Big Mac Price in Argentina Reaches $6.95 in January 2025

Tops Switzerland When Adjusted for National Income

Argentina, struggling with high inflation, ranked second in the world for the Big Mac Index, following Switzerland.

The Big Mac Index was devised in 1986 by the British economic weekly The Economist to examine the purchasing power, exchange rates, and prices of a country's currency. It compares the price of a Big Mac hamburger sold at McDonald's stores worldwide, converted into official dollar exchange rates, and publishes the figures every six months based on the price of a Big Mac in the United States.

Local media reported on the 31st (local time) citing the Big Mac Index released by The Economist in January 2025, stating that the price of a Big Mac in Argentina is 7,300 pesos in local currency. Calculated at the official dollar exchange rate, this corresponds to $6.95 (11,300 KRW).

Switzerland ranks first (7.2 francs). Compared to the US Big Mac price of $5.79 (8,400 KRW), the Swiss franc is considered overvalued by 38%, and the Argentine peso by 20.1%. Generally, a high Big Mac Index indicates an overvalued exchange rate, while a low index indicates undervaluation.

However, since this is a simple comparison of Big Mac prices, variables such as each country's income may affect the results.

Argentine media Infobae reported that when comparing the Big Mac Index adjusted by GDP per capita, Argentina ranks first in the world. Switzerland is second, and Uruguay third. This indicates that prices in Argentina are exorbitantly high relative to the national income.

Local media pointed out, "The Big Mac Index proves the need for a devaluation of the peso, as argued by the International Monetary Fund (IMF) and some economic experts." Infobae also remarked, "Since The Economist, which publishes the Big Mac Index, had praised President Milei's policies before, they probably cannot criticize them this time."

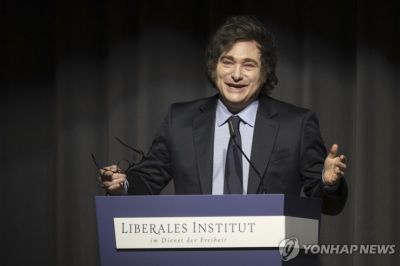

Javier Milei, who took office as Argentina's president in December 2023, is implementing a crawling peg system (a gradual exchange rate adjustment method) that deliberately adjusts the exchange rate to minimize shocks to the foreign exchange market while achieving inflation control targets.

The IMF has recommended that Argentina adopt appropriate exchange rate policies through devaluation, as the peso has been overvalued. However, the government has opposed this and has been raising the official peso-dollar exchange rate by 2% monthly. Nevertheless, it announced that from February, the crawling peg adjustment rate will be reduced from 2% to 1% per month.

President Milei has criticized economists advocating for peso devaluation, stating, "The current exchange rate policy is appropriate."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)