Sharp Drop in KICS for Shinhan Life, KB Insurance, and KB Life

KICS Decline Unavoidable Due to Falling Interest Rates and Accounting Standard Changes

Insurers Continue to Expand Issuance of Capital Securities

Domestic insurance companies have consecutively announced record-breaking performance last year, but their Solvency Capital Requirement Ratio (KICS) has sharply declined. To defend against further drops in KICS caused by benchmark interest rate cuts and changes in International Financial Reporting Standards (IFRS17), insurers are issuing capital securities one after another.

According to the financial sector on the 11th, Shinhan Life's KICS last year was 206.8%, down 44 percentage points from the previous year. During the same period, KB Insurance's KICS fell 27.8 percentage points to 188.1%, and KB Life Insurance's dropped 64.5 percentage points to 265.3%. Although all of them posted record-high earnings last year, they ultimately failed to effectively use these results to defend their KICS. KICS is a financial soundness indicator for insurers, calculated by dividing available capital by required capital.

The main cause of the KICS decline is the 'No/Low Surrender Insurance Actuarial Assumption Guideline' introduced by financial authorities in November last year. The authorities found that insurers had optimistically assumed surrender rates for no/low surrender insurance products, inflating the key performance indicator, Contractual Service Margin (CSM), and thus encouraged more conservative assumptions. Conservative assumptions on surrender rates reduce CSM, leading to a drop in KICS. When the guideline was announced, the authorities estimated that if insurers applied conservative assumptions, KICS would decrease by about 20 percentage points compared to the first half of last year (217.3%).

As the KICS of major domestic financial holding company-affiliated insurers fell more than expected, attention is also focused on the scale of KICS decline among non-financial holding company-affiliated insurers that have yet to announce their results. There is a possibility that many insurers will fall below the financial authorities' recommended threshold of 150%. An industry insider said, "If the guideline had been released earlier, insurers would have issued capital securities in advance to defend KICS, but they did not. The impact on KICS could be greater than the authorities anticipated."

The decline in benchmark interest rates also negatively affects KICS. When interest rates fall, the discount rate applied to insurers' liabilities decreases, causing liabilities to grow faster than assets, which reduces KICS. The expansion of domestic and international bond market uncertainties due to U.S. President Donald Trump's tariff war has also adversely affected KICS management.

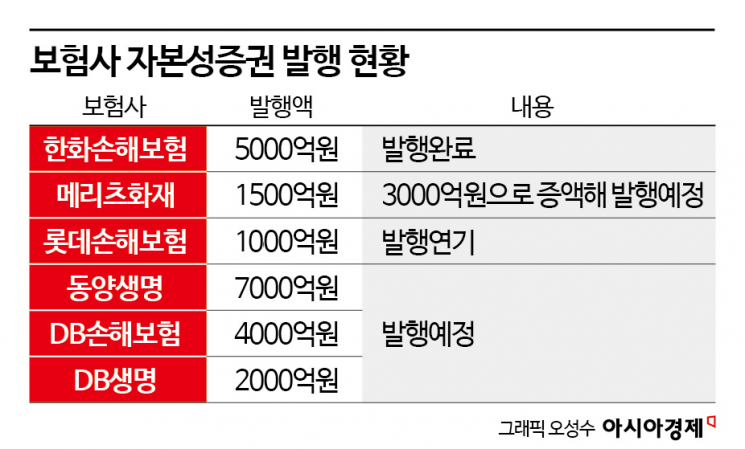

Since the beginning of the year, insurers have been raising KICS by issuing capital securities such as subordinated bonds. Hanwha General Insurance issued subordinated bonds worth 500 billion KRW last month, becoming the first insurer this year to issue capital securities. Hanwha General Insurance initially planned to issue 300 billion KRW but increased the amount due to higher-than-expected demand.

Meritz Fire & Marine Insurance plans to issue subordinated bonds worth 300 billion KRW on the 13th. Initially expecting 150 billion KRW, the issuance amount was increased after securing excess demand. Tongyang Life Insurance recently held a board meeting and approved the issuance of capital securities worth 500 million USD (approximately 700 billion KRW). Additionally, DB Insurance (400 billion KRW) and DB Life Insurance (200 billion KRW) are also expected to issue capital securities soon. Last year, the issuance of capital securities by insurers reached a record high of 8.655 trillion KRW. Considering the issuance plans insurers have made at the beginning of this year, there is a possibility that this level will be exceeded.

However, depending on domestic and international conditions, some insurers may not proceed with capital securities issuance as planned. Lotte Insurance planned to issue subordinated bonds worth 100 billion KRW this year and even conducted demand forecasting but postponed the issuance on the 5th. A Lotte Insurance official said, "Due to interest rate conditions, rapid changes in the economy and external environment, and the introduction of new regulations, we postponed the issuance to protect investors."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.