'K-Chips Act' May Be Submitted to Plenary Session as Early as This Month

Tax Credit for 'Semiconductor Facility Investment' Raised to 20% for Large Corporations

Foundation Laid for Large-Scale Investments by Samsung Electronics and SK Hynix

With the ruling and opposition parties agreeing to increase the tax credit for semiconductor companies' facility investments by 5 percentage points, the so-called 'K-Chips Act,' Samsung Electronics, SK Hynix, and others are expected to reduce their tax burdens by about 6 trillion won. As a foundation for expanding investments has been established, there are also expectations that this will serve as a turning point for a rebound in the global competitive landscape.

According to the semiconductor industry and the National Assembly on the 12th, the amendment to the Restriction of Special Taxation Act (K-Chips Act), which passed the Tax Subcommittee of the National Assembly's Planning and Finance Committee, is expected to reduce the tax burden of major semiconductor companies such as Samsung Electronics and SK Hynix by about 5.88 trillion won in the future.

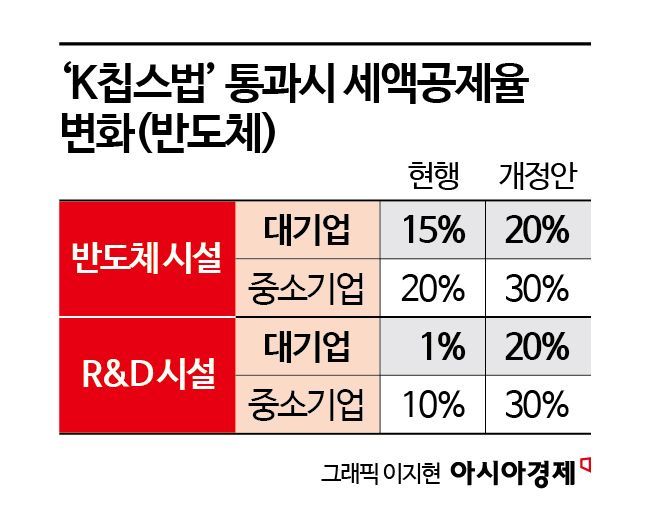

The tax credit rate for semiconductor facility investments by large and medium-sized enterprises will increase from 15% to 20%, and for small and medium-sized enterprises from 25% to 30%. With the inclusion of facility investments for research and development (R&D) in the integrated investment tax credit for national strategic technologies and new growth and original technologies, the related credit rate will also increase significantly from the current 1% to up to 20%. The bill will go through the full meeting of the Planning and Finance Committee on the 13th and is expected to be submitted to the plenary session as early as this month.

Samsung Electronics is building the next-generation semiconductor R&D complex 'NRD-K' at its Yongin Giheung Campus. It is a core base of Samsung Electronics, which Chairman Lee Jae-yong has visited twice, showing his dedication. The equipment import ceremony was held last November, and 20 trillion won will be invested by 2030. Previously, because it was an R&D facility rather than a commercialization facility, a credit rate of 1% (20 billion won) was applied, but with the passage of the K-Chips Act, the standard is expected to be significantly raised to 20%.

SK Hynix also decided to invest 9.4 trillion won by 2028 to build a factory in the Yongin semiconductor cluster last July. Excluding initial execution funds, simply applying the K-Chips Act credit rate to the investment amounts of the two companies could reduce their burden by about 5.88 trillion won (Samsung Electronics 4 trillion won, SK Hynix 1.88 trillion won).

Due to delays in the bill's passage, our companies have been placed at a relatively disadvantageous position compared to competitors. If the bill fails to pass the National Assembly again, Samsung Electronics will only receive a 20 billion won credit for investing 20 trillion won in 'NRD-K.' If the same facility were built in the United States, the tax reduction would amount to 5 trillion won (25% of the investment). Samsung Electronics' Device Solutions (DS) division's facility investment alone last year reached 46.3 trillion won, mostly domestic facility investments. If the bill had passed earlier, the financial mobilization capacity could have been increased to 9 trillion won (20%).

Yang Hyang-ja, a former lawmaker who first led the K-Chips Act in the 21st National Assembly, said, "Although it is quite late, it is welcome that investment promotion can now be expected," emphasizing, "In the era of artificial intelligence (AI), semiconductors will be a tremendous opportunity for Korea, and if this opportunity is missed, the entire industrial ecosystem could face severe difficulties."

'Belated' K-Chips Act, the Plenary Session Hurdle Remains

Even as the K-Chips Act enters the final countdown, the industry's mood remains cautious. Although the ruling and opposition parties agreed on the amendment at the end of last year, the bill could not even be brought to the plenary session due to conflicts over the reduced budget proposal. The Semiconductor Special Act, which includes white-collar exemption (exception to the 52-hour workweek), also faces uncertain prospects.

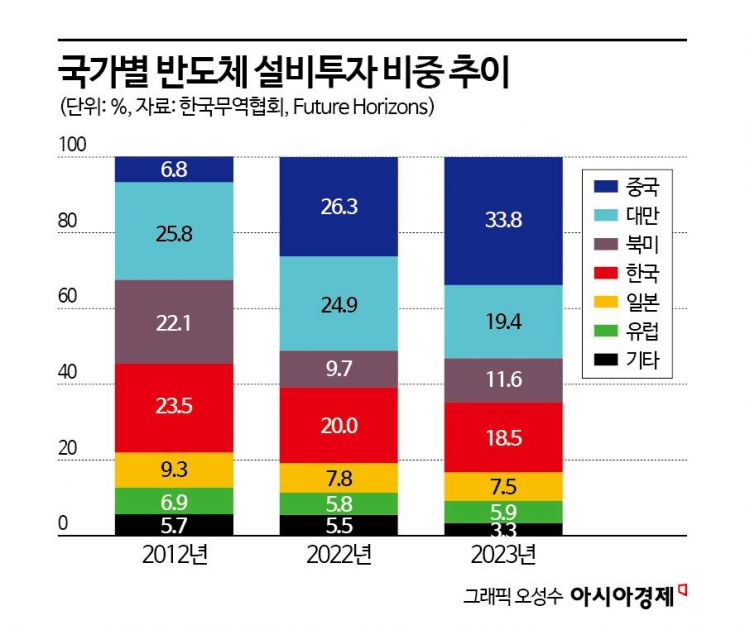

According to the Korea International Trade Association, the proportion of semiconductor facility investment was 23.5% in Korea and 6.8% in China in 2012, with Korea ahead, but this was reversed in 2023 with Korea at 18.5% and China at 33.8%. China's growing market presence is the result of aggressive investments backed by large-scale government support. With the Trump administration even announcing tariffs targeting semiconductors for the first time in 28 years, there are increasing calls for more urgent national-level semiconductor support measures.

An industry official said, "Other competing countries compete in the global market with comprehensive national support," pointing out, "If investments are delayed due to uncertainty, corporate competitiveness will inevitably weaken."

Another industry official said, "Tax credits for facility and R&D investments are not only helpful for new investments but also greatly assist process improvements in existing facilities," expressing hope that the bill will be passed promptly in the plenary session.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)