Consumer Price Index Rose 3.3% Last Year, Highest in Three Years

Cost-Effectiveness Becomes Top Priority as Price Sensitivity Increases

Declining Purchase Counts and Unit Prices Lead to Poor Performance for Large Supermarkets

On the morning of the 3rd, when a severe cold wave of minus 5 degrees Celsius hit, about 30 customers armed with padded jumpers, hats, and masks were competitively filling red baskets with fruits and vegetables at a produce store in Yeongdeungpo-gu, Seoul. Despite it being a weekday, the secret to this seemingly recession-forgotten purchasing line was the cheap prices. Strawberries were 12,000 won per kilogram, a bag of tangerines 4,000 won, three bunches of Shine Muscat grapes for 10,000 won, six packs of blueberries for 10,000 won, and a pack of jujube cherry tomatoes for 3,000 won... These prices were only about half of what you would see at large supermarkets these days.

A woman in her 30s, Mrs. A, whom we met at the store, said, "Fruit prices are so expensive these days, but I heard from other moms at the daycare that this place’s strawberries are cheap, so I walked 15 minutes here," adding, "At these prices, I could only have bought 500g at a supermarket." This newly opened store has quickly absorbed the demand for fruits and vegetables in the neighborhood as word of its low prices spread. During rush hour, it becomes even more crowded. By evening, the popular strawberries are always sold out. This is a stark contrast to the usually quiet large supermarket just five minutes away, except on weekends.

A fruit and vegetable store in Yeongdeungpo, Seoul, bustling with customers despite the cold wave. Photo by Im Onyu

A fruit and vegetable store in Yeongdeungpo, Seoul, bustling with customers despite the cold wave. Photo by Im Onyu

As the high inflation and economic downturn continue, the consumer landscape is changing. Consumers who once preferred large supermarkets for convenience are gradually shifting their footsteps to places where they can put more items in their baskets for the same amount of money to save every penny. Even when visiting large supermarkets, shoppers tend to focus on sale items, resulting in a decrease in both purchase unit price and the number of items bought.

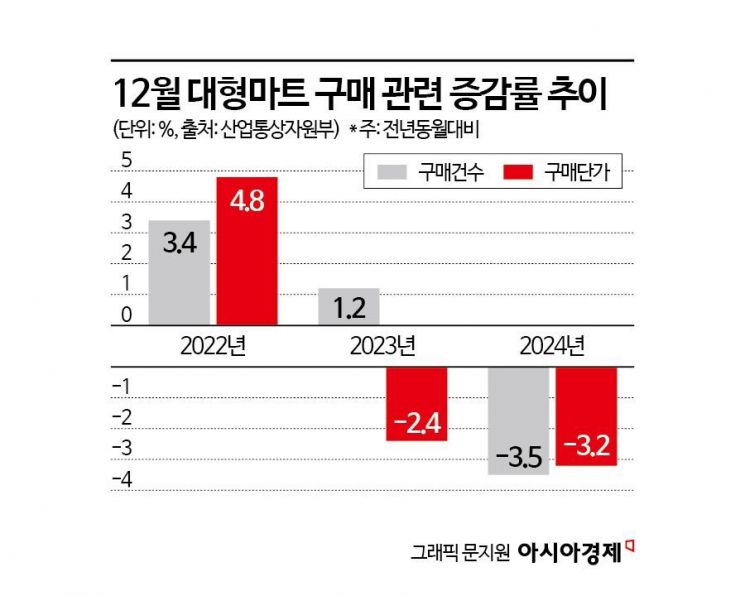

According to the Ministry of Trade, Industry and Energy on the 3rd, most monthly purchase counts and unit prices at large supermarkets decreased compared to the previous year. In January before the Lunar New Year holiday, April to May during peak outing season, July when summer vacation starts, September to October during the Chuseok holiday, and December, the year-end peak season, both purchase counts and unit prices declined compared to the previous year. This contrasts with 2023, when only three months?January, August, and October?showed simultaneous decreases in purchase counts and unit prices.

Looking at the trend in purchase counts alone, in 2023, only two months showed a decline compared to the previous year, but last year, that number increased significantly to seven months. The annual average purchase unit price also decreased by 0.3%, from 50,095 won to 49,966 won.

Last year, large supermarkets such as Emart, Homeplus, and Lotte Mart engaged in 'ultra-low price competition' to cater to consumers with heightened price sensitivity. This led to phenomena such as opening rushes and empty shelves, yet they still failed to increase purchase counts and unit prices. This statistical data can be interpreted as consumers feeling burdened by high prices, reducing their shopping frequency and buying only cheap items. Especially given the rising prices, it is reasonable to assume that the number of items placed in shopping baskets also decreased accordingly.

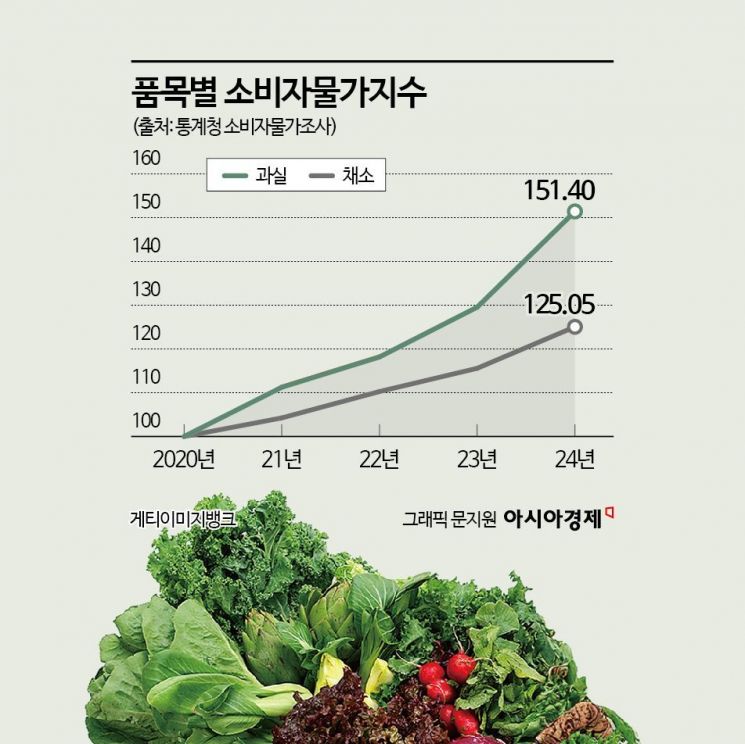

In fact, last year saw not only a sharp increase in perceived prices but also a high real consumer price inflation rate. According to the National Statistical Portal of Statistics Korea, the consumer price index last year was 102.63, a 3.3% increase from 99.34 the previous year. This was the highest inflation rate in three years since the height of the COVID-19 pandemic in 2021. Particularly, items that directly affect perceived prices, such as fruits and vegetables, saw significant price increases. The consumer price inflation rate for fruits was 16.9%, the highest in 20 years since 2004. Vegetables also rose by 8.2%, marking the largest increase since 2020.

The change in consumer behavior?visiting less frequently and buying only cheap items?is leading to a decline in large supermarket performance. Emart’s discount store division recorded sales of 8.8642 trillion won and operating profit of 66.8 billion won for the cumulative third quarter last year, down 2.5% and 8.6% respectively from the previous year. Lotte Mart also saw its cumulative third-quarter sales and operating profit fall by 4% and 2.4% compared to the same period last year.

An industry insider said, "As high inflation prolongs, more consumers are opening their wallets for clearance items nearing expiration and are willing to shop around for cheaper options despite the hassle, showing increasing price sensitivity. Large supermarkets are expected to continue focusing on 'cost-effectiveness' in their sales strategies, as they did last year, to prevent further consumer attrition, which will likely intensify cutthroat competition."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.