'Convenience Store Throne' Neck-and-Neck Competition

Direct Hit from Domestic Demand Slump...

Convenience Store Industry Expected to Shrink This Year

The two major players in the domestic convenience store market both received deteriorated profitability results last year. This is the result of intensified competition in the saturated convenience store market, coupled with the direct impact of the domestic demand slump. During the period when the convenience store market was growing rapidly, performance increased in proportion to the number of stores built. However, as the prolonged domestic demand slump led consumers to reduce spending, new store openings did not translate into sales growth but rather became a cost burden, worsening profitability.

With the domestic market expected to experience an unprecedented slump this year, the convenience store industry has been strengthening product (MD) competitiveness since the beginning of the year by launching unique products. As the growth of the convenience store market continues to slow, competition for the top spot is expected to intensify further.

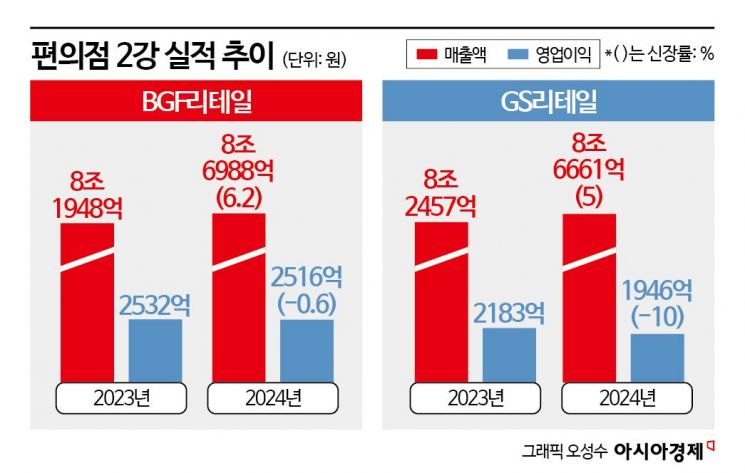

GS Retail and BGF Retail are considered the 'top two' convenience store chains competing for first place in sales, operating profit, and number of stores. Looking at the numbers alone, CU's sales surpassed GS25 for the first time, but since BGF Retail's sales include about 40 billion KRW from affiliates, GS25 is still understood to lead in sales.

Profitability remains ahead for BGF Retail, but both companies saw operating profits decline last year. In the fourth quarter of last year, both companies recorded accounting expenses related to the court ruling on ordinary wages, which caused operating profits to retreat. GS25's decline was particularly large, attributed to increased depreciation expenses, advertising and promotional costs, and logistics expenses due to the increase in operating stores. This means that advertising and promotional expenses were increased to boost growth of new and existing stores, and fixed costs rose as the number of headquarters-leased stores increased.

Headquarters-leased stores are those where the convenience store headquarters directly enters into lease contracts. Since the headquarters pays the store deposits directly, the fixed cost burden is high, but by directly operating high-quality existing stores, the headquarters can achieve both competitor attrition and profitability enhancement.

CU had a high fixed cost burden due to increasing headquarters-leased stores. However, since the headquarters-leased stores started in early 2020 have settled, the base effect has reduced the fixed cost burden. Looking at the increase rate of right-of-use asset lease fees, it maintained double digits at 13.4% in the first quarter of last year, dropped to 6.9% in the third quarter, and fell further to 5.2% in the fourth quarter. Thanks to this, CU was able to record profitability improvement from the third quarter. Ju Young-hoon, a researcher at NH Investment & Securities, analyzed, "During the process of increasing the proportion of headquarters-leased stores, there was a stagnation period in operating profit, but from the third quarter, the base burden decreased, confirming a trend of profit improvement."

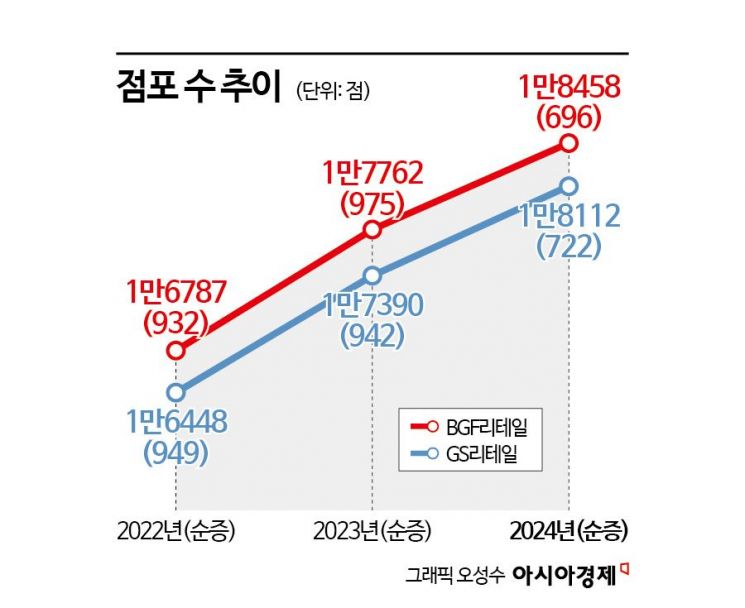

Last year, GS25 opened more new stores. This likely resulted in a higher burden of opening costs. GS25 opened a total of 722 new stores last year, increasing its total number of stores to 18,112. CU opened only 696 new stores, bringing its total to 18,458. Compared to the approximately 900 new stores opened annually in 2022 and 2023 by both companies, the scale of new store openings has significantly decreased. A GS Retail official explained, "The large number of stores last year was due to many stores converting from other convenience stores to GS25," adding, "As the convenience store industry has entered a mature phase beyond the growth phase, we are focusing on solidifying our business as a management policy."

Direct Hit from Domestic Demand Slump... Convenience Store Industry Expected to Shrink This Year

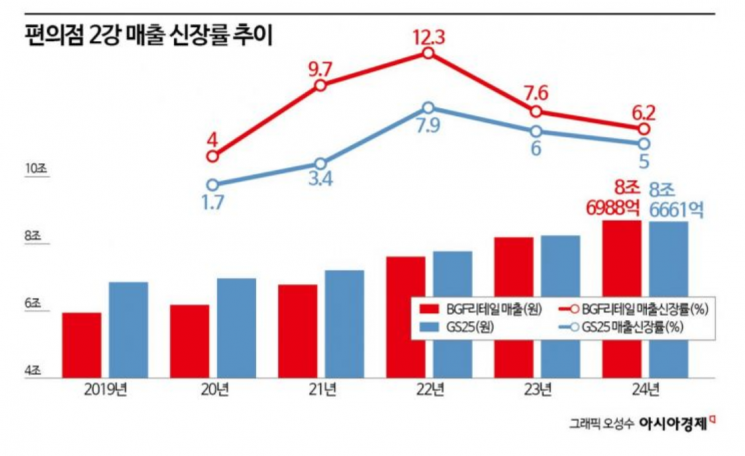

The domestic convenience store market experienced rapid growth through aggressive store opening strategies but began to slow down in the late 2010s. Although the growth rate bottomed out in 2020 due to the COVID-19 pandemic and saw a base effect, growth has declined for two consecutive years since 2022.

According to the '2025 Distribution Industry Outlook Survey' conducted by the Korea Chamber of Commerce and Industry targeting 300 retail distribution companies at the end of last year, the overall retail distribution market is expected to grow by 0.4% compared to last year, while the convenience store industry is predicted to shrink by 0.3% this year. This is based on the judgment that the domestic demand slump deepened due to market saturation, high prices, and high exchange rates, which will also affect the convenience store market.

The convenience store industry appears to be pursuing a profitability-focused business strategy considering this environment. The target number of new store openings this year is expected to be between a minimum of 500 and a maximum of 700, similar to or fewer than last year.

Having shed fixed cost burdens, CU plans to further increase profits by strengthening MD competitiveness. Last year, CU launched differentiated products such as fresh fruit highballs and the 'Heukbaek Chef' Matpolly dessert. Since inflationary pressures are expected to be greater this year than last, CU plans to target consumers with ultra-low-priced, cost-effective products such as the overwhelming ready meals, Deuktem series, 990 series, and dessert 'Dangwajeom.' A CU official said, "We believe that selling differentiated products is the most important factor in strengthening our core competitiveness," adding, "We will expand and strengthen products that customers frequently seek and those that align with social trends, focusing on high-quality stores."

A GS25 employee is posing while holding a 'Musinsa Standard Express' product. Provided by GS Retail.

A GS25 employee is posing while holding a 'Musinsa Standard Express' product. Provided by GS Retail.

GS25 continues to focus on profitability-centered management while actively pursuing new attempts to attract consumers. Accordingly, it recently formed a strategic partnership to sell Musinsa Standard products at convenience stores. Twelve products including jackets, pants, T-shirts, underwear, and socks will be launched.

This is closely related to how Japan's FamilyMart enhanced competitiveness by strengthening product appeal through its 'Convenience Wear' business. In the past, FamilyMart partnered with Muji to sell clothing at convenience stores. After the partnership ended in 2019, it has been offering convenience wear through private brand (PB) products since 2021. In fact, FamilyMart's socks (Line Socks) gained popularity among people in their teens and twenties through social media, and it is known that celebrity Takuya Kimura also enjoys wearing these socks, making them a mainstay product today.

An industry insider said, "Since food sales account for 90% of total sales and store sizes are small in domestic convenience stores, the results need to be observed carefully," adding, "However, the bold new attempts to secure growth momentum seem meaningful."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.