50 Billion Won in Market Funds Flow into Domestic Gold Banking Accounts

International Gold Prices Poised to Break Records... Up 37% in One Year

"Further Growth Potential Remains... Could Surpass Historic Highs"

As gold prices continue to soar day by day, more than 50 billion won of market funds have poured into domestic gold-related products within a month. This is due to the increased demand for gold, a 'safe-haven asset,' amid expanding global uncertainties. Although prices have already risen significantly, there is still room for further growth. Amid forecasts that gold prices could reach historic highs due to the Trump-led tariff war, some experts caution that additional purchases should be approached carefully.

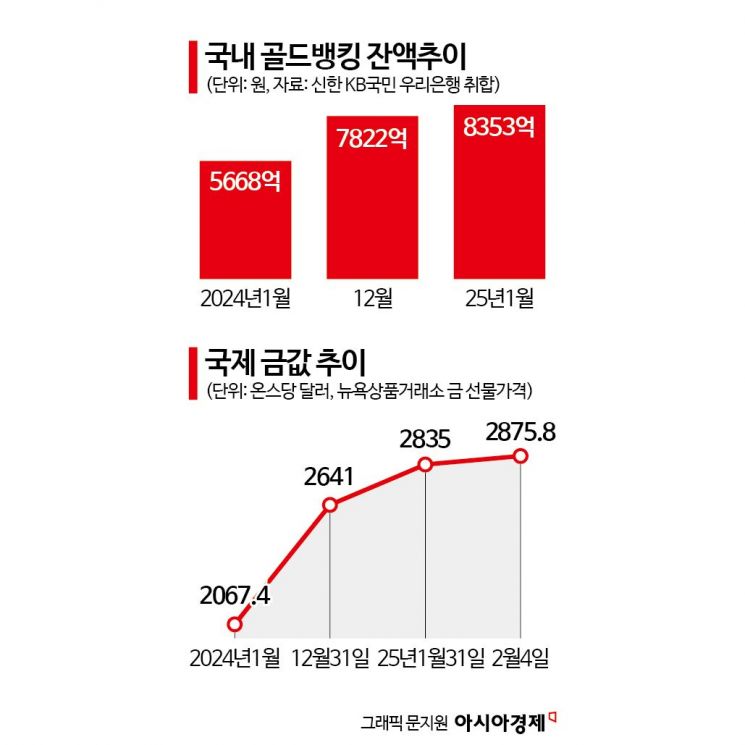

According to the financial sector on the 6th, the balance of Gold Banking accounts at three domestic commercial banks (KB Kookmin, Shinhan, and Woori) stood at 835.3 billion won as of the end of last month. This is an increase of 53.1 billion won from 782.2 billion won at the end of last year. More than 50 billion won of market funds flowed into Gold Banking within just one month of the new year. The balance a year ago was 566.8 billion won, marking a nearly 50% surge. The number of Gold Banking accounts also increased by over 20,000, from 252,332 to 275,424.

This contrasts with the total deposit balance (including demand deposits and time deposits) of five domestic banks (KB Kookmin, Shinhan, Woori, Hana, and NH Nonghyup), which decreased by 1.028 trillion won over the past month.

Gold Banking is a product where deposited money in an account is converted into gold based on international gold prices and exchange rates. When an account is created via mobile banking and money is deposited, gold is purchased and accumulated according to international gold prices. Since profits increase as gold prices rise, balances tend to grow during periods of gold price increases.

The recent influx of market funds into Gold Banking is also attributed to the rise in international gold prices. According to the New York Mercantile Exchange, the international gold price rose to $2,835 per troy ounce (approximately 31.1g) as of the end of January. This represents a 7.35% increase over one month and about a 37% increase over one year.

The expectation that prices will continue to rise has also encouraged purchases. A representative from a commercial bank said, "Since the beginning of this month, the Trump administration has initiated a tariff war, reigniting concerns about inflation and uncertainty, which has further strengthened the preference for safe-haven assets. Additionally, major central banks are increasing their gold demand to reduce dependence on the dollar and secure safe assets, leading to a continuous rise in demand."

Experts predict that gold prices could surpass the historic high of $2,940 reached during the second oil shock in 1980. Lee Young-hwa, an S&T economist at Shinhan Bank, said, "Countries with large foreign exchange reserves like China and India are expanding their gold purchases, and individuals in countries such as Vietnam and China are also increasing gold acquisitions, so there is room for further price increases in the near term. However, gold prices are rising more than expected."

However, he advised caution in purchasing, noting that the increase is not significantly larger than a year ago and that prices may fall after reaching a peak. The economist pointed out, "While gold is an attractive asset in the mid to long term, it has already risen too much, so this is a time to be cautious."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)