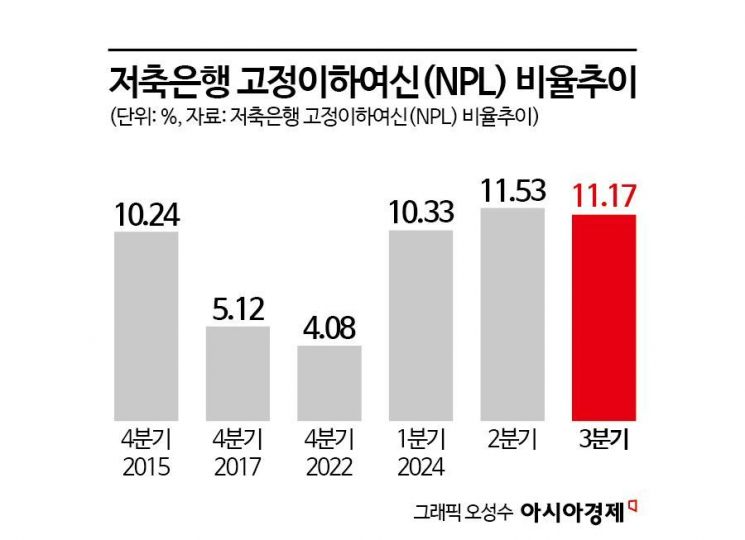

First Three Consecutive Quarters with Double-Digit Average NPL Ratio

Bridge and Land-Secured Loans Account for Ten Times More Than Banks

High-Risk PF-Centered Business Structure... Difficult to Improve Fundamentals

The fixed non-performing loan (NPL) ratio of savings banks has recorded double-digit figures for three consecutive quarters for the first time. It surged sharply starting from the fourth quarter of 2022, immediately after the Gangwon Legoland debt default incident. Given the operational structure of savings banks that absorb high-risk project financing (PF) loan assets such as bridge loans and land-secured loans, it is expected to be difficult to lower the NPL ratio. There is a strong possibility that the double-digit level will be maintained in the fourth quarter as well.

A notice for credit loan consultation posted at a savings bank in downtown Seoul on December 1 last year. Photo by Yonhap News.

A notice for credit loan consultation posted at a savings bank in downtown Seoul on December 1 last year. Photo by Yonhap News.

According to the Financial Supervisory Service on the 3rd, the NPL ratio of 79 savings banks in the third quarter of last year was 11.17%. The NPL ratio is an indicator of asset soundness for savings banks. The lower it is, the more stable it means. Generally, in the secondary financial sector such as savings banks and mutual finance, an NPL ratio below 5% is considered good, and below 3% is considered excellent.

Looking at the figures since the Financial Supervisory Service began announcing the quarterly average NPL ratio of savings banks in the fourth quarter of 2015 (10.24%), it recorded an all-time high of 11.53% in the second quarter of last year. The NPL ratio was in the double digits for three consecutive quarters from the first to the third quarter of last year. This is the first time since statistics began that the ratio has been in double digits for two consecutive quarters. It was also the first time in 33 quarters since the fourth quarter of 2015 that it exceeded 10%. After the large-scale insolvency incident in 2011 (the savings bank crisis), savings banks lowered the NPL ratio, which had soared to double digits, to below 5% in nine years. It dropped to 4.71% in the fourth quarter of 2019 and further to 3.55% in the third quarter of 2022. The NPL ratio, which had been decreasing to an excellent level, rose for seven consecutive quarters after the Legoland incident and soared to a record high last year.

The financial sector expects it will take several years for the NPL ratio of savings banks to fall below 5%. There are also opinions that it could remain in double digits in the fourth quarter. This is because it is difficult to improve the operational structure of savings banks, which absorb high-risk PF loan assets such as unfinished investment buildings, in a short period. The contraction of the real estate market due to high interest rates and rising raw material prices also has a negative impact.

According to Hana Financial Management Research Institute, the proportion of bridge loans and land-secured loans in savings banks is on average 61%, about ten times that of insurance (6%) and banks (7%). The participation rate of small and medium-sized construction companies with lower soundness is also high. Among savings bank PF projects, the proportion of projects by construction companies with credit ratings of BB or below is 68%, about twice that of small and medium-sized securities firms (32%).

Choi Hee-jae, senior researcher at Hana Financial Management Research Institute, said, "During the savings bank crisis, buildings were completed, but due to the 2008 global financial crisis, unsold inventory surged, and the main PF could not be sold. Recently, the problem is that the conversion from bridge loans to main PF is blocked from the early stages due to the sharp increase in project costs." He added, "The risk of unfinished main PF projects is expanding, and although the financial authorities recommend recovery through auction and public sale of non-performing projects, delays in recovery due to sale prices have increased the likelihood of losses burdening savings banks."

Although the authorities are conducting checks on savings bank reserves, improving PF auction and public sale platforms, and encouraging sales, concerns about the contraction of savings bank operations remain high. From the perspective of savings banks, if they do not manage soundness indicators such as the NPL ratio and delinquency rate stably, it hinders the expansion of loan operations. The more the management of savings banks deteriorates, the harder it becomes to obtain loans from primary financial institutions such as commercial banks, which may also shrink loans to ordinary citizens who turn to savings banks.

In this regard, the Financial Supervisory Service conducted year-end settlement inspections last month. Four savings banks underwent on-site inspections, and 16 had management interviews. They requested savings banks to increase their reserves. A Financial Supervisory Service official said, "We instructed them to comply with supervisory regulations requiring reserves to be set aside for 20% of fixed assets," adding, "Support and encouragement activities for auction and public sale of non-performing PF projects will continue separately from the settlement inspections."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)