Yeonwoo Turns Profitable Last Year with 16% Sales Growth

Pumptec Korea Expects Record-Breaking Results

Driven by Rising Indie Brand Demand and Expanding Overseas Clients

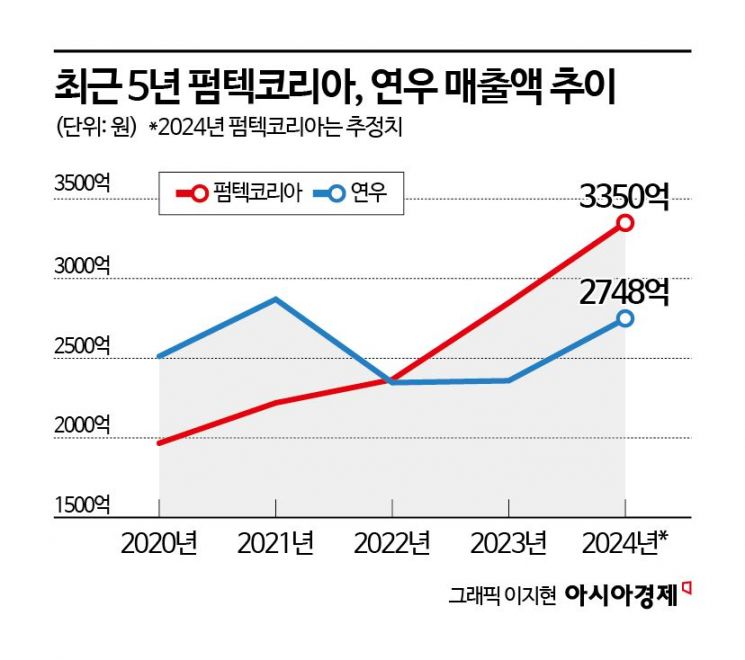

Last year, as 'K-Beauty' soared in the global market, cosmetic container companies also wore broad smiles. The explosive sales of Korean cosmetics, which recorded record-breaking exports, significantly increased container orders. Pumptec Korea, the number one company in the domestic cosmetic container market, posted its highest performance since its founding, while Yeonwoo, ranked second, also turned a profit, both achieving strong results.

According to the Financial Supervisory Service's electronic disclosure system on the 4th, Yeonwoo, a subsidiary of Kolmar Korea, recently announced that its operating profit last year was 940 million KRW, turning profitable compared to a loss of 27 million KRW the previous year.

On the 13th, customers, mostly foreigners, are shopping for cosmetics at a cosmetics shopping mall in Myeongdong, Seoul. Photo by Heo Younghan younghan@

On the 13th, customers, mostly foreigners, are shopping for cosmetics at a cosmetics shopping mall in Myeongdong, Seoul. Photo by Heo Younghan younghan@

Sales increased by 16.5% during the same period to 274.8 billion KRW, and net profit also turned positive to 13.6 billion KRW compared to the previous year. The increase in sales led to higher operating profit, and net profit rose to over 10 billion KRW due to non-operating income such as foreign exchange gains.

Yeonwoo is a company that produces cosmetic containers (accessories) and was acquired by Kolmar Korea in 2022, becoming a 100% subsidiary last year. Before joining Kolmar Korea, Yeonwoo's sales, which were mostly from domestic clients Amorepacific and LG Household & Health Care, plunged from nearly 300 billion KRW to 230 billion KRW due to their sluggish performance in the Chinese market after the COVID-19 pandemic. However, after Kolmar Korea's acquisition, the company diversified its client base and has shown a sales uptrend again since 2023.

The sales growth of Pumptec Korea, the leading company in the domestic container market, is even steeper. Pumptec Korea's sales and operating profit last year are estimated to have increased by 17% and 36%, respectively, to 335 billion KRW and 47.9 billion KRW compared to the previous year. This is the highest sales figure since the company's establishment in 2001. While Pumptec Korea's sales did not reach 200 billion KRW in 2020, it is estimated to have surpassed 300 billion KRW last year.

Pumptec Korea's sales include the performance of Buguk TNC, which mainly produces tube-type cosmetic containers. Although Pumptec Korea holds less than a majority stake with 47%, the board of directors is composed mostly of Pumptec Korea's registered executives, including CEO Lee Do-kyung (30.67%), the second son of Chairman Lee Jae-shin, and CEO Lee Do-hoon (21.35%), so it is accounted for as a subsidiary of Pumptec Korea. With strong performance prospects, the stock price has also trended upward, with Pumptec Korea's stock price rising nearly 91% over the past year.

The double-digit growth of cosmetic container companies is underpinned by the boom in K-Beauty. Globally increasing interest in K-Beauty and growing demand for small and indie brands domestically and abroad have boosted container orders. In the past, Yeonwoo's sales were mostly from domestic clients Amorepacific and LG Household & Health Care, but now the situation is different. The sales proportion from domestic indie brands has increased, reducing Amorepacific and LG Household & Health Care's share to about 20% of total sales.

One key to the strong performance is the significant investment of funds and time in developing molds, a core technology, to attract the rapidly growing indie brands. Molds are templates used for mass production of products with the same specifications. Instead of making molds for individual brands, the company proactively develops molds and proposes them to manufacturers using an Original Design Manufacturer (ODM) approach, saving time and costs.

In Pumptec Korea's case, the mold development is centered in its R&D team, and from 2017 to 2019, after its listing, it invested 10 billion KRW of the 73 billion KRW raised through public offering into mold production. Yeonwoo also invested about 18 billion KRW in equipment last year for mold investment.

Recently, both companies have been boosting performance by securing overseas clients. Both are expanding exports through overseas partners and have recently increased direct export proportions. Among the two, Yeonwoo's export ratio is higher at 45% compared to Pumptec Korea's 21%. Major export countries include the United States, Europe, and Japan. Although Yeonwoo has a 'Yeonwoo China' subsidiary in China, its sales there are in the tens of billions of KRW, so the proportion is not large.

About 31% of Yeonwoo's total export volume is conducted through partners, with direct transactions accounting for about 13%. In the United States, Yeonwoo has PKG Group, a container company, as a sales partner and is gradually increasing global clients. However, in the European market, where there are no large sales partners like in the U.S., Yeonwoo is expanding direct sales by establishing local offices. A Yeonwoo official explained, "In Europe, plastic regulations and eco-friendly policies are being strengthened, so we are enhancing R&D on eco-friendly materials and products to expand our sales network."

Pumptec Korea is expanding its sales network mainly in the United States and Japan. Currently, about 3% of its sales come from direct exports overseas, with the remaining 17% exported through sales partners and ODM companies. To increase direct transactions, Pumptec Korea opened a North American sales office in New York in September last year. In the Japanese market, it conducts direct transactions with Shiseido and plans to increase direct dealings with local brands.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.