The Financial Supervisory Service (FSS) announced on the 30th that it imposed fines after discovering a total of 15 violations during its inspection of compliance with regulations related to the internal accounting control system for the 2023 fiscal year.

Specifically, there were 5 cases of failure to establish an internal accounting control system, 6 cases of failure to report operational status and evaluations, and 4 cases of failure to express review opinions. As a result of this action, companies were fined between 6 million and 12 million KRW, CEOs and auditors between 3 million and 6 million KRW, and external auditors between 6 million and 7.2 million KRW.

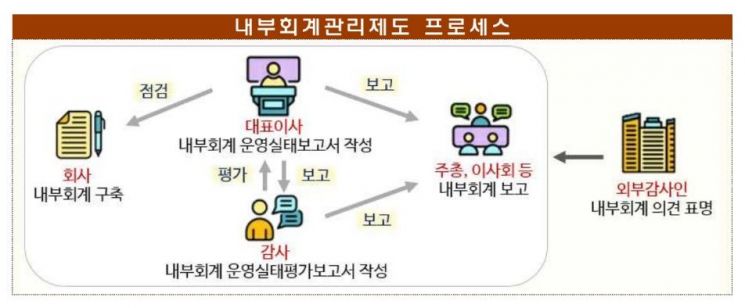

The internal accounting control system refers to an internal control system designed and operated to manage accounting information in order to prepare and disclose reliable financial statements. Considering that the average number of violations over the past five years was 30 cases, this represents a significant decrease.

However, the FSS noted that violations due to deteriorating financial conditions or errors still occur and urged companies and external auditors to accurately confirm and comply with the obligations related to this system.

First, the FSS emphasized the need to carefully verify whether unlisted corporations are also subject to the requirement to establish an internal accounting control system. Listed companies must establish this system regardless of total assets, and unlisted corporations are subject to this requirement if their total assets at the end of the previous fiscal year exceed 500 billion KRW.

However, attention should be paid to exceptions. Among unlisted corporations, those required to submit business reports as of the end of the previous fiscal year, domestic companies belonging to publicly disclosed business groups, and financial companies are also subject to this requirement if their total assets exceed 100 billion KRW.

Additionally, the FSS stressed that even if a company applies for corporate rehabilitation procedures, it is still obligated to establish an internal accounting control system for the fiscal year prior to the commencement of such procedures. Each company’s CEO must also appoint an internal accounting manager and ensure that related personnel are adequately staffed. The CEO must report the operational status to the general shareholders’ meeting, the board of directors, and auditors, while auditors must report the operational status evaluation to the board of directors.

Furthermore, external auditors must accurately determine whether the company is obligated to establish the system and express their opinions accordingly. An FSS official stated, "After the disclosure of financial statements for the 2024 fiscal year, we will inspect compliance with related regulations and provide guidance on necessary precautions if needed. We will also encourage the effective operation and establishment of the internal accounting control system through audits."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)