Pharmaceuticals Less Affected by Economic Cycles

China's Price Competitiveness Losing Ground

High Added Value per Unit Weight

Domestic bio CDMO (Contract Development and Manufacturing Organization) companies are aggressively expanding their capacity despite the global economic downturn. Some critics argue that such aggressive expansion could lead to an 'oversupply.' However, K-bio companies are committed to emerging as new leaders in the global CDMO industry by enhancing production efficiency and quality competitiveness. Unlike other industries experiencing oversupply, they plan to structurally minimize economic fluctuations and leverage their advantageous position against competition from China to break through head-on.

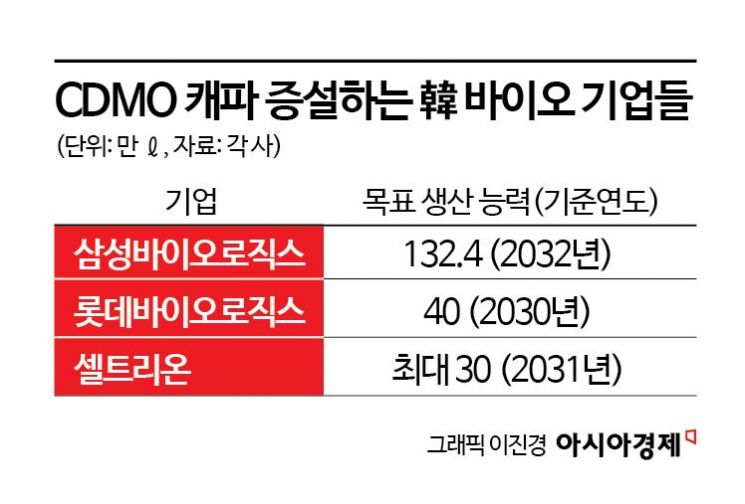

According to the industry on the 18th, Samsung Biologics aims to build up to its 8th plant in Songdo, Incheon, by 2032, securing an overwhelming production capacity of 1,324,000 liters by that year. Lotte Biologics is also constructing a 360,000-liter scale factory at its Songdo Bio Campus, with the first plant scheduled to begin full operation in January 2027. Celltrion has declared its participation in the CDMO new business and plans to build a factory with a maximum capacity of 300,000 liters domestically. While companies like Roche, Boehringer Ingelheim, and Johnson & Johnson remain lukewarm about capacity expansion, aggressive investments by Korean companies are expected to change the global CDMO rankings in 4 to 5 years. The aggressive expansion by CDMO companies is due to the global pharmaceutical industry's structure working favorably for Korean companies.

First, pharmaceuticals are essential consumer goods, so demand does not fluctuate significantly with economic cycles. Unlike other consumer goods that can be avoided if unsatisfactory, cancer treatments or osteoporosis medications cannot be forgone even in poor economic conditions. Despite the global recession and economic bloc formation causing crises in most domestic industries, pharmaceutical and bio companies recorded record-breaking performances last year. In an industry heavily dependent on exports and thus sensitive to global economic conditions, the bio industry is playing a 'hedge' role in risk diversification.

Competition with China also differs from other industries. Price competitiveness is not as critical. China's global industrial strategy is to dominate the entire value chain from raw materials to finished products and then use price competitiveness to eliminate competitors. The battery industry is a prime example. From mining lithium and nickel to producing finished electric vehicles, China has taken over the entire EV and battery supply chain, appealing to global consumers with 'affordable and good quality' products. In the bio CDMO sector, it is expected that such price competition will not be effective. A pharmaceutical and bio industry insider said, "In CDMO, quality competitiveness is ultimately linked to life and health, making it the most important factor," adding, "Companies must undergo stringent production approval processes from regulatory bodies like the U.S. FDA, and since it is a strategic industry, clients have little incentive to choose Chinese companies despite geopolitical risks."

Bio CDMO is also compared to the battery industry, which is currently affected by global oversupply. Both industries have seen the most rapid capacity expansions in the domestic industry over the past 5 to 10 years. However, their outcomes differ amid capacity increases. While the battery industry faces oversupply due to the 'chasm' (temporary stagnation) in electric vehicle growth and China's volume offensive, bio CDMO maintains high plant utilization rates despite rapid capacity expansion, with even new entrants increasing.

Another advantage of the CDMO industry is the high added value per unit weight. Batteries have a high cost and weight proportion in electric vehicles, with about 250 to 900 kg of batteries per vehicle. In contrast, biopharmaceuticals are light enough for air transport and have high added value per unit weight. According to the industry, a 10,000-liter bioreactor can generate around 50 billion KRW in sales. Even if the raw pharmaceutical materials amount to 50 billion KRW, their weight is only about 10 tons. While battery companies must build local plants with annual capacities of hundreds of GWh in North America and Europe, CDMO companies focus on domestic production. In the U.S., construction costs are about twice as high as in Korea, and labor supply issues follow.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.