Daewoo's Operating Profit Expected to Be Halved...

DL Also Likely to See Decline

GS Recovering, HDC Hyundai Development Projected to Hold Ground

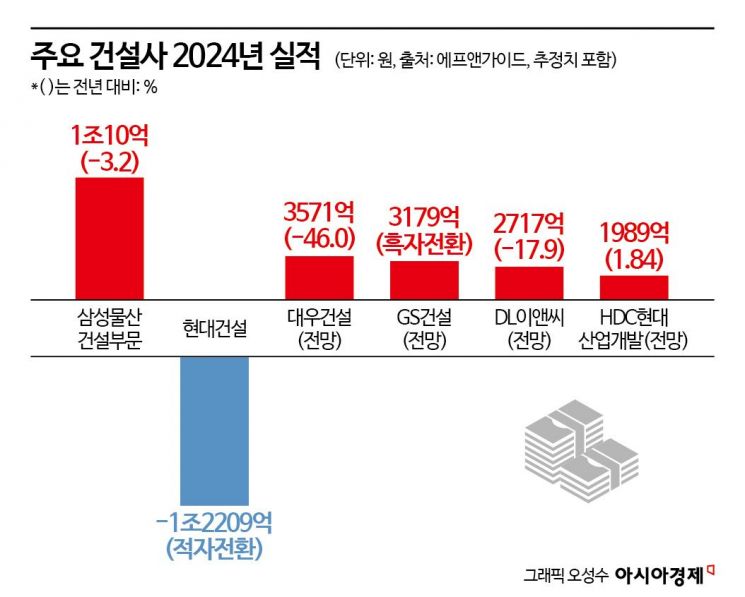

Samsung C&T Construction Division and Hyundai Engineering & Construction, ranked first and second respectively in the construction industry's construction capability evaluation, both recorded a decline in operating profit last year, raising concerns that listed construction companies announcing their earnings after the Lunar New Year holiday may also present weaker-than-expected results.

According to the Financial Supervisory Service's electronic disclosure on the 29th, Daewoo E&C, DL E&C, GS Engineering & Construction, and HDC Hyundai Development are scheduled to disclose their Q4 2024 and annual financial results in February after the holiday. Prior to the holiday, Hyundai Engineering & Construction reported an 'earnings shock' with an operating loss of about 1.2 trillion KRW, and Samsung C&T Construction Division also showed a 3.2% decrease in operating profit compared to 2023, increasing industry-wide concerns that the downturn is now reflected in the numbers. This has heightened attention on the performance of other major construction companies.

Daewoo 'Halved'... DL Also Expected to 'Decline'

Daewoo E&C, ranked third in construction capability evaluation, is expected to see its 2024 operating profit plunge to about half of the previous year. According to financial information provider FnGuide, Daewoo E&C's operating profit last year is estimated at 357.1 billion KRW, a 46% decrease compared to 662.5 billion KRW in 2023. Sales are also expected to decline by about 10%.

DL E&C, ranked fifth, is also likely to experience 'negative growth.' The consensus among securities firms forecasts an operating profit of 271.7 billion KRW for DL E&C, down from 332.1 billion KRW in 2023. If the consensus holds, operating profit will decrease by approximately 17.9%. In addition to poor performance, DL E&C is facing the adverse factor of a tax investigation by the National Tax Service. The NTS has detected suspicions of illegal rebates involving DL E&C and is conducting an investigation, with results expected in February.

GS 'Recovery' HDC Hyundai Development 'Holding Ground'

On the other hand, GS Engineering & Construction, ranked sixth, is expected to return to profitability. The securities consensus forecasts an operating profit of 317.9 billion KRW. GS E&C recorded an operating loss of 387.9 billion KRW in 2023, largely due to one-time costs related to the collapse of the underground parking lot at an apartment complex in Geomdan, Incheon. However, this is still far from the operating profit level of 554.8 billion KRW in 2022. GS E&C joined the '1 trillion KRW club' in operating profit back in 2018.

HDC Hyundai Development, ranked tenth, is expected to post an operating profit of 198.9 billion KRW in 2024, a 1.84% increase compared to 195.3 billion KRW in 2023. While most construction companies are retreating, HDC Hyundai Development is considered to be 'holding ground.' The company’s performance had been sluggish due to consecutive collapse accidents in Gwangju Metropolitan City in 2021 and 2022. Compared to other construction firms, HDC Hyundai Development has a higher proportion of residential projects, especially in the Seoul metropolitan area. Additionally, securities analysts note that the company is improving its profit resilience by expanding its own projects that handle both construction and development, such as the Gwangwoon University Station area development project.

Jang Moon-jun and Kang Min-chang, researchers at KB Securities, stated, "Political uncertainty is actually impacting the construction sector. Due to ongoing political and economic uncertainties stemming from the impeachment crisis, construction companies are struggling to set annual pre-sale plans properly, leading to poor performance. Therefore, rapid political stabilization is necessary for this industry."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.