MSS Announces "Domestic Venture Investment and Fund Formation Trends"

Total Venture Investment Up 9.5% Year-on-Year

Investment in Startups Under Three Years Old Down 17%

"ICT Services" Sector Shows Notable Growth by Industry

Last year, domestic venture investment in South Korea rebounded, totaling 11.9 trillion KRW. However, more than half of the investment funds were concentrated in late-stage startups older than seven years, while investment in early-stage startups actually decreased. Although the global venture investment market remained stagnant, domestic venture investment showed a relatively rapid recovery, but the analysis indicates that the investment concentration by company age is intensifying.

On the 12th, the Ministry of SMEs and Startups (MSS) announced the "2024 Domestic Venture Investment and Fund Formation Trends," which included performance data from venture investment companies and new technology business finance operators (new technology finance companies).

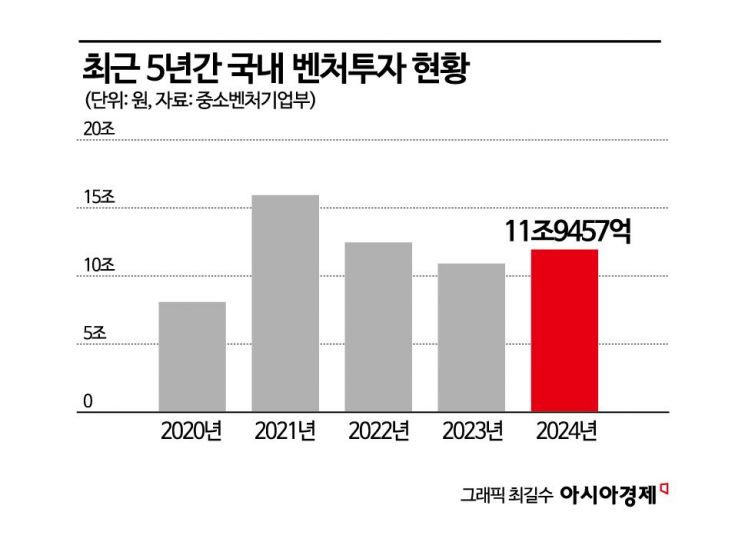

Last year, the total venture investment amounted to 11.9 trillion KRW, marking a 9.5% increase compared to the previous year. This ended a declining trend that had continued since 2021, achieving a rebound after three years. Considering that the global venture investment scale (480 trillion KRW) remained almost unchanged from the previous year during this period, the MSS interprets this as a clear recovery trend compared to the global market.

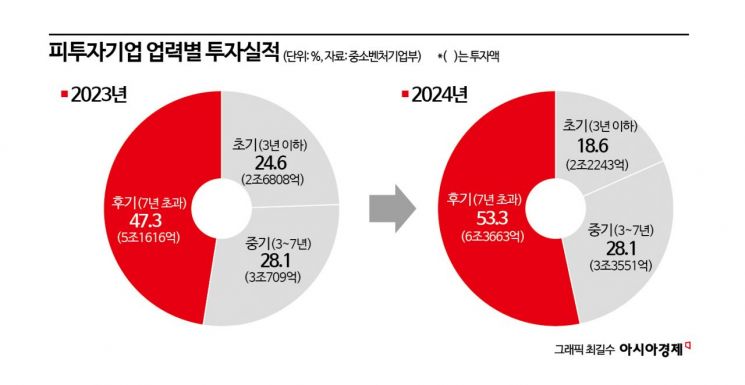

Although the overall investment scale increased, investment in early-stage startups significantly declined. Investment in startups within three years of establishment last year dropped by 17% from the previous year to 2.2243 trillion KRW. In contrast, investment in late-stage startups older than seven years rose by 23.3% to 6.3663 trillion KRW. Mid-stage startups with 3 to 7 years of operation attracted 3.3551 trillion KRW, a 9.3% increase from the previous year.

Kim Bong-deok, Director of Venture Policy at the MSS, analyzed, "It seems that investments are concentrated on projects with higher chances of success, even if the returns are lower, rather than on early-stage companies that require a long wait until IPO (Initial Public Offering)."

To revitalize investment in early-stage startups, the MSS plans to provide incentives to sub-fund managers. Director Kim stated, "While we cannot mandate private funds to invest compulsorily, if fund managers commit to focusing investments on early-stage companies, we plan to award additional points during the sub-fund selection process."

Meanwhile, the amount of domestic fund formation decreased by 19% to 10.6 trillion KRW compared to the previous year. The number of funds formed also declined from 859 in 2023 to 811 last year. By investor type, private investments from general corporations, financial institutions, and venture capital (VC) decreased by 25.1% to 8.1324 trillion KRW. Conversely, policy finance, including the Korea Fund of Funds, increased by 11.3% to 2.4226 trillion KRW during the same period.

Director Kim emphasized, "If the trend of interest rate cuts continues this year, venture investment formation is expected to increase further," but added, "We are closely monitoring the situation with awareness that the decline in fund formation could lead to a contraction in future investments."

By industry, interest in artificial intelligence (AI) expanded, leading to a 38% increase in investment in the ‘ICT Services’ sector, recording the highest growth rate. It is known that over 70% of ICT services utilize AI technology. On the other hand, investment in ‘Video, Performance, and Music’ declined the most among industries by 23.7%, influenced by the rapid growth of the OTT market.

The MSS plans to accelerate the current recovery of the domestic venture investment market by announcing the entire 2025 MSS Korea Fund of Funds contribution budget (1 trillion KRW) in January to provide early seed money.

Oh Young-joo, Minister of SMEs and Startups, said, "Despite the challenging global market conditions, South Korea’s venture investment scale steadily grew last year. We will faithfully implement plans to advance into a leading venture investment market, continuously strive to create a world-class venture investment ecosystem by easing regulations reflecting field voices, and make relentless efforts."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.