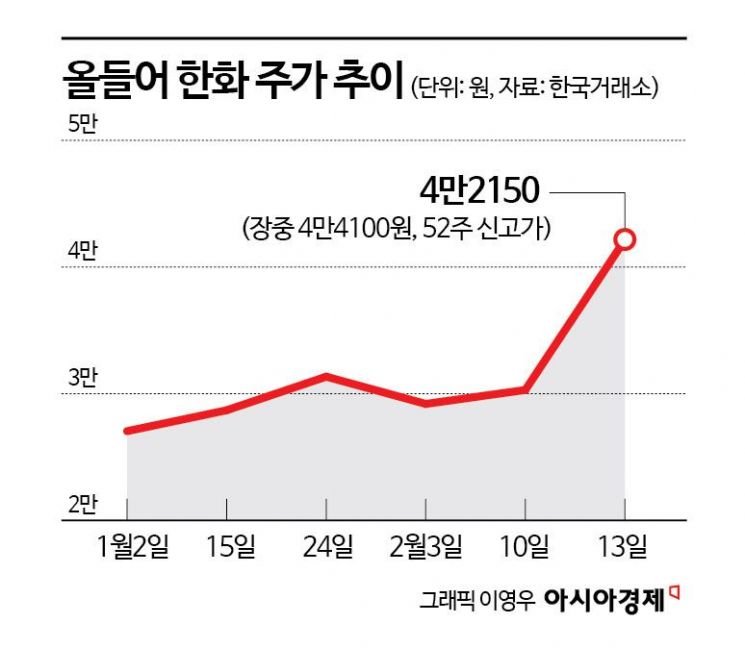

Hanwha rises 11.8% on the 13th, closing at 42,150 KRW

First time above 40,000 KRW since May 2018

Strong subsidiary performance and business improvements drive stock surge

Brokerages raise target prices in succession

Hanwha's stock price is soaring. It recently rose for three consecutive days, surpassing 40,000 KRW. This is the first time in about seven years that Hanwha's stock price has reached the 40,000 KRW level. Strong performance from its subsidiaries and the stock price rally have acted as the driving forces behind Hanwha's stock price increase. The securities industry expects Hanwha's earnings and corporate value to grow this year, supported by subsidiary growth and improvements in its own business, leading to higher target prices.

According to the Korea Exchange on the 14th, Hanwha closed at 42,150 KRW, up 11.80% from the previous day. During the session, it rose to 44,100 KRW, setting a new 52-week high. The stock has been on a sharp upward trend for three consecutive days, with a cumulative increase of 39% over this period. This is the first time Hanwha's stock price has reached the 40,000 KRW range since May 2018.

The strong performance of its subsidiaries, which led to a surprise earnings beat in the fourth quarter of last year, is interpreted as the driving force behind the stock price rise. In the fourth quarter of last year, Hanwha recorded sales of 17.9952 trillion KRW and an operating profit of 1.1289 trillion KRW. These figures represent increases of 24.3% and 387.2%, respectively, compared to the same period the previous year. KB Securities analyst Park Geon-young stated, "Hanwha's fourth-quarter results significantly exceeded consensus estimates (sales of 15.2 trillion KRW, operating profit of 365.3 billion KRW). The subsidiaries Hanwha Aerospace, Hanwha Solutions, and Hanwha Life Insurance showed improved performance, and the construction division achieved a turnaround to operating profit in the fourth quarter due to a decrease in cost ratio from increased Iraq BNCP projects."

Hanwha Aerospace, in which Hanwha holds a 33% stake, posted fourth-quarter sales of 4.8311 trillion KRW, a 56.0% increase year-on-year, and operating profit of 892.5 billion KRW, up 222.1%. Hanwha Solutions also showed solid results during the same period, with sales rising 21.6% to 4.6429 trillion KRW and operating profit increasing 70.8% to 107 billion KRW.

This year, the improvement trend in subsidiaries and Hanwha's own business is expected to continue, leading to growth in earnings and corporate value. Daishin Securities analyst Yang Ji-hwan said, "The improvement in consolidated subsidiaries' performance is expected to continue this year, and the separate division will see growth in scale and profit from the operation of the nitric acid plant starting in the second quarter. Additionally, the construction division is expected to turn around from the second half of the year due to the execution of the Iraq BNCP project, leading to increases in earnings and corporate value."

There is an analysis that Hanwha's valuation appeal has increased due to the sharp rise in its subsidiaries' stock prices this year. SK Securities analyst Choi Gwan-soon said, "This year, the stock prices of major subsidiaries such as Hanwha Aerospace, Hanwha Vision, and Hanwha Solutions have risen rapidly. In particular, Hanwha Aerospace plans to consolidate Hanwha Ocean, which will accelerate synergy creation in defense, shipbuilding, and marine sectors, opening the possibility of further stock price increases." He added, "Despite Hanwha's stock price rising significantly compared to the beginning of the year due to the sharp rise in subsidiaries' stock prices, the discount rate relative to net asset value (NAV) has actually widened compared to the end of last year. Considering the transfer of increased subsidiary value to the holding company and the potential for improvement in its own business performance, Hanwha's current stock price has sufficient room for further gains."

Reflecting earnings improvements and increases in subsidiary value, securities firms have consecutively raised their target prices for Hanwha. SK Securities raised its target from 39,000 KRW to 44,000 KRW, and NH Investment & Securities increased theirs from 39,000 KRW to 50,000 KRW. KB Securities raised its target by 22.2% to 44,000 KRW, and Daishin Securities increased theirs by 20.9% to 52,000 KRW. Analyst Park explained, "The market capitalization is rising due to improved earnings of listed subsidiaries, and Hanwha's own business performance and subsidiary NAV are improving."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.