of total sales, significantly contributing to performance. CU and GS25 are enhancing PB competitiveness centered on the 'Deuktem Series' and 'Real Price,' respectively.

CU's Deuktem Series offers products such as ramen, eggs, tissues, and instant rice. Since its launch in 2021, a total of 50 million units have been sold, with 30 million sold last year alone. As it offers lower prices than general distribution companies, more people are purchasing daily necessities at convenience stores. The sales growth rate is also steep; last year's PB sales increased by 21% compared to the previous year. Considering CU's overall sales growth rate was in the 6% range last year, PB products are understood to have grown significantly.

GS25 has been focusing on expanding GS Supermarket's ultra-low-price PB brand 'Real Price' since last year. This year, it plans to enhance price competitiveness and introduce various new products. To improve price competitiveness, GS25 recently lowered the price of some Real Price chicken breast products from 2,300 won to 1,800 won, a reduction of about 20%. A GS25 official said, "The cost-effectiveness trend due to high inflation will continue this year," adding, "This year, we plan to strengthen Real Price's 'refrigerated food' category."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.