No North American Plants Yet for Samsung Biologics and Celltrion

Donald Trump, the President of the United States, who was expected to maintain a policy of drug price reduction, suddenly hinted at the introduction of tariffs on pharmaceuticals. This is to encourage the establishment of factories within the country. The need for North American investment by the domestic bio industry is also expected to increase.

According to the industry on the 31st, Lotte Biologics is currently expanding its antibody-drug conjugate (ADC) contract development and manufacturing organization (CDMO) facility at its Syracuse plant in the U.S., acquired from Bristol-Myers Squibb. Matica Biotech, a subsidiary of CHA Biotech, completed a cell and gene therapy (CGT) CDMO plant in Texas in 2022 and is now building a second production plant.

However, Samsung Biologics and Celltrion, considered the 'Big 2' in the bio industry including biosimilars (biopharmaceutical generics) and CDMO, are cautious about establishing local plants in the U.S. These companies have judged that domestic production is more efficient in terms of costs and other factors. John Rim, CEO of Samsung Biologics, said at the '2024 Bio International Convention (BIO USA)' in June last year, "Expanding the Korean plant is more efficient than acquiring a U.S. plant," adding, "The U.S. plants have difficulties providing various services to clients and also face aging issues."

If the introduction of tariffs on pharmaceuticals becomes a reality as President Trump suggested, it could affect the strategies of these companies. Earlier, President Trump named pharmaceuticals, semiconductors, and steel as industries subject to tariffs during a speech at the Republican Federal House Conference held in Florida. He emphasized, "It could start in the very near future," and "If you don't want to pay taxes or tariffs, you have to build factories in the U.S."

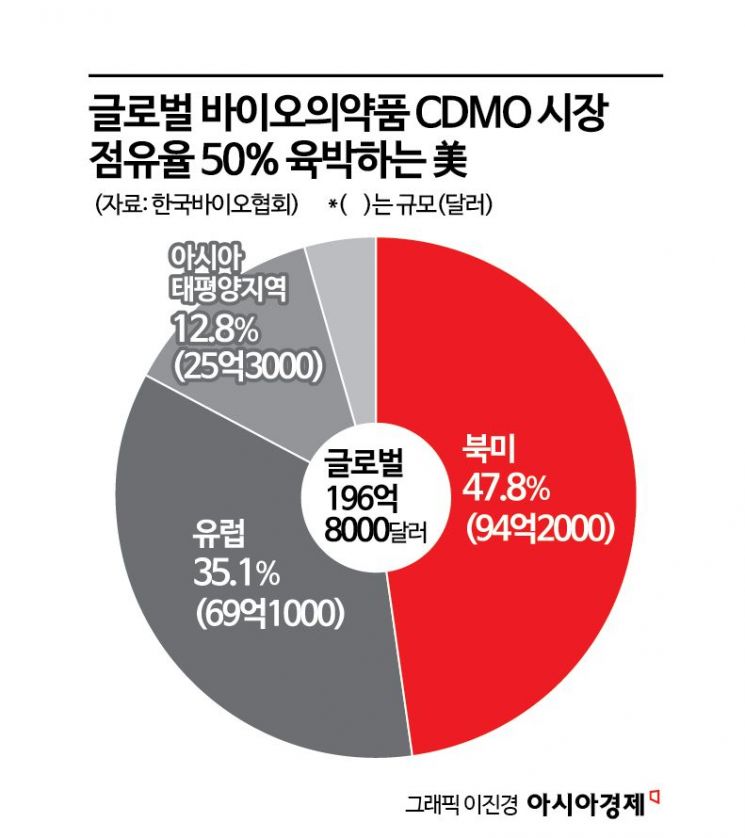

The global CDMO industry is moving to secure local production bases in North America. In June last year, Siegfried, the world's sixth-largest CDMO, signed a contract to acquire an active pharmaceutical ingredient production facility in Wisconsin from Curia. Japanese CDMO company Fujifilm Diosynth Biotechnologies also announced plans in April last year to invest an additional $1.2 billion (about 1.7352 trillion KRW) in its pharmaceutical production facility under construction in North Carolina. Lonza, the global number one, signed a contract in the same month to acquire Roche's pharmaceutical production plant in California for $1.2 billion.

Since the launch of the second Trump administration, the domestic bio industry was expected to benefit. In the U.S., where drug prices are high, expansion of biosimilar approvals and activation of CDMO were anticipated to reduce drug prices. In particular, President Trump announced a four-year plan to ban imports of pharmaceuticals and other products from China through his campaign agenda 'Agenda 47.' Even if universal tariffs are implemented, it is believed that the bio industry can mitigate shocks through local plant establishment and tariff negotiations. Jeong Yeogyeong, a researcher at NH Investment & Securities, said, "Even in the worst-case scenario where the Trump administration imposes universal tariffs, sectors like bio are expected to remain resilient," adding, "If regulations on Chinese bio companies are strengthened through laws like the Biological Security Act, domestic CDMO companies could benefit."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)