153 Billion Dollar Export Forecast by Export-Import Bank's Overseas Economic Research Institute

Higher Than Last Year's 139 Billion Dollars

Memory Semiconductors Like HBM Drive Growth

Domestic Shipbuilding Orders and Value Expected to Decline

"Need to Utilize Trump's Policy Rather Than Lowering Prices"

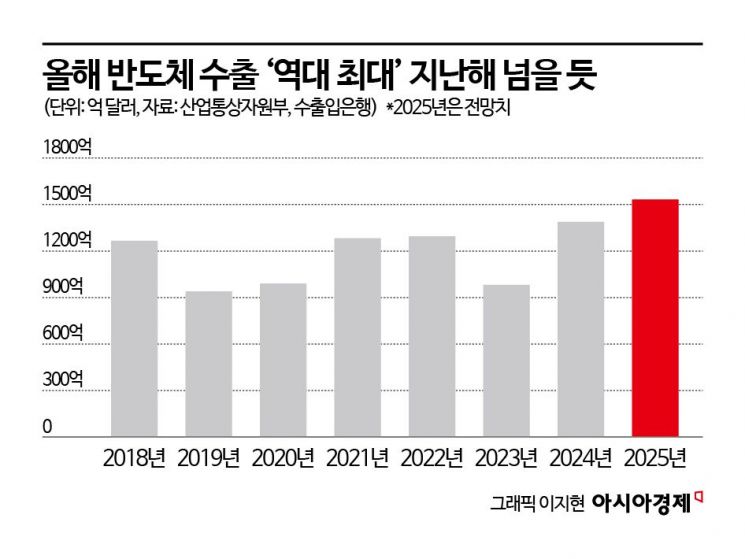

This year, South Korea's semiconductor exports are expected to reach an all-time high. It is projected to grow by 10% compared to last year, which was already the highest on record. However, a variable factor is the potential fluctuation in IT device sales due to U.S. President Donald Trump's tariff policies. In the shipbuilding industry, there is also a forecast that order volumes will decrease by 7% compared to last year.

According to the financial sector on the 17th, the Export-Import Bank of Korea's Overseas Economic Research Institute recently revealed this in its reports titled "2025 Semiconductor Industry Export Outlook" and "2024 Trends and 2025 Outlook for Shipping and Shipbuilding." Senior researcher Lee Mi-hye projected this year's semiconductor export value to be around $153 billion (approximately 220.8555 trillion KRW), a 10% increase from last year. Although exports may be sluggish until mid-year due to semiconductor inventory adjustments by demand companies, exports are expected to increase from the second half of the year as demand for memory semiconductors recovers.

Memory Semiconductors like HBM Drive Exports... Trump's Tariff Policy is a Variable

Specifically, High Bandwidth Memory (HBM) is driving memory semiconductor exports. This year, the HBM capacity installed in artificial intelligence (AI) semiconductors is increasing. HBM exports accounted for over 10% of memory semiconductor exports for the first time in May last year, and reached 25% in October, with total HBM exports last year expected to exceed $10 billion.

This figure surpasses last year's numbers, which are expected to record the highest performance ever. Last year's semiconductor exports are estimated at $139 billion, a 39% increase compared to 2023 ($98.6 billion). Last year's exports exceeded $120 billion for the fourth time ever, driven by AI infrastructure investments triggered by generative AI and the recovery of memory semiconductor prices. Memory semiconductors particularly led exports. The share of memory semiconductors in total semiconductor exports rose from 54% in 2023 to 64% from January to November last year. Conversely, the share of system semiconductor exports declined. Based on export value, it increased only by $700 million from $43 billion in 2023 to $43.7 billion from January to November last year.

However, the Trump administration's tariff policy is expected to act as a variable. Especially if high tariffs are imposed on China, it could cause price increases for smartphones, PCs, and other devices in the U.S., leading to volatility in sales of various IT devices. Seventy-eight percent of smartphones and 79% of laptops and tablets sold in the U.S. are imported from China. Researcher Lee said, "If high tariffs are imposed, U.S. smartphone prices will increase by 26%, and laptops/tablets by 46%. Consequently, smartphone sales are expected to decrease by 44%, and laptop/tablet sales by 54%."

Domestic Shipbuilding Orders to Decline Compared to Last Year... "Need to Utilize Trump's Policy"

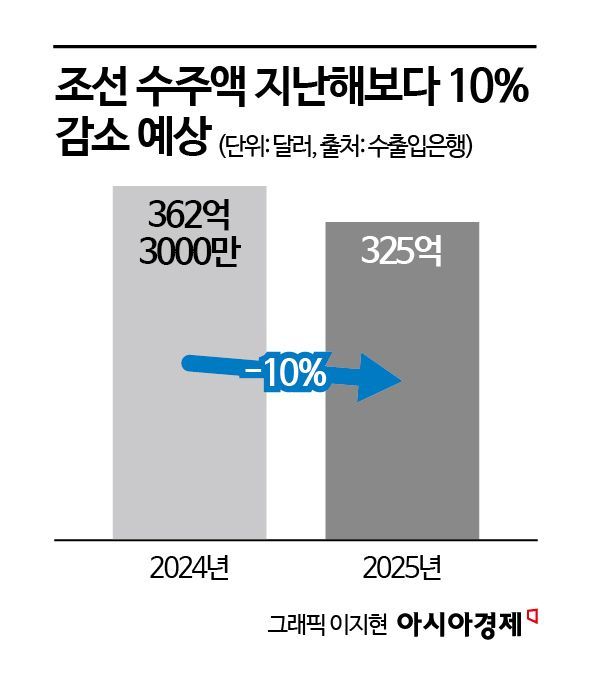

In the shipping and shipbuilding sectors, new orders for liquefied natural gas (LNG) carriers and container ships in the global market are expected to decline significantly. Senior researcher Yang Jong-seo predicted that global order volume this year will decrease by about 32% compared to last year, to 45 million CGT (Compensated Gross Tons, equivalent to 51 vessels), and order value will also drop by 34% to around $135 billion. Domestic order volume is forecasted to decline by 7% to 10.2 million CGT, and order value by 10% to $32.5 billion compared to last year. Yang stated, "If demand for LNG carriers decreases, the market share of oil tankers and container ships will attempt to recover, which is expected to slightly increase the overall market share of Korean shipbuilding."

Yang expressed caution regarding attempts to recover order volume through price reductions, as this could trigger excessive price competition with China. He viewed the recent two-year decline in domestic shipbuilding market share as due to the price gap remaining large relative to the quality difference with Chinese products. Therefore, Korean companies are currently in a situation where new ship prices are high enough to generate operating profit despite rising labor and raw material costs, making it easier to aim for market share recovery through price cuts.

However, he warned, "Chinese shipbuilders also have sufficient capacity for price reductions and are believed to receive massive government support, so they are likely to respond more aggressively to price competition." Yang suggested alternatives, saying, "In the short term, there is a possibility of increased orders to Korea by shipowners trying to avoid tariffs on Chinese ships due to Trump's tariff policy, and Trump's fossil fuel-first policy is expected to boost orders for U.S.-origin LNG carriers and large oil tankers."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.